CFOs today are operating under more pressure than any other executive in the C-suite. Markets are volatile. Investors are impatient. Every forecast is scrutinized, and every decision is expected to drive profitable growth. At the same time, the CFO role itself is expanding. Many finance leaders now co-own data, analytics, and digital transformation initiatives across the enterprise, shaping how the organization makes decisions and improving financial visibility across the business.

In this environment, pricing is no longer a tactical lever. It is one of the few remaining levers that can move the needle on profitable growth.

Dynamic, AI-driven pricing gives CFOs a way to influence margin quality, revenue predictability, and financial forecasting accuracy without sacrificing governance or discipline. Rather than replacing cost management, it strengthens it by adding a growth lever that finance can actively control.

Building a Strong Pricing Strategy vs. a Reactive One

One of the biggest traps executives fall into with pricing is spending too much time focused on individual prices. Hours get burned debating SKU prices, approving discounts, or tweaking price lists, while the larger questions about deal quality, customer value, and revenue predictability go unanswered.

What matters more than the margin on any single line item is how pricing performs across deals, customers, and relationships over time. Long-term customer value, deal profitability, share of wallet, and competitive win rates offer a far more accurate picture of pricing strength than isolated product margin.

This broader view also makes it clear that pricing decisions sit at the intersection of finance and revenue strategy; CFO buy-in depends heavily on alignment with the CRO. Each leader brings a distinct but necessary perspective. The CFO protects long-term financial health and forecasting integrity, while the CRO brings real-world insight into customer behavior, competitive pressure, and deal dynamics. When these perspectives are aligned, pricing becomes both disciplined and market-aware.

In practice, this alignment means accepting that not every product needs to be profitable on its own. In some cases, pricing a product aggressively, even at a loss, can be the right decision if it strengthens a strategic relationship, accelerates a larger deal, or increases portfolio adoption. CFOs who evaluate pricing only through a product-level lens risk missing where the business truly wins or loses.

Investors increasingly take the same view. Beyond revenue and margin headlines, they look for evidence that pricing power and market fit are improving. They evaluate whether average selling prices are rising, deals are closing faster, win rates are improving, the company is gaining share, and customers are buying more across the portfolio.

Strong pricing shows up in deal velocity, more predictable margins, competitive performance, and sustained wallet-share growth. Reactive pricing, by contrast, introduces volatility. Deals slow down, average selling prices decline, competitive outcomes become inconsistent, and margin surprises become more common. PROS helps CFOs move away from this reactivity by delivering deal-level insight, enabling leakage reduction, and real-time visibility into pricing performance so leaders see the full picture.

How AI Redefines Pricing for CFOs

For many finance organizations, pricing has historically been a periodic and manual process. Models were refreshed infrequently, built on historical data, and distributed through spreadsheets that quickly became outdated.

AI fundamentally changes this dynamic by turning pricing into a continuous, market-aware system. CFOs gain real-time visibility into customer behavior, demand shifts, and competitive signals. Pricing decisions can move at the speed of the market while improving forecast accuracy and financial confidence. This shift has meaningful implications across the finance organization:

- Faster insight with greater control. AI reduces the gap between price execution and performance reporting. It shows how closely deals align with target prices and where deviations are emerging. Unexpected patterns surface earlier, giving finance leaders time to intervene before small issues become material risks.

- Data-driven decisions replace anecdotal influence. In organizations where pricing outcomes are shaped by the loudest voice in the room or by ad hoc deal pressure, AI introduces recommended ranges, scenario analysis, and confidence intervals grounded in data.

- Greater predictability. AI helps forecast revenue more accurately, increase risk visibility, and simulate how pricing changes will ripple across product lines and customer cohorts to support measurable pricing ROI.

- Stronger pricing governance. Guardrails are enforced consistently, discounting behavior becomes more transparent, and pricing policies scale without slowing the business down. This balance between flexibility and control is critical for finance leaders who are accountable for both growth and discipline.

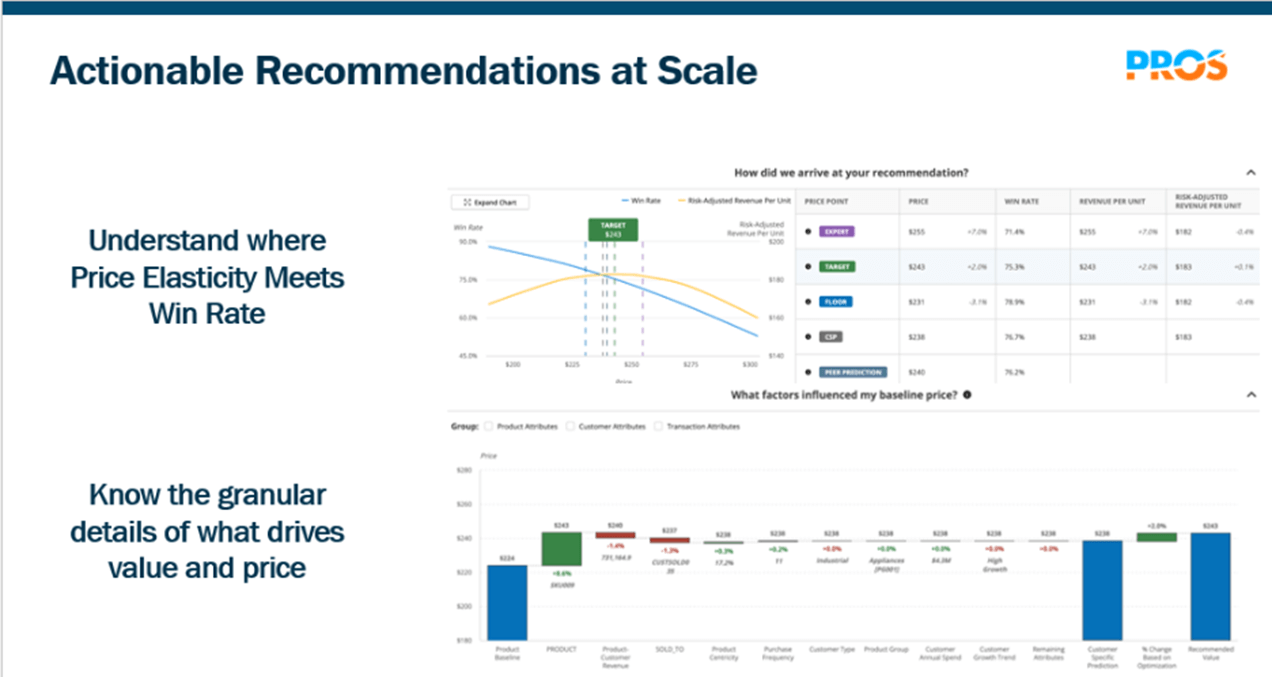

Adoption, however, requires trust. While confidence in AI has grown, many CFOs remain cautious about digital skills, AI literacy, and explainability within finance and revenue teams. Leaders want solutions that are intuitive, transparent, and easy to adopt. They want to understand why a recommendation is being made and how it will affect outcomes.

Modern pricing platforms like the PROS Platform address these concerns by emphasizing explainability, usability, and built-in coaching, helping finance leaders stand behind pricing decisions with confidence and showcasing their pricing leadership.

Aligning CFO and CRO Priorities Through AI

Pricing alignment between finance and revenue has always had its challenges. AI is reshaping how CFOs and CROs collaborate on pricing by giving both leaders a shared, data-driven view of market dynamics and deal performance.

CFOs bring the analytical lens to pricing. They assess macro trends, elasticity, and expectations for how markets should respond to pricing decisions. CROs bring market reality. They see how customers behave, where resistance emerges, what competitors are doing, and how deals truly move.

Without the CRO’s insight, pricing becomes theoretical. Without the CFO’s discipline, it becomes inconsistent. Pricing works best when both perspectives guide how prices are set, adjusted, and communicated.

Together, CFOs and CROs create a unified pricing narrative for the board. Expectation and reality are blended into a single story. The CFO nudges toward the optimal price, while the CRO informs where real-world adjustments are required. Neither owns the narrative alone.

AI simplifies this partnership by creating shared visibility into margins at the deal, segment, and account level. It identifies where to pursue value-based pricing and where cost discipline matters more. It enables faster planning cycles reinforced by real-time insight and supports targeted investment instead of blanket cost cuts. Most importantly, it strengthens leadership credibility with defensible, data-backed pricing decisions.

PROS enables this collaboration through dashboards, analytics, and expert guidance that align finance and revenue teams around a single source of truth.

A New CFO Mindset for Pricing Transformation

The role of the CFO has shifted from protector of costs to architect of sustainable growth. Cost discipline will always matter, but it cannot be the only lever finance leaders pull. To operate in this new capacity, CFOs need more than visibility. They need explainability and control. This is where margin drivers reporting becomes foundational, providing a clear view of what truly impacts profitability. By breaking down the factors that influence margins, such as pricing, product mix, and operational efficiency, finance departments can gain actionable insights to steer growth strategically rather than reactively.

AI-driven pricing gives CFOs a powerful way to influence profitability. It improves forecast accuracy, strengthens pricing governance, and creates a scalable system for identifying growth opportunities. Organizations that embrace this shift will be more resilient to external shocks, more aligned internally, and better positioned to outperform competitors without simply outspending them.

To explore why pricing remains the most overlooked growth lever in the C-suite and how AI-driven pricing is transforming revenue performance, download our eBook, The Pricing Blind Spot: Why the C-Suite Is Sleeping on Its Biggest Growth Lever.

Download eBook