Real-Time Dynamic Pricing

Right Price, Right Now

Drive more conversions with real-time pricing and availability.

Evolve your pricing beyond rigid, class-based fares using real-time demand and availability. PROS Real-Time Dynamic Pricing helps RM teams deliver more accurate, competitive prices today—while supporting your transition toward class-free continuous pricing, and the broader shift towards modern airline retailing.

- Increase Conversions at Scale

- Reduce Revenue Leaks

- Reduce Transaction Costs

- Future-Ready Pricing

Deliver competitive pricing instantly across every channel. PROS Real-Time Dynamic Pricing (RTDP) empowers airlines to convert more shoppers by calculating availability in real time, optimizing pricing based on demand, capacity constraints, and your business strategies and rules. Built for high-volume environments, RTDP delivers reliable, always-on performance and enterprise-grade uptime at scale.

Prevent revenue leaks by delivering relevant prices that discourage buy-down and reflect real-time demand for each request. PROS Real-Time Dynamic Pricing acts as a price recommendation engine, helping airlines apply their dynamic pricing logic consistently and capture more revenue opportunities across channels.

Lower IT costs by intelligently managing high volumes of availability requests. PROS Real-Time Dynamic Pricing shields core airline inventory systems from unnecessary load while delivering fast, accurate availability across all sales channels, distribution partners, codeshare and interline networks. The result: improved system performance, lower hosting costs, and more efficient scaling as shopping volumes continue to grow.

Modernize your pricing at your own pace. PROS Real-Time Dynamic Pricing supports today’s class-based environment while enabling a smooth transition toward modern, class-free continuous pricing. RTDP meets airlines wherever they are on their commercial journey, helping them transition to next-generation dynamic pricing and offer management without disrupting existing systems.

Handles

13B+

Transactions Daily

Up to

3.5%

Direct Revenue Uplift

with Continuous and Request-Specific Pricing

99.99%

Uptime

for seamless, uninterrupted performance

AI & Science

Continuous Pricing

PROS Real-Time Dynamic Pricing supports AI-driven continuous pricing, helping airlines offer precise fares between predefined price levels instead of relying on rigid class-based pricing. This scientific approach uses real-time data and advanced algorithms to adjust fares dynamically, capturing hidden demand and increasing revenue with more market-responsive, future-proof pricing.

Request-Specific Pricing (RSP)

Request-Specific Pricing (RSP) enables airlines to deliver more relevant contextualized offers. RSP uses AI models to interpret real-time demand, itinerary attributes, and shopping context, and dynamically adjust prices at the request level rather than relying on static filed fares or broad pricing rules. This approach improves competitiveness, reduces missed revenue opportunities, and supports the transition toward class-free pricing and modern Offers & Orders retailing.

Integrations

PROS Real-Time Dynamic Pricing offers seamless integrations with Revenue Management Systems (RMS), Shopping engines, PROS Group Sales Optimizer (GSO), Global Distribution Systems (GDS), Passenger Service Systems (PSS), and more, helping you ensure your pricing strategy is always connected, efficient, and responsive.

By leveraging PROS dynamic pricing technology, we’ve created more tailored and flexible pricing options, improving customer experience and driving revenue growth.

Stefan Kreuzpaintner

Senior VP, Commercial Customer Offer

By adopting the most advanced revenue management and airline pricing solutions from a trusted market leader, we will deliver more personalized and dynamic offers that customers find truly desirable and valuable – leading to greater conversion rates, customer loyalty and incremental revenue to power our future.

Mario Cruz

Chief Commercial & Revenue Officer

We are very grateful to the engineering staff of PROS for helping us through continuous adjustments. At present, PROS Real-Time Dynamic Pricing has been successfully implemented on China Southern Airlines’ domestic cloud.

Yu Haiyan

Deputy Director of RM Division, Sales Department

Features

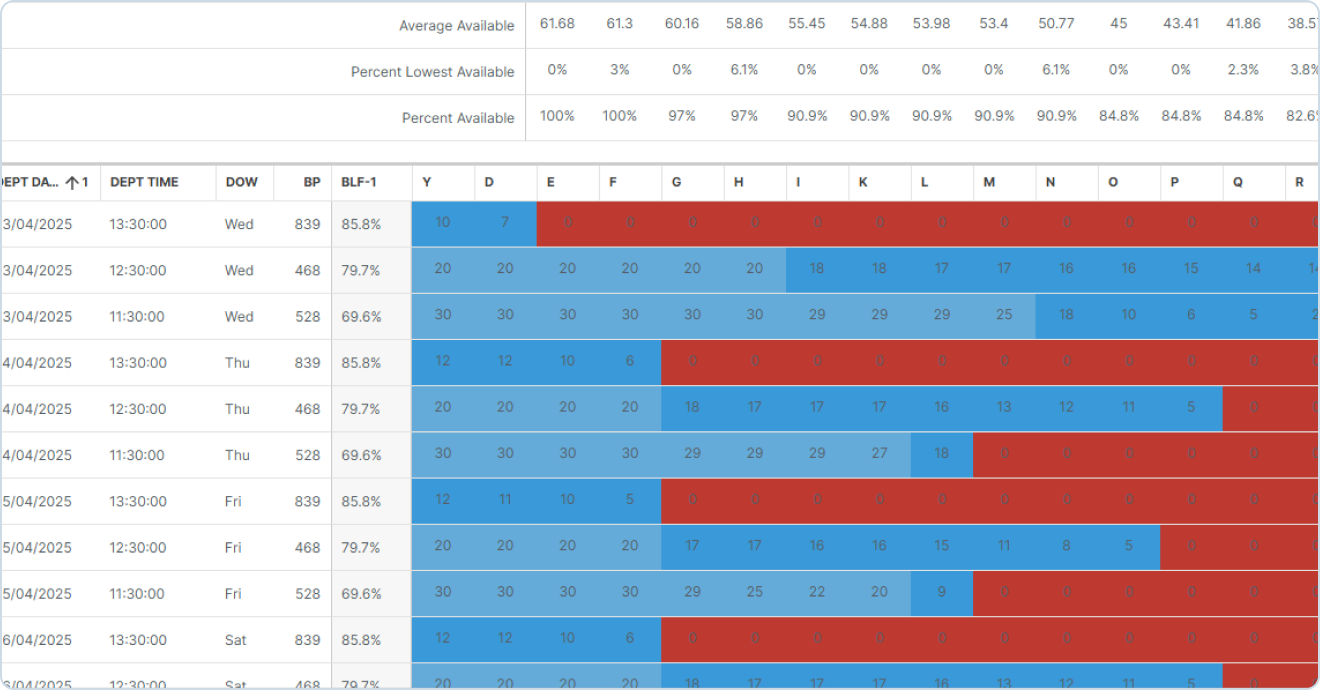

Dynamic Availability

Adjust seat availability and pricing decisions in real time across sales channels. Dynamic availability strategies help airlines react instantly to shifts in demand and inventory, improving offer quality and supporting more consistent commercial performance.

Availability Workflow & Simulation

Test pricing and availability strategies before deploying them. Simulation tools enable analysts to validate the impact of new rules, configurations, and business strategies – reducing risk and improving decision quality.

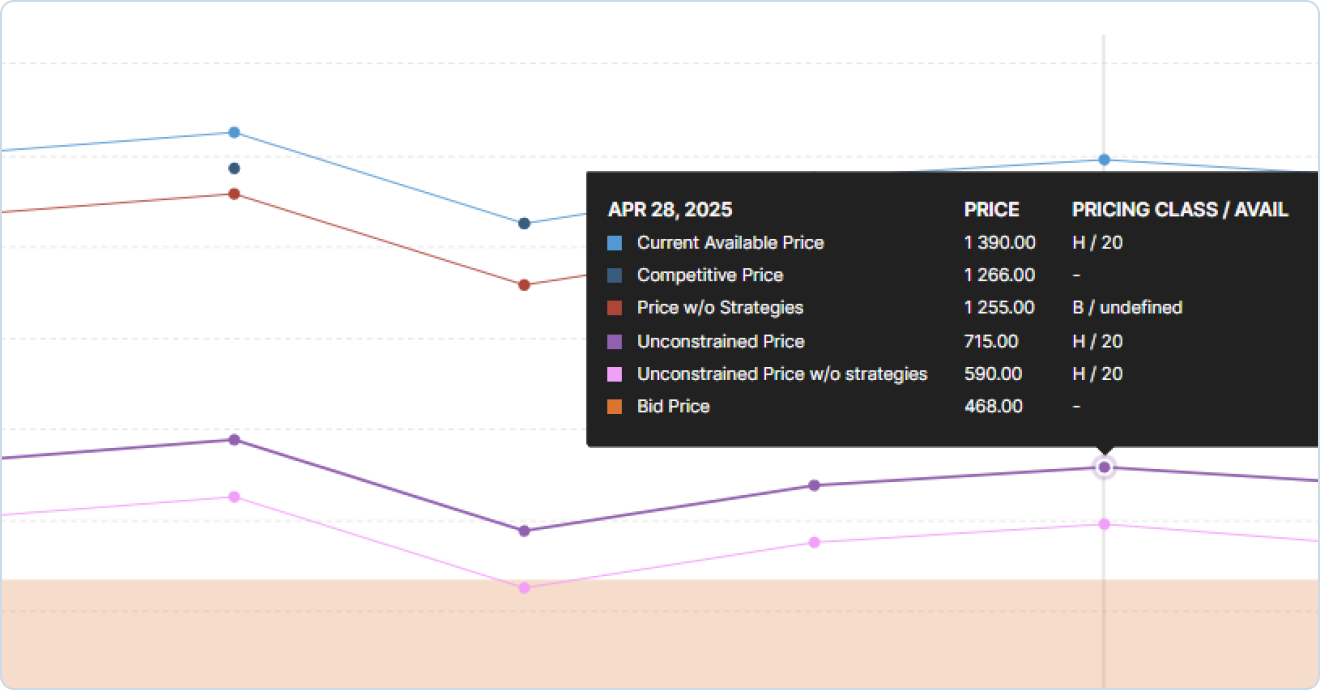

Competitive Strategies

Stay competitive with rules that adjust your pricing based on competitor fare data. RTDP helps airlines react quickly to market changes by matching or adjusting prices according to your business strategy, protecting revenue while improving conversion.

Business Analytics

Gain visibility into RTDP usage with BI reports that track look-to-book ratios, availability requests, and sell request volumes across channels. Monitor performance and distribution activity with clear operational insights.

Abuse Prevention

Protect inventory and reduce revenue leakage by detecting suspicious or high-risk shopping behavior. Tools such as married segment control and integrity reporting help safeguard against abusive practices and ensure fair access to offers.

Pricing Chart

Visualize the final price that shoppers would see under different availability scenarios. Pricing Chart helps analysts understand how real-time pricing responds to changing inventory conditions for specific itineraries and fare products.

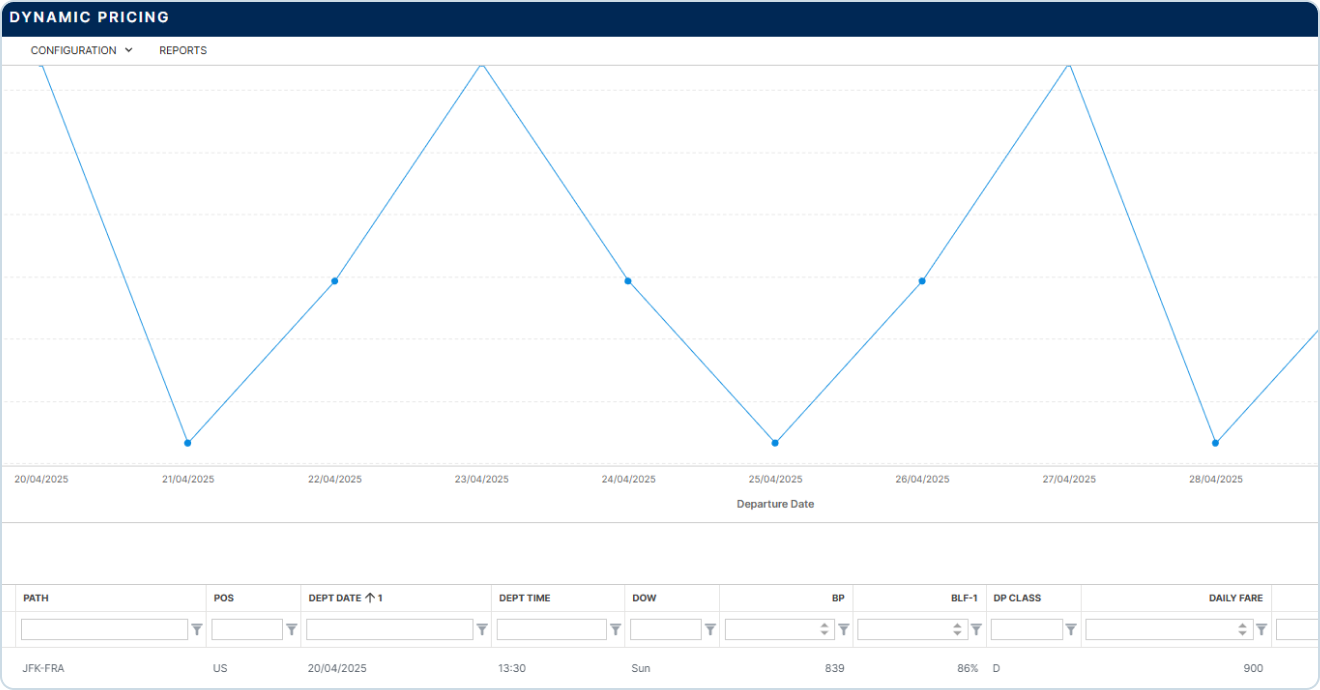

Fare Viewer

Displays daily and transformed fares used during RTDP price evaluation, providing transparency into the fare inputs driving real-time price recommendations.

Partner Availability

Ensure seamless data sharing with codeshare, interline, and joint-venture partners. Instantly evaluate availability and sell requests to maintain pricing accuracy, improve bookability, and capture more revenue.

Your Dynamic Pricing Journey

Every airline is at a different point in its RM and pricing modernization path. PROS Real-Time Dynamic Pricing meets you where you are today and enables you to advance toward more flexible, intelligent, and revenue-generating offers at your own pace.

Stage 1: Dynamic Availability - Return the best fare in real time.

Airlines beginning their dynamic pricing journey often rely on filed fares but want more responsiveness. With RTDP, analysts use real-time demand signals and business strategies to dynamically calculate availability at any moment, resulting in the most relevant filed fare to be offered. This ensures more consistent pricing across channels and reduces revenue leakage, all without requiring changes to fare structures. It’s the foundation for moving from static to real-time offers.

Stage 2: Continuous Pricing - Introduce price points beyond the fare ladder.

Once real-time responsiveness is in place, airlines can begin expanding beyond rigid fare steps. With Continuous Pricing, airlines can generate price points between filed fares—creating smoother pricing curves, reducing abrupt fare jumps, and capturing more hidden revenue. This stage enhances revenue performance without requiring a full transformation of internal pricing workflow, while building the foundation for classless pricing.

Stage 3: Contextualized Pricing - Deliver the right price using rich shopping context.

At the most advanced stage, tailor pricing to the unique characteristics of each shopping intent. Request-Specific Pricing allows airlines to incorporate itinerary details, timing, availability, and request attributes to return the most relevant offer in real time. This stage, building on continuous pricing, unlocks truly modern, next-generation pricing that aligns with the emerging Offer & Order ecosystem and maximizes conversion by aligning prices in real-time to traveler intent.

Bringing Continuous Pricing to Life with PROS RTDP

Discover how airlines can adopt continuous pricing while maintaining legacy systems, featuring insights from Air Canada, the Lufthansa Group, and PROS.

Book a Demo with an Airline Retailing Expert

Don’t let legacy technology dictate your revenue potential. See what happens when you put PROS precision behind every offer.

FAQs

How does PROS Real-Time Dynamic Pricing (RTDP) help increase revenue?

By continuously adjusting fares based on customer behavior, market demand, and real-time insights, airlines can maximize revenue and reduce revenue leaks.

Can PROS Real-Time Dynamic Pricing (RTDP) integrate with our existing revenue management system?

Yes, PROS RTDP is integrated with PROS Revenue Management to help ensure the seamless execution of your airline’s RM strategy and a smooth transition to dynamic pricing. PROS RTDP also integrates with Revenue Management Systems (RMS), Global Distribution Systems (GDS), and Passenger Service Systems (PSS).

How does Request-Specific Pricing work?

It uses AI to assess passenger information and preferences, shopping context, and historical booking trends to offer the most relevant price.

What makes PROS Real-Time Dynamic Pricing (RTDP) different from traditional availability management?

Unlike traditional systems, PROS RTDP focuses on pricing optimization, not just fare availability, helping airlines consider margin and price sensitivity, implement smarter, more flexible pricing strategies.

How does PROS Real-Time Dynamic Pricing (RTDP) help prevent revenue loss?

PROS RTDP helps prevents spillage (underpricing) and spoilage (overpricing) by dynamically adjusting prices to match real-time demand and market trends.

Is PROS Real-Time Dynamic Pricing (RTDP) future-resistant for Offer and Order Management?

Yes, PROS RTDP supports the transition to class-free dynamic pricing, so airlines are ready for the next evolution in airline retailing.

Additional Resources

How Airlines Can Adopt Continuous Pricing

- read more

Unlocking the Power of Airline Dynamic Pricing

The airline industry is at a turning point. Traditional fare structures and the 26 rigid booking classes that have defined airline pricing for decades are no longer sufficient to present attractive offers and capture the full revenue potential of modern air travel.

- read more

From Optimal Price to Issued Ticket: How Airline Dynamic Pricing Really Works

How does an optimal price actually become a ticket? The short answer: it’s more straightforward than you’d think. But first, let’s take a quick step back.

- read more