By PROS and Skyscanner

The industry advances on the path to modern airline retailing. Airline-led offer optimization strategies become critical as airlines rethink their channel distribution strategies. The metasearch channel is no exception, presenting airlines with new opportunities to extend their market reach and engage travelers in enhanced retailing experiences beyond their own platforms.

By adopting a direct airline-led distribution approach, airlines of different sizes and business models can harness the potential of metasearch engines to bring offer optimization to life, present richer offerings, and boost conversion rates.

At PROS, we are deeply engaged in the airline perspective, working with carriers on their airline-led offer optimization and distribution strategies. Moreover, through our partnership with Skyscanner, we are privileged to be part of the metasearch perspective too. The exciting part – in the next few pages you will get access to insights and best practices from both worlds.

PROS and Skyscanner will take you on a journey to explore the endless opportunities for direct and more meaningful retailing through metasearch engines.

“Industry initiatives around NDC, Offers and Orders, aim at giving airlines absolute retail freedom: to be in control of how their product reaches the market and optimize the offers customers are presented with. This gives to indirect channels like metasearch a totally new significance, opening new opportunities for better retailing.”

Surain Adyanthaya

PROS President of Travel

“We are excited by the renewed focus on modern airline retailing and as one of the biggest consumers of NDC APIs in the industry, Skyscanner is well positioned to help our partners unlock the promise of personalization and true dynamic offers using data from over 1 billion monthly searches across our platforms.”

Phil Donathy

Skyscanner VP Product Management

A few decades ago, in the early days of digital commerce, airlines were at the forefront of innovation, offering travelers the convenience of online flight shopping. But digital savvy metasearch engines (MSEs, metas) like Skyscanner, quickly emerged and evolved as travel players, taking advantage of being digital-first platforms. Metas provided travel shoppers with a user-friendly, easy-to-use tool for fare comparison and shopping at their fingertips. For airlines, this marked the first major disruption of traditional distribution which posed challenges to airline pricing and emerging digital acquisition strategies.

Now, in a world where digital is king, both airlines and MSEs are realizing the true potential and mutual benefits of their partnership and collaboration:

Combined with the current technology evolution, the partnership opens a whole new world of retail opportunities for airlines to explore.

Airlines are investing seriously in building their brands and brand experience. But they rarely have the same brand strength and recognition across different markets and regions to acquire shoppers directly on their dotcoms. Having a helping hand for global reach is a must.

With the rise of eCommerce and the internet for travel inspiration metasearch engines and online travel agencies emerged as new sales channels for airlines. Slowly but steadily, the dominance of traditional travel agencies, agents and the GDS eroded, with OTAs and MSEs becoming the go-to place for travelers. Travelers want choice and convenience to easily compare flight options in one place, so it is no surprise that today metasearch engines account for almost a third of global flight search sessions.

At the same time, distribution through the traditional GDS channel is expensive and not customer centric. More and more carriers are exploring alternative, more cost-efficient ways to expand their reach and directly distribute their offers. Thanks to the progress in NDC, they are also realizing the untapped commercial value of direct retailing and actively breaking free from the GDS monopoly, legacy distribution models and their cost burden.

Metasearch engines – these digital-first platforms, offer end-customers irreplaceable convenience: modern and intuitive user interfaces, self-serve, and single-view offer/cost comparisons – no blue screens, no extra browser tabs or windows opened. They know how to aggregate vast amounts of flight search data and help shoppers effortlessly narrow down their choice. But their role has evolved to also inspire and encourage travel through affinity shopping applications and destination travel, as well as facilitate travel research and planning. In a world of Offers and Orders, MSEs are here to stay.

“Metasearch engines are already a huge channel for airlines. We have great reach and help carriers showcase their brand and network globally, providing them with highly qualified web traffic. With the transition to dynamic offers, MSEs will be of even greater value, educating travelers that the cheapest offer is not always the best one.”

– Phil Donathy, Skyscanner VP Product Management

Explore the conversation between Air Canada, Lufthansa Group and Skyscanner on “Leveraging metasearch within offer optimization strategies.”

Shopping for travel is becoming more complex than ever. Nevertheless, travelers want to effortlessly explore options, easily compare every offer available and receive relevant recommendations. So, there has been a significant evolution in the role and perception of metasearch.

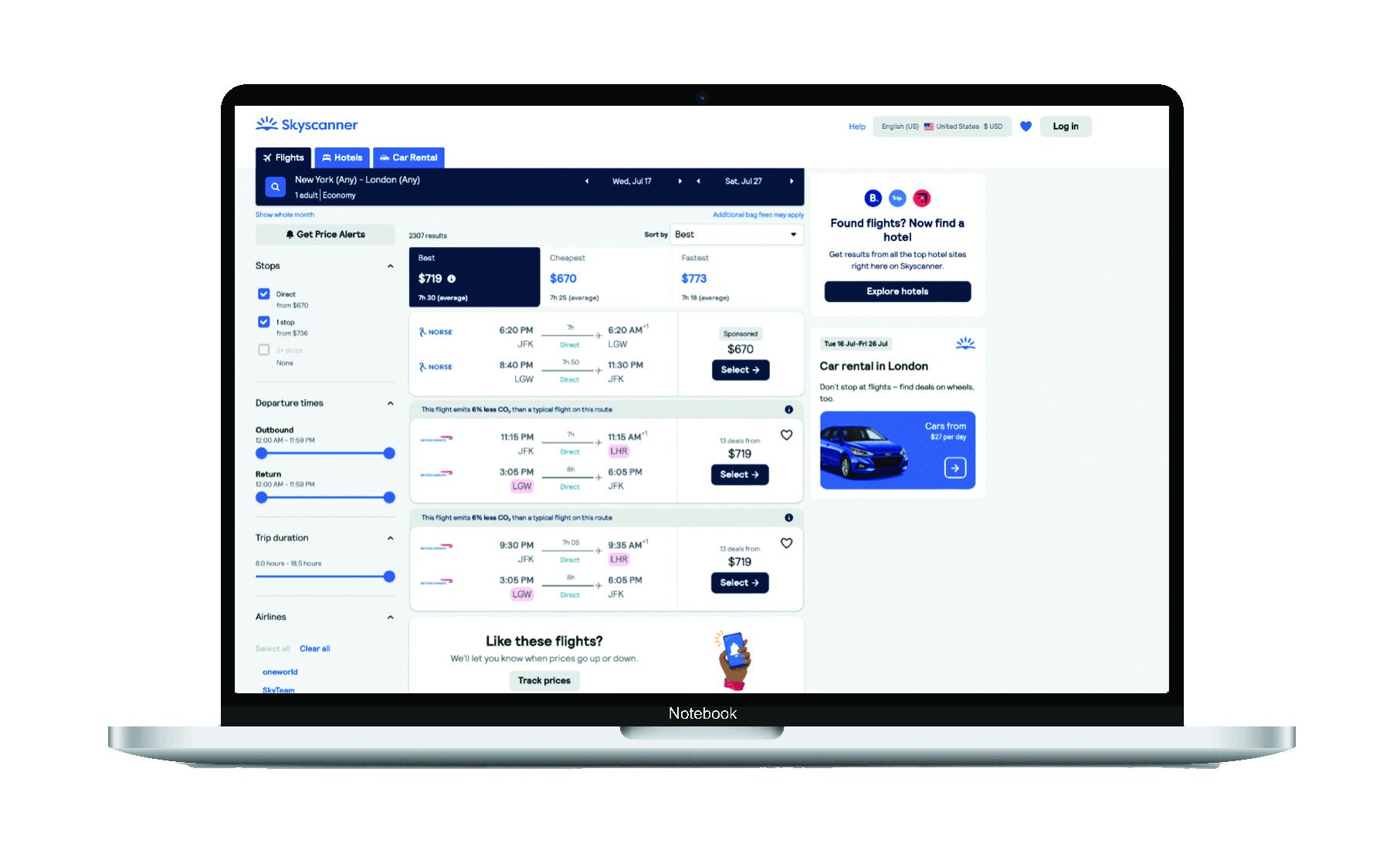

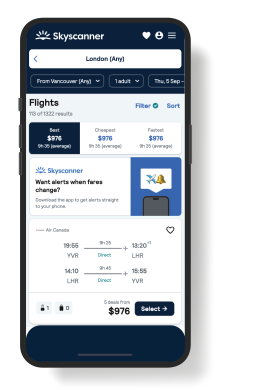

Travelers no longer go to Skyscanner to look solely for the “lowest fare” – they are increasingly looking for value. Thanks to the advancements in comparative shopping and user experience, shoppers trust metasearch to deliver true offer transparency as they compare options. With that, there has been a conscious and natural shift to look for the “best offer.” Metasearch engines like Skyscanner are doing a great job at bringing digital retailing innovation in that aspect. Skyscanner’s flight ranking model now defaults to “best” rather than “cheapest,” leveraging a machine learning algorithm that is using cohort-based personalization (i.e., people in this market at this time of year tend to have a certain type of behavior). In addition, to streamline the user experience and easily narrow down and compare flight options, the meta offers customers multiple filters based on things like flight connections, departure time, airline, or airport.

“Skyscanner was the fastest growing flight meta globally in 2022 and in 2023 gained more market share than any other metasearch engine. We are searching 80 billion prices daily and today 56% of travelers are coming to Skyscanner for travel inspiration.”

– Hugh Aitken, VP Strategic Relations and Development Skyscanner

Skyscanner flight search filters

As the NDC standard keeps evolving toward maturity, an enormous opportunity emerges for airlines to do more meaningful retailing, with full control of their offers. To do that successfully and effectively, airlines need to distribute directly to their metasearch partners.

The transition to NDC and Offer and Order management requires airlines to regain control of their product and how it is distributed across the variety of sales channels. To do so, carriers need to own and manage offer creation and distribution in-house and at scale. Direct connect distribution is proving to be the more effective and cost-efficient way of distributing airline offers to metasearch:

“Airline customers doing direct distribution are seeing up to 2 times lower costs, significantly reducing high GDS booking fees and excessive PSS fees. The greatest benefit is that they do not have to sacrifice the quality and quantity of the offers, presented to MSEs, in order to reduce their distribution bill.”

– Boyan Manev, Travel Principal, PROS

To maximize value from retailing via metasearch, both airlines and MSEs are acknowledging the challenges around speed, choice, offer accuracy and look-to-book ratios. PROS is collaborating with diverse airlines helping them overcome these challenges, as well as with Skyscanner which is constantly experimenting, testing, measuring, and evaluating to assess the optimal way to deliver and present airline offers in a structured way that makes customer choice easy. This approach has proven a successful formula for direct offer distribution to metasearch.

In the digital world, shoppers are rarely keen on waiting for flight results to load. An important differentiator between dotcom and metasearch shopping is intent. On the airline website the customer, in many cases, already has the intention to research, buy, and fly with the airline. So, waiting a couple more seconds to see all options and evaluate them is worth the time.

On MSEs, like Skyscanner, that’s rarely the case. Travel shoppers often start there and revisit multiple times, with the goal of comparing airline prices, different offers and considering itineraries and alternative options they haven’t thought of. They want answers fast and can’t wait forever, so speed matters and, as Skyscanner data illustrates, getting flight results on the screen should happen in the first seconds.

“You have to have the first result for the traveler on the screen in less than 2-3 seconds.”

– Phil Donathy, VP Product Management, Skyscanner

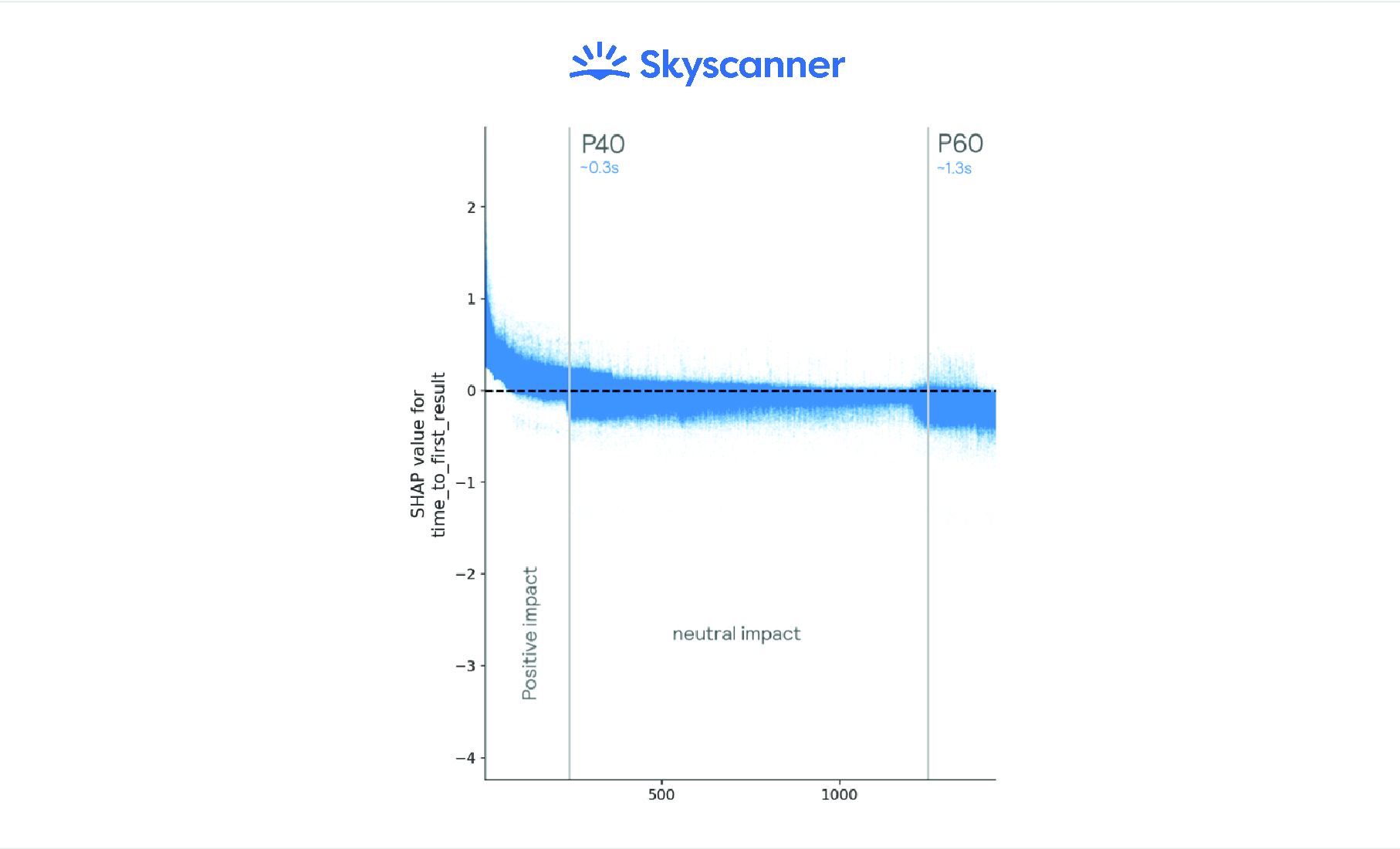

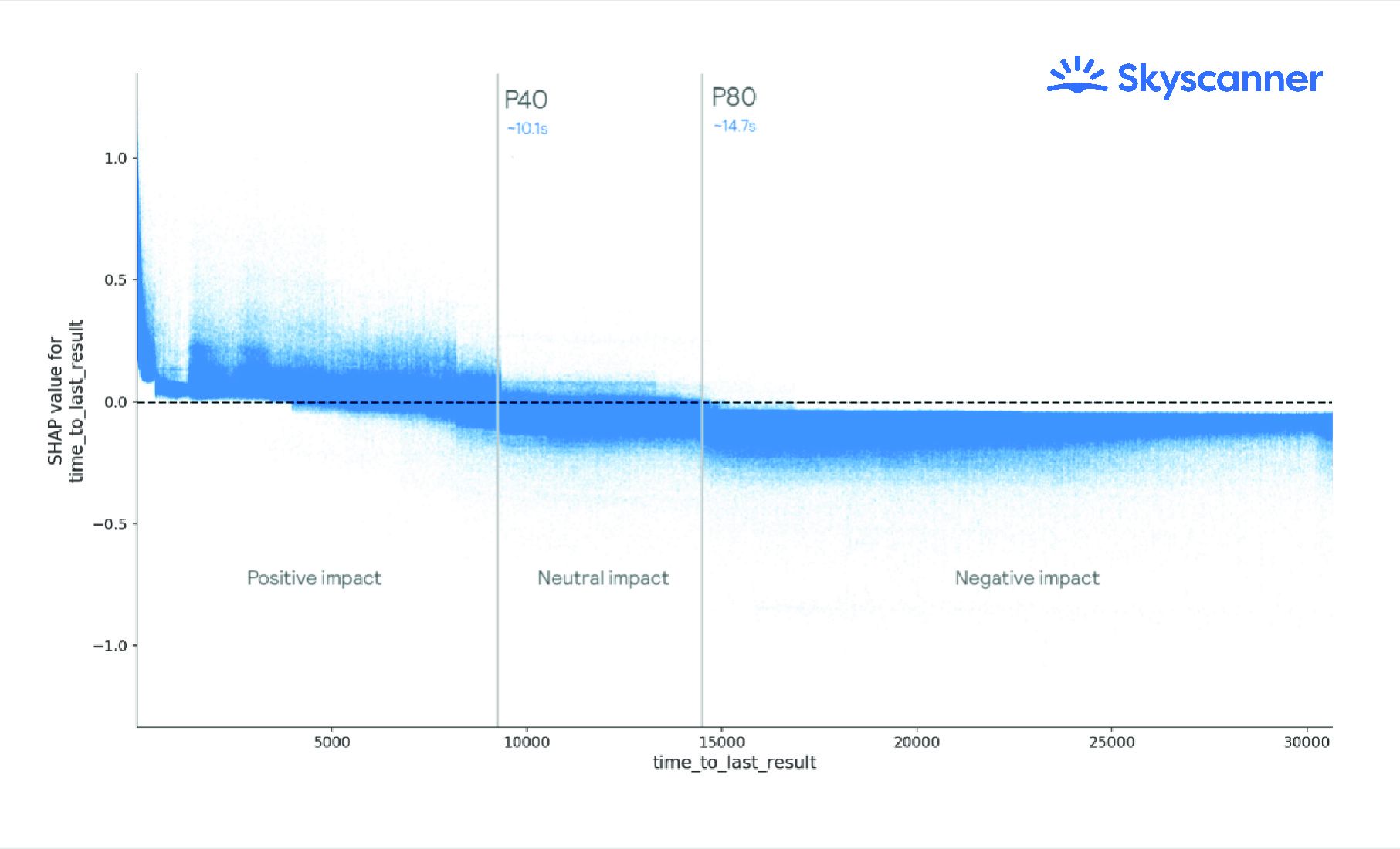

Time to first result (TTFR) and time to last result (TTLR) are two measures Skyscanner uses today to understand the correlation between speed and conversion. The analysis shows that improving speed by orders of 100ms increases conversion across both measures.

Time to First Result (TTFR)

Time to Last Resultt (TTLR)

But too fast is not always preferred, because shopping speed is also a matter of trust. Showing the best offers means that there has been research effort done in the background to browse all airlines. And that is supposed to take time, so customers believe that the airline offers are real and bookable, not some predefined cache.

“You need to be fast. If you are too fast it can also be a downside, so there is a certain threshold.”

– Mario Maier, Head of Distribution Solutions, Lufthansa Group

Flexible shopping technology helps airlines manage the speed-quality challenge effectively, so they can respond to shopping requests from MSEs in seconds with accurate content and offers. By being able to evaluate requests and fully manage their content, carriers can determine what variety of offers can be targeted to travelers using metasearch as an extension of their dotcoms. This reduces the volume of data and offers that need to be processed and increases speed of delivery, while at the same time also help increase conversion probability. This is especially important in the context of real-time dynamic offers and continuous pricing which will inevitably impact speed, but for the sake of more meaningful customer-centric retailing, it is worth the trade-off.

After all, shoppers on metasearch don’t need the entire variety of brands and cabins to make up their mind. Rather, just enough choice, so they convert and land on the airline dotcom. So, what exactly is “enough choice”?

Carriers have unbundled their product through branded fares across all cabins and brought a wide range of good-better-best options for travelers to choose from. But presented with too much choice, shoppers often get overwhelmed and abandon their decision.

On metasearch, customers are determined to pick the best flight option between airlines. So MSEs like Skyscanner do a great job at narrowing down the choice not to overwhelm, but to convert travel shoppers. Constantly analyzing shoppers’ behavior, they know that simplicity drives conversion and awareness in upper funnel, when lookers have not yet become bookers.

Skyscanner progressive disclosure of offer attributes

One great way to do this is focusing customers’ search efforts on the “best value” instead of the “cheapest fare.” The pandemic has impacted travelers’ behavior, making them spend more time researching and planning and more open to evaluating travel offers. For airlines this is an opportunity to capitalize on their brand differentiation efforts and highlight unique attributes.

“Customers are looking for options. More than 40% of the time, they don’t purchase the lowest fare. They are willing to buy more, and this works in our favor because they are more satisfied with their purchase.”

– Keith Wallis, Managing Director, Customer Digital & Distribution, Air Canada

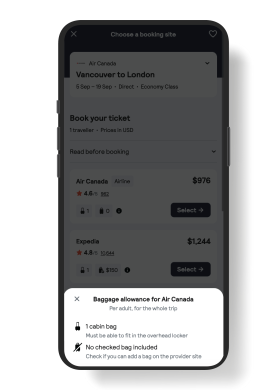

Metasearch engines are known for successfully providing value through comparison shopping based on price and schedule. Where it gets complicated and tricky is providing that level of visibility on what’s actually included in the price in a manner that is unified across different airlines and their variety of offers. It requires comprehensive, structured, and accurate data—all delivered at speed.

This type of offer attribute comparison is challenging for the metas and the industry. As such, IATA and ATPCO have taken steps forward to standardize the offer attributes across the industry through IATA taxonomy codes and ATPCO retailing attributes. Higher adoption from airline offer management systems will help MSEs streamline comparison shopping and provide customers with a user experience that facilitates their travel choice.

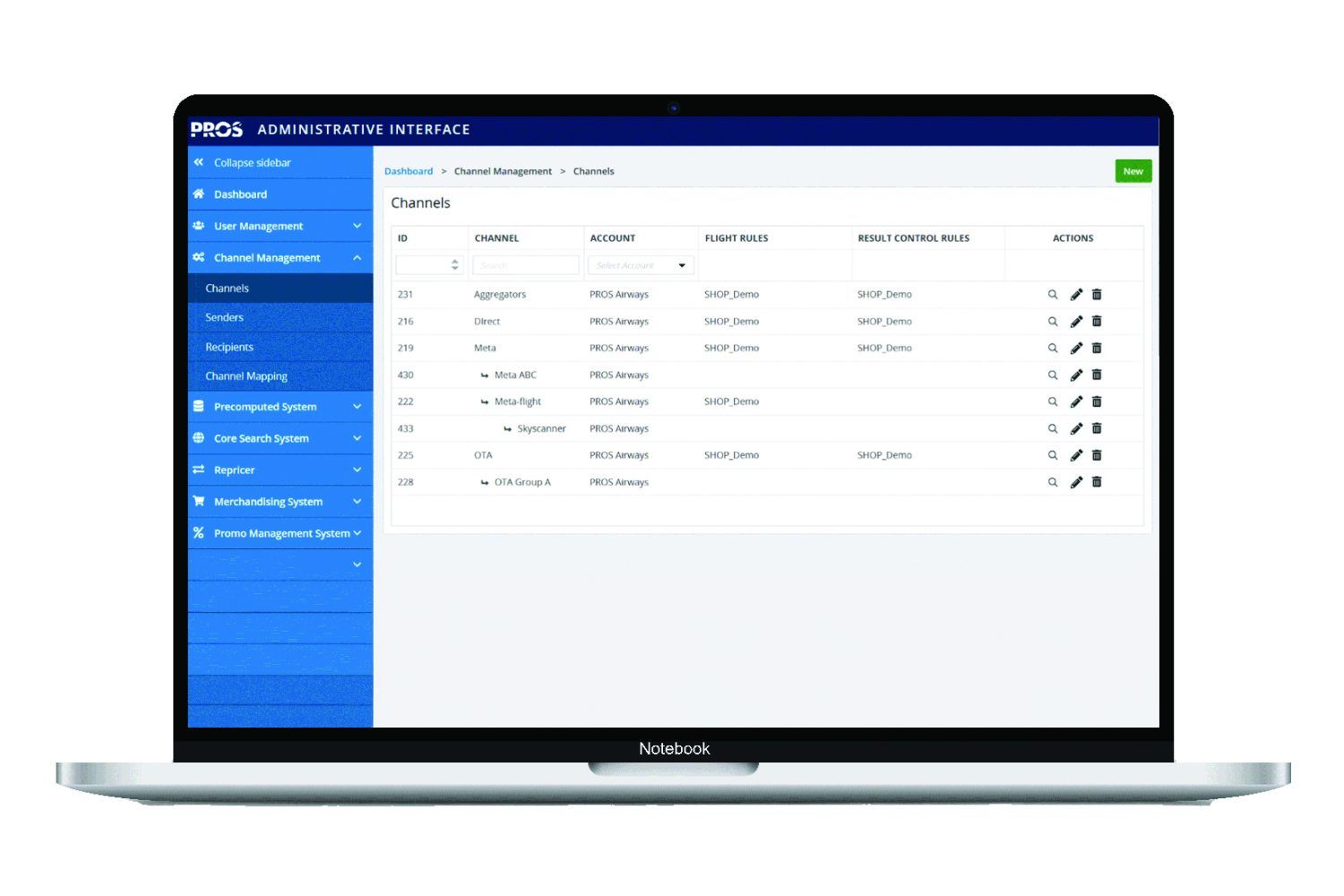

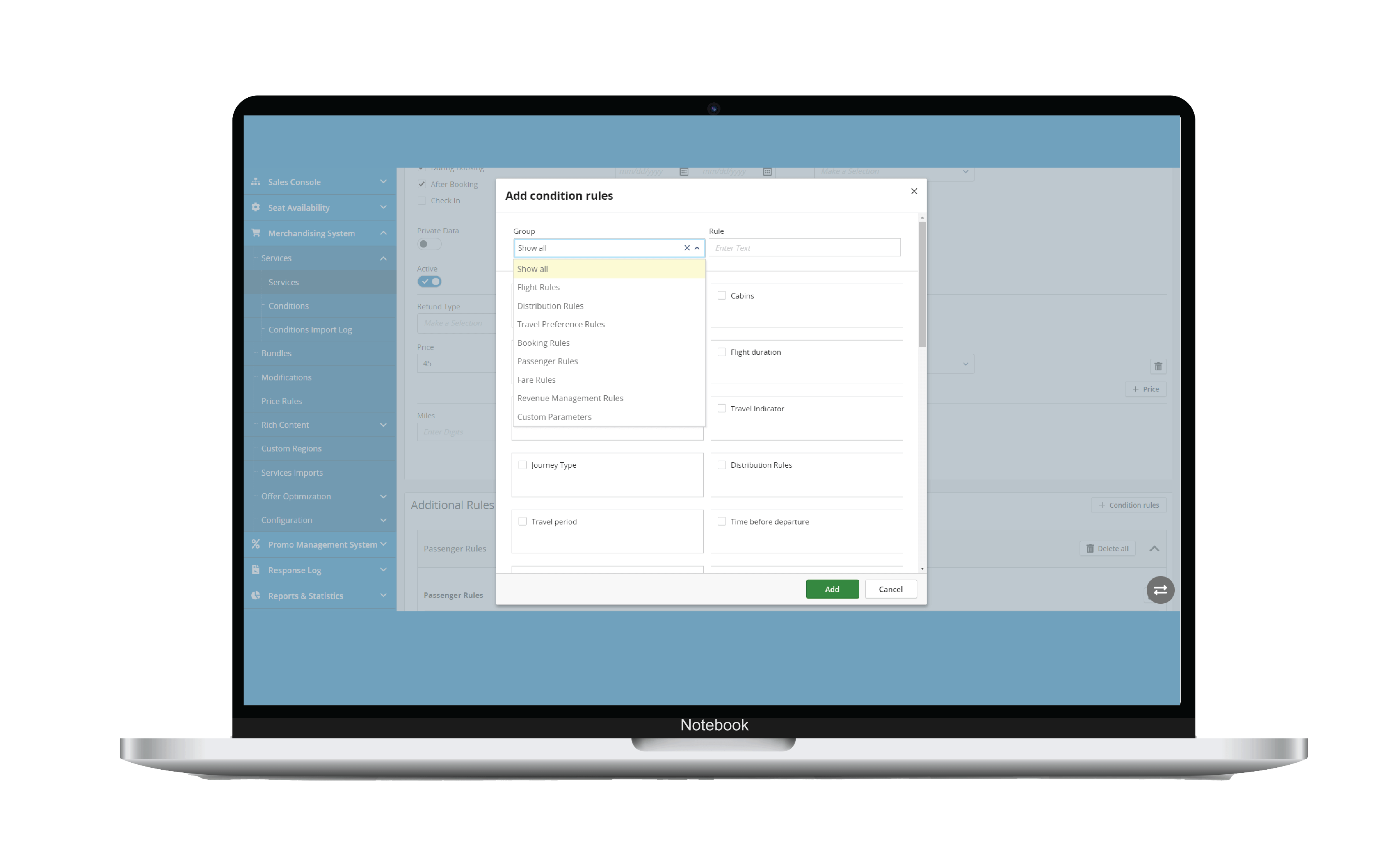

At the same time, airlines need to be mindful when defining the content strategy for their metasearch channel in their offer management system. Not all MSE partners require the same amount of offers or variety of choice. Offer technology, like PROS, is also there to allow that level of robust offer control—down to a very granular level, even at individual seller level, so carriers can effectively do content differentiation. This is an enabler for managing offer distribution to metasearch in a revenue-optimal manner for the airline. For high-value partners, airlines can deploy special offers or ancillary tactics to drive even higher conversions, increase the average basket size and increase overall customer satisfaction with their purchase.

On the other hand, if a metasearch engine is generating uncontrolled transactional costs for shopping requests but not converting travelers and bringing low value traffic, carriers have the tools to deploy control tactics. This can mean measures like limited access to offers, fewer brands and real-time content.

Content and distribution rules configuration in PROS offer management system

Whatever the distribution use case, airlines must be empowered to steer their metasearch distribution strategy based on the sought channel ROI and desired outcome, and not based on the limitations and predefinitions of legacy technologies. This is the power of decoupling the offer engine from legacy PSS and GDS systems.

If there is one thing travel shoppers are not tolerating, it is inaccuracy of travel offers. Disappointment with offer availability and pricing does not only impact conversion, leading to abandoned shopping carts, but deteriorates trust and brand image in the long run.

“Where people have absolutely zero tolerance, and is the #1 complaint, is price accuracy.”

Phil Donathy, VP Product Management, Skyscanner

“Even a penny dramatically impacts conversion. The greater gain is accuracy and choice.”

Keith Wallis, Managing Director, Customer Digital & Distribution, Air Canada

Offer accuracy is dependent on shopping technology. Many airlines suffer from having a mediocre legacy solution for metasearch offer distribution: to avoid unbearable distribution costs for live shopping polls, carriers would compromise offer quality and settle for inflexible cached solutions that have a high price discrepancy rate between initially presented offer and offer at the time of booking.

For airlines this is not only money left on the table, but also a sure way to push travelers away from booking with your brand. So, how do you ensure offer accuracy on high look-to-book channels like metasearch engines but in a cost-efficient way?

Real-time offer pricing is at the heart of airline retailing with Offers and Orders. If cache was a solution a decade ago, airlines today must be thinking ahead and preparing for real-time modern airline retailing, based on the shopping context and customer profile, because dynamic pricing is already happening.

“Today, PROS offer technology is already processing 7000+ transactions per second, 200+ billion pricing and shopping transactions per year with over 99% bookability ratio that we monitor and continue to improve. This equals to close to 1.8 trillion offers a month.”

– Boyan Manev, Travel Principal, PROS

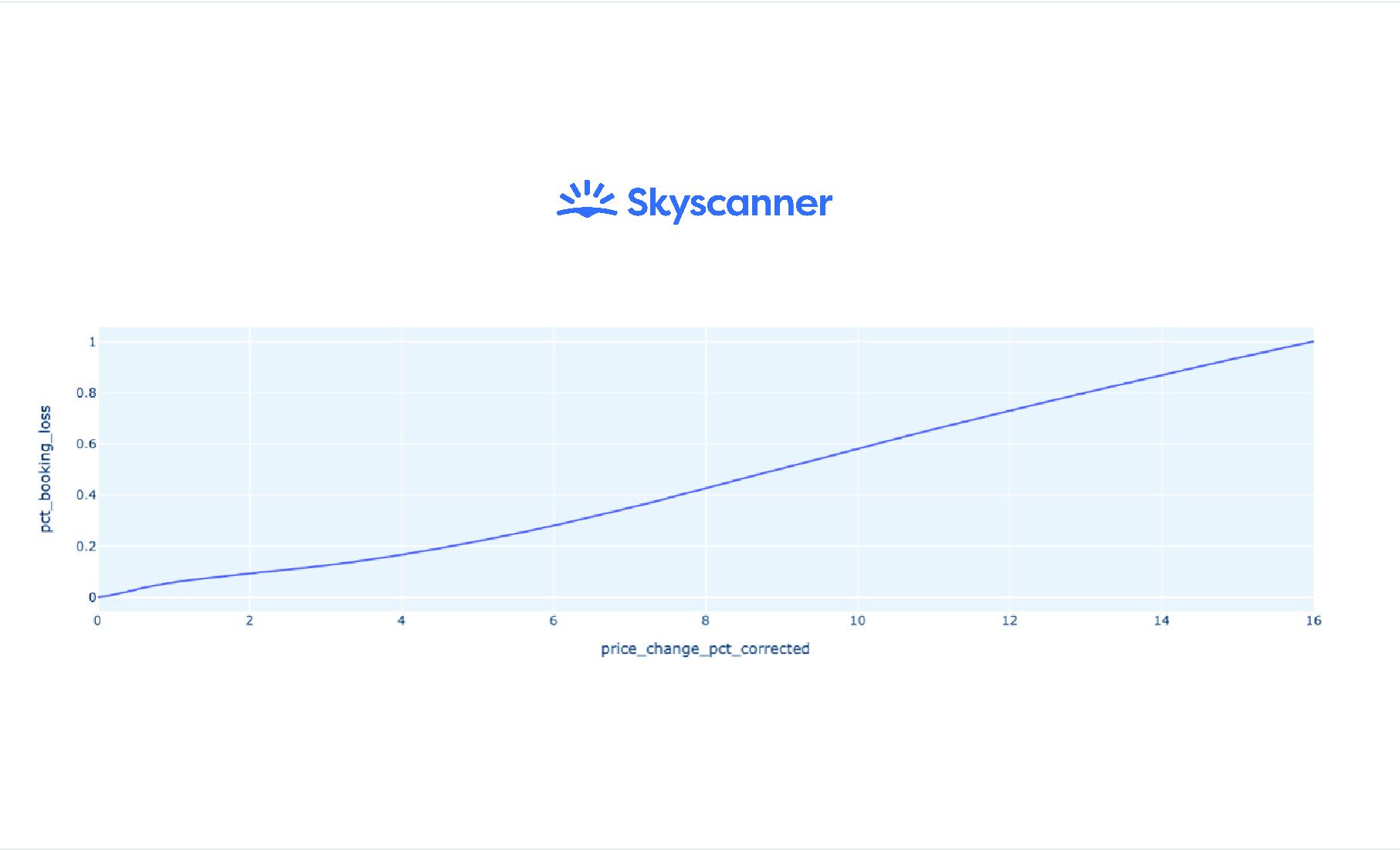

To monitor offer accuracy Skyscanner does regular price checks too. The metasearch engine is comparing redirect price and landing price shown on airline and 3rd party partners’ website and monitoring price discrepancy. A price is considered an inaccurate redirect when it has increased with more than 1% or decreased by more than 4%.

The implication for airlines from that is to put a strong focus on making sure offers are accurate and available for purchase across the MSE channel in order to protect and grow incoming bookings.

Price accuracy

This is going to become even more critical as the airline industry progresses on the path to modern airline retailing. With the broader penetration of dynamic pricing, travelers are only expected to increase frequency of shopping, while offer creation would still require real-time computation and highest accuracy.

Airlines can be smart in addressing this challenge. Instead of having to generate large volume of offers, trying to replicate the choice and variety of their dotcom across metasearch engines, airlines can limit those real-time offers on MSEs to the best ones, thus reducing distribution volumes and the computational costs. Understanding better what these best offers include, who they will be designed for and which competitors they will be compared against, is a smarter approach to broadcasting fewer options that are most likely to convert, while being close to 100% available for purchase.

Metasearch engines are increasingly able to provide more context and user details to carriers for a given search request. This enables airlines’ offer management systems to make an educated decision when responding to the request with the right “best” offers – equal or better to the offer on their own channels, driving incremental revenue. On the other hand, being well aware of their top selling markets and their long tail, airlines can leverage flexible offer management systems, like PROS, to control offer accuracy and the associated computational and distribution cost by dedicating more of the resources to their top selling markets.

Metasearch engines are high look-to-book distribution channels by default. They play a key complimentary role in the travel funnel for airlines, at the top in the inspiration stage, pushing consumers through to book. They are designed to make travelers explore options, compare offers and search for the best match to their needs, over and over. And that implies large search volumes. As the digital distribution landscape becomes more and more fragmented, and airline offers – more dynamic, shopping volumes are only expected to grow. Modern offer technology must keep up.

Skyscanner’s role in the travel funnel

Thanks to cloud technology and smart computing, high look-to-book ratios that are challenging airlines, their IT providers and MSEs today, can be managed successfully. And more important KPIs like look-to-value are being considered.

Look-to-book is a challenge – we have look-to-book ratios in the range up to 25,000:1. You have to manage this and also consider look-to-value.

– Mario Maier, Head of Distribution Solutions, Lufthansa Group

Direct connect distribution is a successful approach because it allows airlines to focus their business strategy on the ROI from their distribution partners which, in return, focuses partners on generating value. This is a foundational win-win principle in digital retailing where a partnership is evaluated based on the revenue contribution of the partner, not only on the cost they generate. Lufthansa Group, who today have a mature NDC strategy in place, are already considering look-to-value in direct distribution to metasearch engines and using it as a driver of their offer optimization strategy.

Learn more about Lufthansa’s direct distribution strategy to metasearch engines here.

The post-pandemic recovery period has been marked by significant advancements in modern airline retailing. Many airlines are making exclusive content available in their direct connect channels of sale, pushing higher NDC volumes and wider industry adoption.

As digital savvy tech players in travel, metasearch engines have a quick turnaround for innovations. Airlines who are looking to capitalize on their offer optimization efforts via NDC should be considering MSEs as a primary channel. Two innovation streams unlock incremental revenue potential: ancillaries and dynamic pricing.

Yes, travelers do want it all. They want simplicity – to easily find options, and choice – to select exactly the options that fit their needs. When combined, simplicity and choice result in a relevant offer.

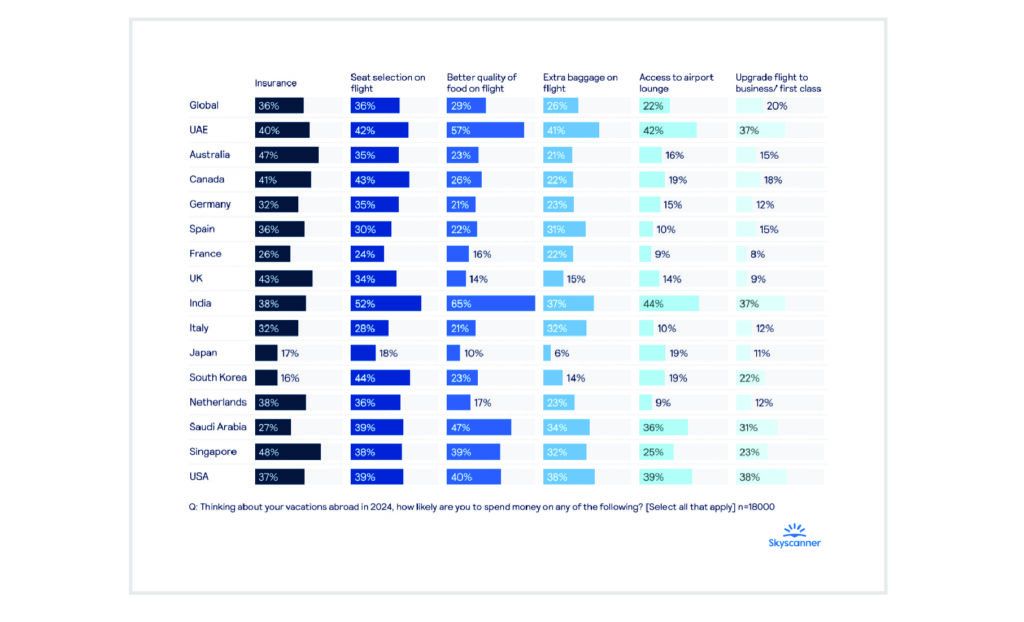

Skyscanner Ancillary Research

Ancillary products and services are a great way to present more relevant offers on metasearch engines. According to Skyscanner research, the most desired ancillaries by travelers are checked bags, seat assignment and the flexibility of the offer, with 20% of travelers willing to upgrade. It is clear that flyers are keen on spending more to make their travel experience as rewarding and enjoyable as possible. With airline ancillary revenue estimated at close to $118 billion (Source: CarTrawler/Ideaworks Company) there is a solid revenue potential sitting and waiting to be materialized.

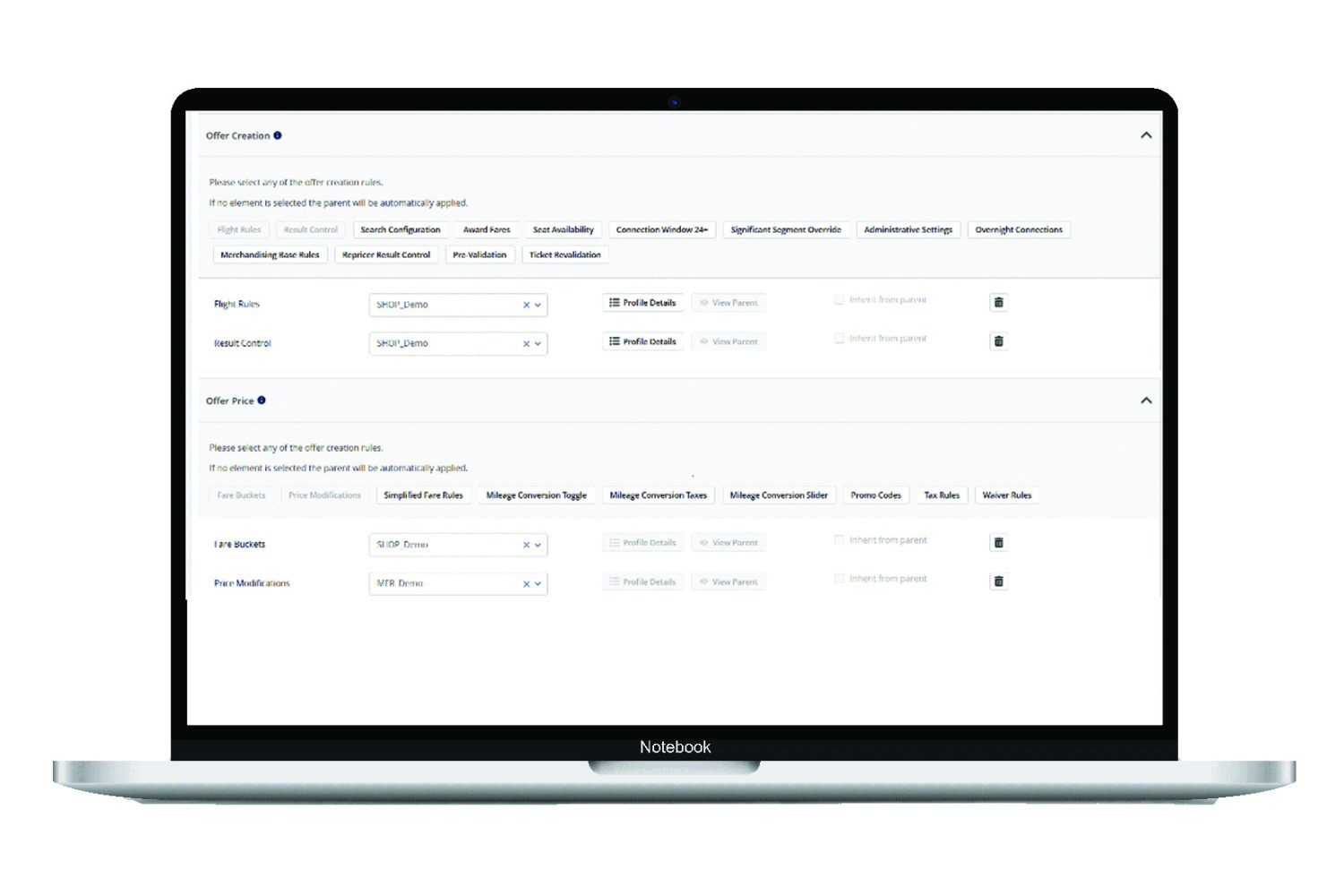

Airline-led offer creation and distribution allows airlines to take advantage of this revenue opportunity through a strategic approach. Giving access to the airline’s ancillary catalog of products and services amplifies the sales opportunities during the booking process, leading to a win-win-win situation for the airline, the meta and the customer. By managing their entire ancillary catalogue outside of their core reservation system (PSS) carriers can create ancillary offers for their metasearch partners and define differentiated distribution strategies based on the partner’s ROI and market readiness.

Legacy-free merchandising systems, like PROS, allow airlines to optimize ancillary strategies, manage complex ancillary pricing tactics, and differentiate their ancillary catalog offers for each MSE partner separately. This can be easily done by the airline itself by creating and managing a variety of business rules in real-time for direct control over ancillary pricing and content per channel.

PROS Merchandising ancillary business rules

By leveraging flexible retailing techniques airlines can benefit from improved content quality and ancillary price diversification, while being in control of the cost of sale. Today, such business strategies are business rules driven by airline analysts across various teams. As airlines accelerate AI adoption and invest more heavily in AI-fueled offer optimization in the upcoming years, they will benefit from more recommendation in defining ancillary strategies and more automation in deploying them across channels, making analysts more efficient, offers more relevant and market tactics sharper and data-driven.

Thanks to real-time engines like PROS RTDP, airline dynamic pricing is no longer a distant future in metasearch distribution. In fact, Lufthansa Group have been live with continuous pricing since 2020, having invested in this critical innovation during the pandemic. Today, the airline group is doing continuous pricing at scale across their dotcom channel and metasearch network, and realizing incremental revenue increase.

“We went live with continuous pricing during the pandemic and today we are reaping the benefits – the benefit is revenue.”

– Benedikt Zimmermann, former Sr. Director of Business Development, Methods and Solutions, Commercial Offer, Lufthansa Group

Moving to a world of dynamic airline offers, there is untapped revenue opportunity to focus on cohorts of travelers with similar preferences and provide tailored offers to each particular cohort. To capitalize on this opportunity, there must be a profound understanding of airline dynamic pricing from all players in the value chain, especially from airlines and metasearch engines.

Read more about this topic in the blog post What Exactly is Dynamic Pricing in the Airline Industry?

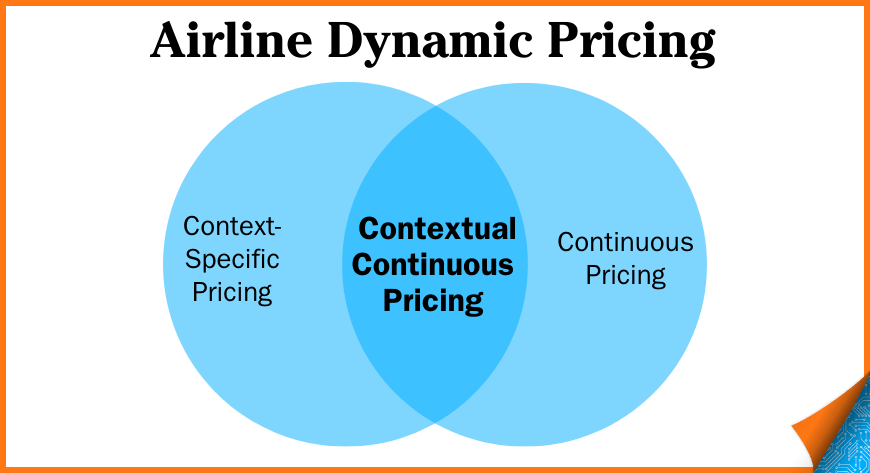

Airline dynamic pricing is a broad term that includes two core components: Continuous Pricing and Context-Specific Pricing. This diagram illustrates that you can have context-specific pricing without continuous pricing, and you can have continuous pricing without context-specific pricing. Either of those is dynamic pricing. But the ultimate goal where the industry is headed is to do the combination of both based on customers’ price sensitivity and willingness-to-pay and leave class-based pricing practices in the past.

Through collaboration, airlines and MSEs can partner to deliver these dynamic pricing innovations to life today. PROS customers are leveraging dynamic pricing algorithms to determine the dynamic price of an offer. To convert this offer into an order and ensure interoperability, such dynamic offers must include certain legacy attributes to comply with legacy PSS capabilities, until modern order systems replace them.

Shopping engines, like PROS, are mapping the dynamic price to a filed fare and RBD and presenting the dynamic price into the data model recognizable by the PSS (i.e. fare components, FBCs, fare calculation line, etc.), so the offer can be converted into an order. With this transitory approach airlines can start benefiting immediately from revenue uplift from offers, priced in more context and closer to what shoppers are willing to pay for. At the same time the dependency on a functioning next-gen order system is removed until it is put in place and running. This hybrid approach allows not only the initial order creation but also the order servicing through the typical channels the airline uses today.

To keep up with industry innovation metasearch are following the dynamic pricing trend. Skyscanner reports an increase in the number of airlines who want to deploy dynamic offers and are working together to enable them across the meta channel. To maximize the value potential of real-time dynamic pricing airlines can harness competitive pricing insights and traveler demand insights.

Skyscanner today is a leading source of traveler demand data, with over 110 million monthly users, above pre-pandemic levels. The metasearch engine has a key role in the upper funnel for airlines and is a great channel for offer presentation, extending their market reach and making it easy for offer fulfilment through tailored deep links to the airline dotcoms.

Sustainability efforts in the airline industry have become the norm and airlines are implementing various initiatives to minimize their environmental footprint, such as investing in more fuel-efficient aircraft, adopting sustainable aviation fuels, and optimizing flight routes to reduce fuel consumption. There is a growing emphasis on eco-friendly practices like promoting carbon offset programs and encouraging passengers to make environmentally conscious choices when booking flights, too.

The integration of sustainability in airline retailing responds to increasing consumer demand for responsible and eco-friendly travel options. Airlines are looking to raise awareness around their green fares and showcase their focus on newer more fuel-efficient aircraft, optimized networks and carbon offset programs.

Carriers and metas have the opportunity to actively collaborate, emphasize, and educate on sustainable choices across travel inspiration and flight shopping outside of direct airline dotcom shopping. As more travelers prioritize sustainability, the aviation industry is likely to respond by further enhancing its environmental initiatives.

Green fares display on Skyscanner

As the airline industry transforms, moving away from the monopoly of GDS distribution, the travel retail landscape becomes more fragmented and attractive for new technology and travel entrants. The adoption of open and modular offer- and order-based retail platforms allows for airlines to rethink partner integration and find new ways to innovate faster, outside of legacy core IT systems. Enabled to think outside locked IT architectures and closed ecosystems, carriers are starting to leverage 3rd party cloud capabilities, marketplace partner integrations, content aggregators, as well as realizing the value of structured data, delivered with speed and accuracy across the value chain.

Active partnership and deep collaboration across the aviation ecosystem are key to delivering a better flight shopping experience for travelers. The goal of this airline-led business model and its underlying technology is to help travelers discover and compare all the great investments airlines have been making in their products – going beyond just price. As a result, customers can shop and book seamlessly, access bundled packages and self-serve for more convenience, which directly translates into higher revenues for airlines and the entire value chain, and ultimately – happier travelers.

“What do travelers really want? This is the question that we as an industry must always ask ourselves. To deliver a seamless experience from travel inspiration, exploration, booking and the journey itself, we need deep collaboration across the ecosystem and meet travelers where they are.”

– Hugh Aitken, VP Strategic Relations and Development

As the industry advances to modern airline retailing, opportunities for more meaningful retailing through the metasearch channel multiply. This directly translates into increased potential for airlines to generate revenues.

To make the most out of these opportunities the travel ecosystem needs to come together and actively collaborate – airlines, their meta partners and travel technology providers. Legacy outdated technology will still be a recurring challenge for a few more years to come. But with direct offer distribution and the adoption of AI for offer optimization there is potential for some truly innovative thinking in the airline retail space today. Thanks to the vast amounts of traveler demand data metasearch engines possess and their key role for reach and customer acquisition, these digital savvy travel players are and will be key to bringing innovation to life.

To quote PROS President of Travel, Surain Adyanthaya – “It’s an exciting and transformational time for the airline industry.” So, we urge our airline customers and travel partners to join forces, explore offer optimization through metasearch and go far together on the path to commercial autonomy and retail freedom.

Explore more about airline offer optimization in the e-guide “Airline Digital Transformation and Retail Freedom Through Offer Optimization.”

Driven by proven, industry-leading AI, PROS connects the critical components of airline retailing to drive revenue generation: revenue management and offer optimization, offer creation and distribution, offer marketing, inventory and order management. With a focus on modular, open technology, PROS is dedicated to helping airlines embrace commercial autonomy by creating and dynamically pricing offers based on customer attributes, delivering those offers dynamically and fulfilling each order seamlessly.

To learn more visit: https://pros.com/travel

Skyscanner is a global leader in travel connecting over 110 million users in 180 markets and 30+ languages to more than 1200 flight, hotel and car hire partners every month.

Skyscanner’s global audience provides unrivalled reach into geographies and deep insight into traveler search and redirect behavior in almost every market. Skyscanner’s app, desktop and web metasearch platforms offer next generation, best-in-class brand and performance capabilities to deliver on partners strategic priorities. Skyscanner is using the latest technology to build dynamic distribution and advertising solutions to connect businesses with highly qualified audiences, using real-time, actionable intelligence.

Founded in Edinburgh in 2003, Skyscanner has offices worldwide, in Asia-Pacific, Europe and North America. Skyscanner is committed to helping shape a more responsible future for travel in collaboration with our partners, so that every traveler can explore our world effortlessly for generations come.

For more information visit: https://www.partners.skyscanner.net/