Airline revenue management (RM) has long been an integrated process of capacity control and price optimization. Traditional revenue management systems attempt to forecast demand, optimize pricing, and allocate capacity simultaneously. However, the increased complexity in customer segmentation and pricing has opened up the door for new opportunities.

One opportunity that addresses the challenges of traditional RM is to separate capacity control from price optimization, treating them as distinct but complementary processes. This concept, explored in a paper co-authored by Karl Isler, Stefan Pölt, and Jonas Rauch, is at the heart of Lufthansa Group’s new revenue management implementation with PROS. By disentangling these two functions, airlines can simplify forecasting, improve revenue outcomes, and make revenue management systems more adaptable.

The Evolution of Integrated Revenue Management

For decades, airline RM models have successfully combined pricing (execution) and capacity control (planning) within a single optimization framework. This approach has driven significant advancements, allowing airlines to maximize revenue through detailed forecasting and structured pricing strategies.

As market dynamics evolve and customer segmentation becomes more granular, opportunities exist to refine pricing models even further by considering additional context information. The challenge with a fully integrated RM approach is that it requires a demand forecast that operates on the same level as pricing. Adding additional dimensions exponentially increases the number of forecasts, which leads to a number of complexities:

- Data Volume: The large number of forecast values not only increases computational cost, but also makes it harder for analysts to validate and manage those forecasts.

- Data Sparsity: Predicting demand at a highly detailed level leads to small numbers, which makes it difficult to estimate the price-demand relationship and can lead to compounded inaccuracies, especially in dynamic markets.

Because of these challenges, airlines have refrained from adding certain pricing dimensions to the RM forecast model. For example, length of stay is one of the most effective customer segmentation criteria used in pricing, while RM systems typically do not forecast roundtrips but only directional itineraries. Similarly, airlines have highly differentiated prices for corporate customers, tour operators and other customer segments while the RM system works with a single representative fare per booking class. These simplifications keep the RM forecast and optimization manageable without causing much harm, because the omitted dimensions are not critical for effective capacity control. On the other hand, pricing decisions along these dimensions cannot be informed by the RM demand model but are typically made by pricing analysts, potentially informed by a separate model or data analysis.

The disentangled approach takes this concept a few steps further. Instead of starting with a fully integrated demand model and dropping some dimensions, we design two separate models, each specifically tailored to their respective use case. This way, the demand model for capacity control can focus on aggregate demand forecasting to optimally protect capacity, while a separate price elasticity model enables pricing to adapt dynamically to real-time conditions. By building on the strengths of existing models, airlines can improve both forecast accuracy and pricing flexibility, ensuring that RM continues to evolve alongside technological advancements.

The Trail Running Analogy: Budgeting Energy Like Capacity

A useful analogy to help explain this concept comes from trail running. In long-distance races, success is not just about being physically fit and having good running technique (execution). Runners must also have a good game plan to manage energy expenditure over time (planning). This is where race strategy comes in, the runner’s anticipation of the course’s challenges and appropriate allocation of effort to ensure they maintain peak performance at critical moments.

Roughly, the optimal game plan can be characterized as follows:

- Energy is depleted exactly at the end of the race. Having excess energy at the finish line means that we could have run faster, and running out of energy early is clearly sub-optimal, too.

- Therefore, given that the total energy spent is fixed, this only leaves the choice of when to spend more or less energy based on the difficulty of the terrain (e.g., conserving energy uphill, speeding up downhill). If we save some energy on one part of the track by slowing down and spend that extra amount of energy elsewhere to make up more time than we had lost, that is a favorable trade.

- Based on this insight we can conclude that for an optimal game plan the trade-off between spending or saving a bit of extra energy and the corresponding change in pace is the same everywhere on the track. If it was not, we can initiate such a favorable trade to improve the plan.

Importantly, to come up with a good game plan it is sufficient that we know this trade-off between running speed and energy usage at every part of the track. But we do not and cannot anticipate how exactly we will physically navigate the different types of terrain. We solve that problem only when we get there. The high-level game plan is a key input into real-time execution because it dictates the speed in which we plan to run. But to execute, we also use much more detailed information about our surroundings to make micro-level decisions like avoiding puddles or jumping over roots.

In RM, capacity is the finite energy supply, and expending capacity by selling seats allows us to generate revenue. Instead of minimizing the run time, we optimize the rate of capacity consumption to ensure maximum revenue. Like with running, we first need to determine the game plan, which in RM is usually encoded in the form of a bid price. To do so we only need to know the high-level trade-off between capacity usage (bookings) and revenue at every point in time. Then, when we get an actual pricing or availability request, we use the bid price as a key input to determine how aggressively we want to sell our capacity. But to make the real-time pricing decision (execution) we can consider much more detailed context information about the specific request (customer segment, competition, market conditions) that we would not have been able to predict ahead of time.

Doing RM in the classic “entangled” way where we use a single demand model for both capacity control and real-time pricing is like trying to plan a 10km race by predicting every single stride instead of focusing on pacing strategy. That approach is not only unintuitive and unnecessarily complex but also destined to fail because it is simply impossible to anticipate everything that can happen during the race.

Key Principles of the Disentangled Approach

By applying these analogies, we arrive at a framework where capacity control and pricing operate separately but harmoniously:

Capacity Control as Planning:

- Forecast the relationship between demand and revenue:

- Avoid micro-level forecasting at the customer request level.

- Instead, predict expected demand as a function of bid price, which is equivalent to predicting the relationship between demand and revenue.

- Use tailored forecasting models for capacity control:

- Demand forecasting models can range from simple regression models to machine learning models like neural networks.

- The goal is to maintain a stable, high-level demand function without being affected by real-time pricing fluctuations.

- Compute bid prices dynamically:

- Use dynamic programming or other RM optimization techniques to compute bid price vectors.

- These vectors quantify the marginal value of capacity at different points in time.

Pricing as Execution:

- Estimate request-specific price elasticity:

- Consider all request or context features that are available during real-time pricing and estimate how they affect price elasticity

- We can afford to use arbitrarily many request-level features, because we do not need to predict into the future but only react to the request at hand.

- Make price decisions in real-time:

- For every incoming request, utilize estimated willingness to pay and the current bid price of the resource to determine the optimal price.

Benefits of this Approach

By separating capacity control from pricing, airlines can:

- Enhance Pricing Flexibility: Airlines can use additional dimensions for pricing and customer segmentation without affecting forecasting and capacity control. Conversely, linking the forecast model directly to the pricing mechanism means that any pricing change necessitates a forecast adjustment, which adds additional complexity to pricing projects and makes it difficult to estimate a demand model from data that spans times before and after a significant pricing change. Any airline that has had to adjust a class-based forecast to account for an RBD re-alignment knows what I’m talking about.

- Improve Forecast Quality: Eliminating pricing dimensions from the forecast model greatly reduces data volume and the number of forecast entities. This reduces the issue of data sparsity and therefore leads to more robust predictions.

- Specialized Forecast Models: With separate models we can choose different types of models specifically tailored to the challenges of demand forecasting and elasticity estimation, instead of having to find a compromise that works for both but is not great at either one.

- Simplify Forecasting Processes: Due to the fewer dimensions used in forecasting, forecasts become easier to analyze and adjust by business analysts.

- Reduce System Complexity: RM solutions become more scalable, adaptable, and easier to maintain.

- Clear Responsibilities: Most airlines have flight analysts responsible for capacity-related decisions on route level, including the bid price, and pricing analysts that are responsible for pricing and availability related decisions on O&D/customer segment level. With a single integrated demand model, it is unclear which function should own the forecast. Whenever any analyst adjusts the forecast, there are side effects outside their area of responsibility. With separate models, flight analysts can independently manage the demand forecast without affecting pricing, and pricing analysts can manage elasticity models without affecting bid prices.

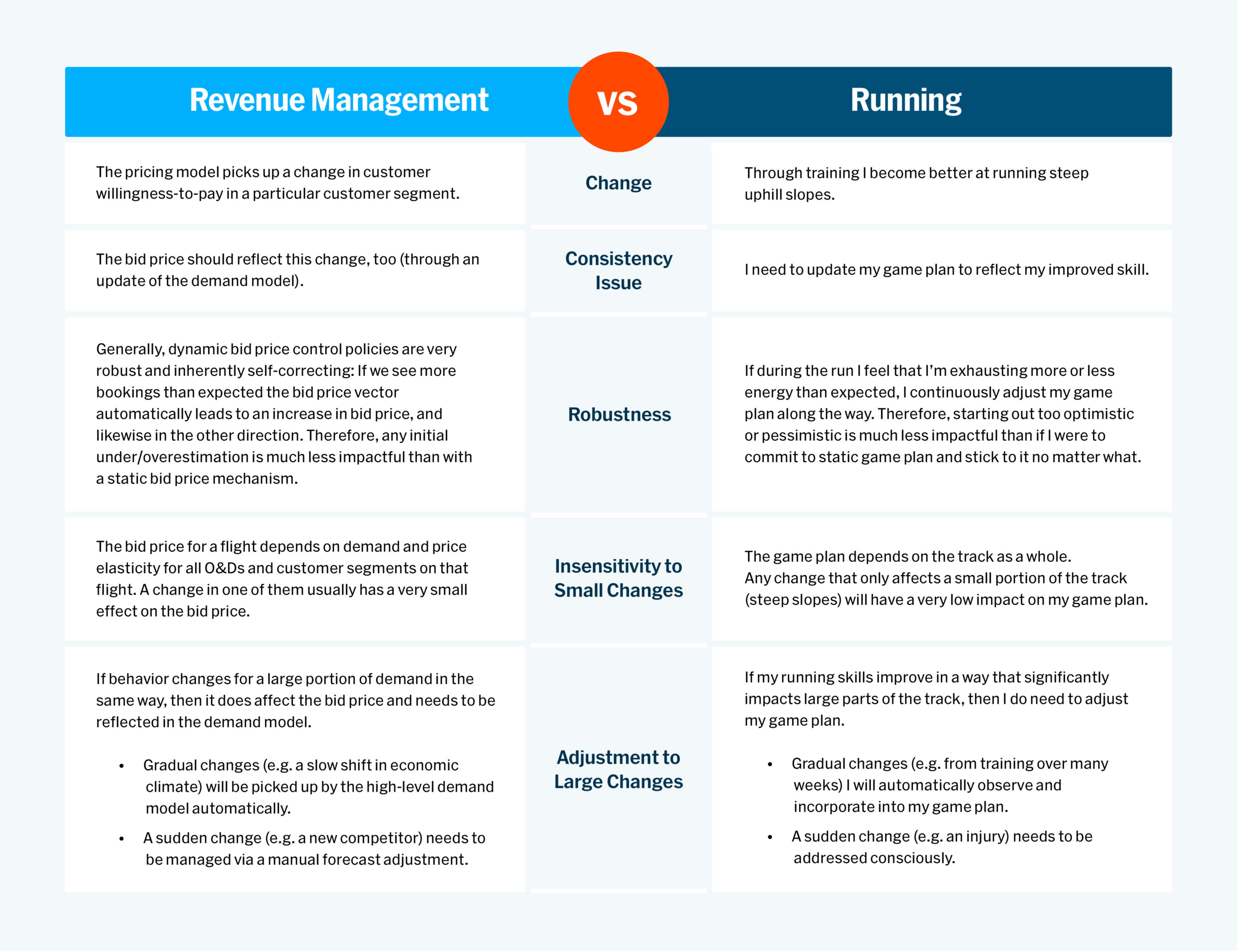

Consistency

The most common criticism to this approach is that we need to ensure consistency between the two models. That is a valid concern, but not nearly as much of a problem as it might seem. For illustration, we again use the trail running analogy:

Trade-offs

The disentangled approach with separate demand and elasticity models certainly has some drawbacks, too. First and foremost is the complexity of managing two entirely separate models, including the required data processing, user interface, training, etc.

There is no clear answer that either approach is strictly better than the other. Every airline needs to decide for itself which approach is better suited for them specifically depending on their priorities.

- Consistency vs. flexibility and independence

- Theoretical precision vs. simplicity and speed

- Single solution vs. separate, specialized state-of-the-art models

But as pricing becomes more and more dynamic, customer segmentation becomes more fine-grained, and real-time data sources like competitor prices are starting to get used in pricing, we believe that the scale is tipping in favor of the disentangled approach.

How We Got Here

Seasoned RM veterans may struggle with this concept. That is understandable, because RM textbooks have taught the traditional all-in-one RM model since the 1980s, and it is what we have all been using successfully for decades. This does not imply that airlines (and PROS!) have been managing RM incorrectly all along. Rather, the evolving landscape of pricing and segmentation necessitates a fresh approach.

In the past, when RM systems and pricing methods were limited by the available data and compute capabilities, the “entangled” approach worked very well. As airlines moved to O&D based pricing and more fine-grained customer segmentation, additional dimensions were gradually added to demand forecasting, but the added complexity was still manageable. However, recent advances in machine learning methods, computing power and the explosion in the amount of available data open up entirely new possibilities beyond the scaling limits of traditional RM approaches. By disentangling capacity control from price optimization, airlines can now fully leverage contextual pricing strategies, ensuring more adaptive, real-time revenue management decisions that were not feasible with legacy airline systems.

And interestingly, even traditional RM approaches have long been doing a bit of disentangling without explicitly saying so, because some pricing dimensions were never used in forecasting. For example, length-of-stay and weekend-stay criteria are among the strongest customer segmentation dimensions available to airlines but are not used in demand forecasting because adding round-trip information would lead to an unmanageable explosion in the number of forecasts. Similarly, airlines have long offered specific fares for corporate customers, tour operators and other customer segments, which are not forecasted separately in most RM systems.

Conclusion

Airline revenue management is evolving. Traditional RM systems that integrate pricing and capacity control are reaching their limits, particularly as dynamic pricing and AI-driven strategies become more prevalent. By embracing a disentangled approach, airlines can achieve greater efficiency, flexibility, and revenue optimization.

This approach is not necessarily a new one. Just as runners must optimize their energy usage intuitively without anticipating every single step, separation of high-level planning from execution is commonplace across many industries. Self-driving cars plan the route without predicting how exactly they will execute the drive. Chefs plan and sequence their prep based on past experience, but without anticipating every single action they need to carry out to ensure a meal comes together on time and with perfect flavor. Similarly, airlines should rethink RM by decoupling capacity control from price optimization—paving the way for smarter, more adaptive revenue management strategies.

Read the full published paper here: Rauch, J., Isler, K. & Poelt, S. Disentangling capacity control from price optimization. J Revenue Pricing Manag 17, 48–62 (2018). https://doi.org/10.1057/s41272-017-0118-9

Frequently Asked Questions

The disentangled approach separates capacity control (planning) from price optimization (execution), allowing airlines to use tailored models for each process. This improves forecasting accuracy and pricing flexibility.

Separating these processes reduces data complexity, improves forecast quality, and enables airlines to adapt pricing dynamically based on real-time customer segmentation and market conditions.

By focusing capacity control on aggregate demand forecasting and removing pricing dimensions, airlines can reduce data sparsity and achieve more robust, accurate predictions.

Traditional RM systems struggle with data volume, sparsity, and complexity when forecasting demand at highly detailed levels, limiting their ability to adapt to dynamic pricing and segmentation.

With separate models, airlines can use real-time data, such as customer segments and competitor prices, to make dynamic pricing decisions without affecting capacity control forecasts.

Capacity control focuses on high-level demand forecasting and bid price computation, while pricing uses real-time elasticity models to optimize prices for specific requests.

The approach is ideal for airlines prioritizing flexibility, scalability, and dynamic pricing. However, each airline must evaluate its specific needs and resources to determine the best RM strategy.