EDITOR’S NOTE: This research has been published in two parts. Part I (below) explains our research methodology and explores Google Flights’ increasing dominance in organic search and its potential connection to regulatory pressure. Part II examines how this shift has impacted airlines, flight aggregators, and OTAs, with detailed analysis of ranking data across different markets.

On September 13, 2011, Google launched Google Flights, a flight booking service allowing users to search for and compare flights from various airlines. Over time, Google Flights underwent significant changes, ultimately becoming a search box pinned at the top of search results pages (SERPs) for flight-related queries.

Obviously, this enormous search visibility has proved problematic for flight aggregators, online travel agencies (OTAs), and airlines since the very beginning. For years, the Google Flights SERP feature has been the first thing people see on Google when they search for flights.

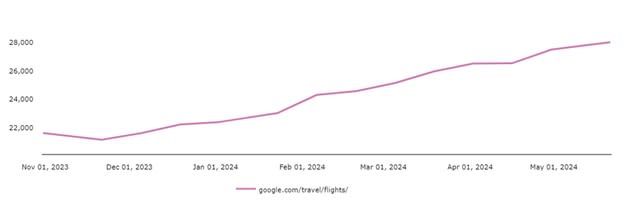

However, the Google Flights website itself maintained a relatively low profile in organic search results. This changed around August 2023 when an unprecedented surge in indexed pages catapulted the site into the spotlight.

Figure. 1. Increasing number of organic pages within google.com/travel/flights/, according to Ahrefs.

We also saw dramatic increases in Google Flights’ Visibility Score in Advanced Web Rankings (AWR), where we have been tracking hundreds of thousands of flight-related keywords for over a hundred airlines, flight aggregator sites, and OTAs.

Figure 2. Google Flight’s increase in Visibility Score on Google.com Mobile (US), based on 1,285 flight-related keywords, according to AWR. Visibility Score is AWR’s proprietary metric to measure a website’s progress in search.

By mid-2024, it was no secret to SEOs that Google Flights was beginning to dominate the organic search landscape for flight searches.

Google Travel is surging. (https://t.co/TUSKNRpymT)

This subfolder earned the #1 ranking for the keyword “travel” back in September, and now it earned the #1 ranking for the keyword “flights” last month. pic.twitter.com/eSvP1kovk1

— Lily Ray 😏 (@lilyraynyc) June 6, 2024

In this article, we will take a hard look at Google Flights’ performance in search results after its indexing. Specifically, we are going to answer these questions:

- Did Google Flights significantly improve its rankings from December 2023 to August 2024?

- In which countries was this increase more noticeable?

- Which customers were negatively impacted by the indexing of Google Flights?

- Which major flight aggregator sites and OTAs were outranked by Google Flights?

- What other noticeable patterns can we find?

TL; DR

We tracked Google Flights’ organic search performance from December 2023 to August 2024, and wow, did they make moves. Here’s what we found:

- The indexing of Google Flights may be Google’s response to mounting regulatory pressure and potential restrictions on SERP features and self-preferencing in search results.

- Google Flights dramatically increased its visibility in search results for flight-related searches across all analyzed countries.

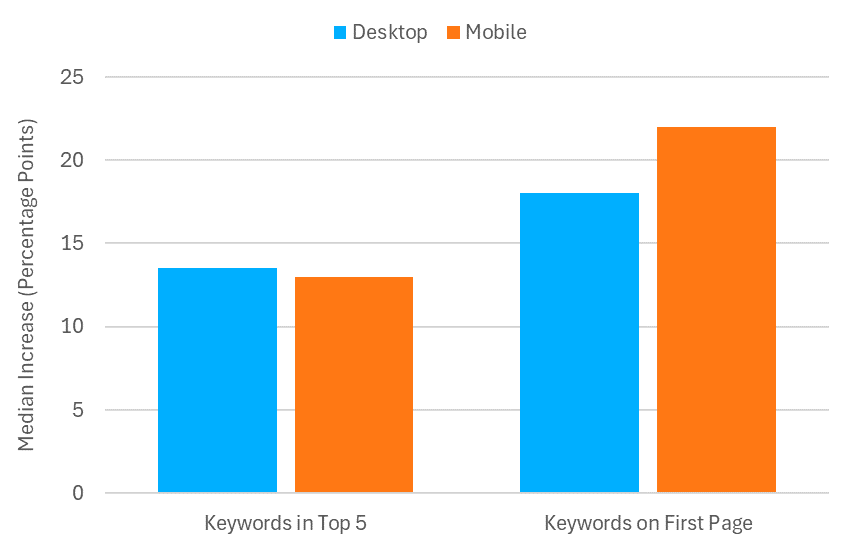

- The site had a median increase of 13.5 percentage points in “Top 5” rankings on desktop and 12.9 on mobile.

- Google Flights showed even larger gains in “First-page” rankings: 18.2 percentage points growth on desktop and 21.8 on mobile.

- While Google Flights is gaining traction, our customers continue to lead in a head-to-head comparison. About 86% of customers have more keywords in the top 5 positions, while roughly 70% outperform Google Flights in first-page rankings.

- Looking at the median percentage of keywords ranked, our customers still dominate. They have three to four times more top-5 rankings than Google Flights while positioning roughly two-thirds of keywords on first page (Google doesn’t reach 50%).

- Airlines are more resilient to Google Flights in their home markets, with about 75% having more first-page rankings than Google Flights compared to only 53% in foreign markets.

- Fifteen major flight aggregators and OTAs lost significant ranking positions to Google Flights in advanced countries where English is the primary language. The most impacted travel companies were Momondo, Kiwi.com, Trip.com.

A Tale of Two Google Flights: SERP Feature vs. Website

Google Flights has been around since 2011, so why are we writing this article now? We understand this could be a little confusing to non-SEOs, so let’s clear it up.

Google Flights exists in two different forms, and they’re not the same thing.

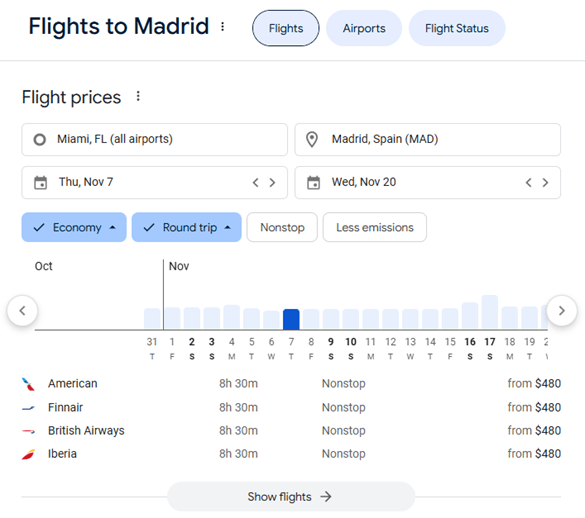

The Google Flights SERP feature is the box that pops up at the top of Google when you search for flights. Type in “flights to Madrid” and there it is, impossible to miss:

Figure. 3. Google Flights SERP feature for the query “flights to Madrid.”

If you click on the “Show flights” button or the flights listing, you will go to the actual website.

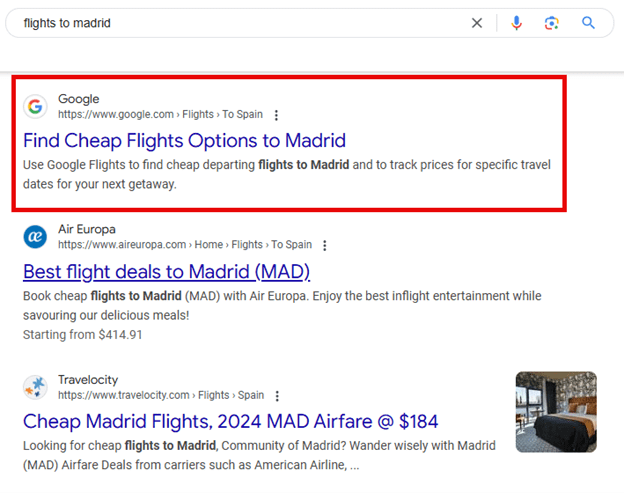

Until August 2023, most flight pages living at www.google.com/travel/flights/ weren’t indexable. Today, these flight pages have their own URLs for specific routes and destinations, which can appear in organic search results and compete with other flight-related pages from airlines, flight aggregators, and OTAs.

Figure. 4. A flight page from Google Flights shows up in search results for the query “flights to Madrid.”

Although the Google Flights SERP feature has been Google’s long-established presence in flight search, the website’s increasing organic visibility indicates a new strategic direction.

This analysis will focus on the Google Flights website’s ranking performance, not the SERP feature.

The Empire’s “Hidden” Agenda

Why did Google index the Google Flight pages anyway? We have got a theory.

Google Flights’ decision to start aggressively indexing its site in August 2023 may have been partly driven by mounting regulatory scrutiny.

In 2020, the U.S. Department of Justice (DOJ), along with 11 state attorneys general, filed a significant antitrust lawsuit against Google, alleging that the company maintained its search and search advertising monopoly through exclusionary agreements, such as paying to be the default search engine on Android devices and browsers like Apple’s Safari. In August 2024, Google lost its case and was found to be a “monopolist.”

Later in 2020, a coalition of 38 state attorneys general also filed a lawsuit, challenging Google’s dominance more broadly. This state-led suit raised additional concerns about Google’s practices in vertical services, such as Google Flights and Google Shopping, as part of its broader monopoly power in online search.

Google faced pressure from the European Union (EU), too. On March 6th, 2024, the EU enforced the Digital Markets Act, a regulation to ensure fair competition in digital markets.

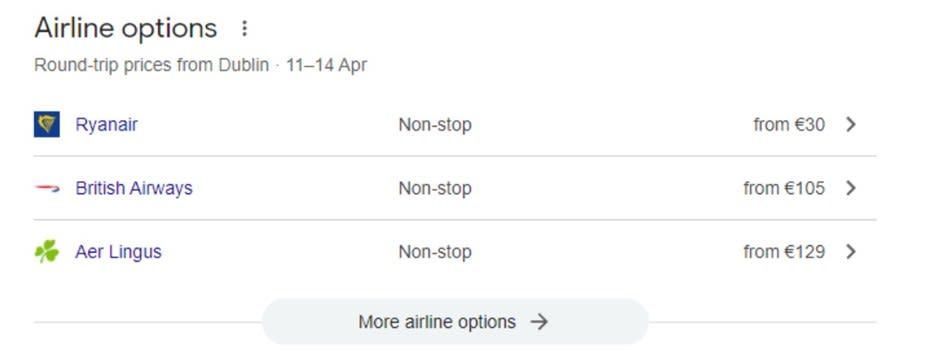

As a result, Google was forced to remove the Google Flights module, which was replaced by new SERP features: Flights Sites, Airline Options, Rich Web Results, and Chip Refinements.

Figure. 5. Airline Options, one of the new SERP features that replaced the Google Flights SERP feature in the European Economic Area (EEA).

Figure. 5. Airline Options, one of the new SERP features that replaced the Google Flights SERP feature in the European Economic Area (EEA).

Regulatory headwinds may have prompted a strategic pivot for Google. We believe the search giant sees a world where it won’t be able to embed Google Flights directly at the top of SERP as it does today.

Therefore, they may be building organic rankings as a potential fallback should restrictions tighten around embedded placements and self-preferencing in search results.

But is it working? We wanted to find out.

Why Are We Tracking Google Flights? Enter airTRFX

We have been tracking keyword positions for airlines for years. That’s because we occasionally need to demonstrate the SEO value of one of our key products: airTRFX.

Funny name, we know. Think of airTRFX as a dynamic landing page generator for airlines’ routes and destinations.

Through airTRFX, airlines can instantly launch different page types for every route or destination they operate. airTRFX comes with built-in features that can dramatically improve an airline’s website visibility in organic search, including:

- Pricing modules with real-time fares.

- Proper multi-language SEO configuration (hreflang tags, full page translations, etc.)

- Dynamic XML sitemaps.

- Dynamic interlinking modules based on relevancy.

- Customizable URLs.

- Indexable JavaScript content.

- Relevant schema markup integrated.

- Optimized page content.

And many more. But, getting into the SEO intricacies of airTRFX is not our purpose today.

All you need to know for now is that airTRFX pages aim to capture non-branded traffic, and we need to track their success.

In November 2023, we observed a sharp increase in Google Flights’ visibility for non-branded keywords in several countries. It became evident that we needed to treat Google Flights as a competitor. Therefore, in December 2023, we started tracking its keyword ranking performance.

Methodological Considerations

Before we get into Google Flights’ performance data, let’s talk about the methodological parameters that guided our research.

The keywords

So far, we have mentioned “flight-related keywords” quite a few times. But what are these?

For our purposes, non-branded flight-related keywords are search queries with purchasing intent that do not contain the name of airlines, flight aggregator sites, or OTAs.

These keywords can be grouped into “templates” or “types.” Internally, we call these groups “keyword permutations.”

We developed different page templates in airTRFX to purposely target these non-branded keyword permutations:

- Flights from City to City (e.g., flights from Miami to Chicago)

- Flights to City (e.g., flights to Chicago)

- Flights from City (e.g., flights from Miami)

- Flights from City to Country (e.g., flights from Miami to Bahamas)

- Flights to Country (e.g., flights to Bahamas)

- Flights from Country (e.g., flights from India)

Think of keywords as routes. airTRFX creates a page of each template for every airline’s route. For example, if one of our carrier customers flies from Miami to Madrid, the system will dynamically launch these pages:

- Flights from Miami to Madrid (Flights from City to City)

- Flights to Madrid (Flights to City)

- Flights from Miami (Flights from City)

- Flights from Miami to Spain (Flights from City to Country)

- Flights to Spain (Flights to Country)

- Flights from the US (Flights from Country)

The system will do this for every country where the airline operates, creating regional versions of every page. This, of course, is a massive undertaking from an international SEO standpoint, but we managed to tame that beast.

As you can imagine, bigger airlines will have more airTRFX pages and, therefore, more target non-branded keywords, which we are monitoring in AWR. However, we generally only track these in the airline’s primary market.

In some cases, we also monitor variations (e.g., Miami to Chicago flights) and keywords with popular modifiers (e.g., cheap flights to Miami).

In total, we are tracking 331,948 keywords for 170 customers in 27 languages in 58 countries. That’s a lot!

For this exercise, though, we will work with a much more reduced dataset because we removed the following:

- AWR properties of non-airline customers.

- AWR properties of airlines with airTRFX implementations indexed after December 2023.

- AWR properties of airlines for which we are not tracking keywords in English (there is a reason for this, as you will see later).

- AWR properties that, for some reason, had not been tracking Google Flights since December 2023.

The resulting dataset was further processed depending on the research question we wanted to answer.

Why Only Keywords in English?

Google Flights’ website has localized versions targeting 19 languages and 40 countries. Localized URLs use the following parameters:

- gl for region declaration.

- hl for language declaration.

For example, the page https://www.google.com/travel/flights/flights-from-new-york-to-london.html?gl=ES&hl=es targets Spanish-speaking users in Spain.

However, as of October 29th, 2024, Google Flight’s localized URLs are not indexable. They also have all sorts of technical problems, including:

- Using URL parameters to target locale.

- No language-specific URLs.

- Several hreflang implementation issues (missing return links, unindexable canonicals, etc.)

We are not sure whether Google is not indexing these pages on purpose or whether they are terrible at international SEO (who knows!). The point is that the localized pages from Google Flights are not indexable and, therefore, do not rank well in languages other than English.

Thus, we decided to analyze only keywords in English.

Date Ranges

We started tracking Google Flights’ website rankings for our target keyword permutations in December 2023. In this article, we will work with keyword position data we gathered from December 6th, 2023, to August 7th, 2024, which is nine months of data!

KPIs

Throughout the study, we zeroed in on two metrics to assess keyword ranking performance:

- Percentage of Keywords in Top 5: the percentage of keywords in the dataset for which a site reached the top five positions in SERP.

- Percentage of Keywords on First Page: the percentage of keywords in the dataset for which a site reached the first page in search results.

Even though there can be many other metrics we could analyze, we believe these will provide the most meaningful insights.

Has Google Flights Improved Rankings Since December 2023?

To answer this question, we needed to ask two other questions: in which countries and in what device type?

We selected countries where we are tracking more than 300 keywords in either Google Desktop or Google Mobile. This threshold provides a good balance between data robustness and market diversity.

We ended up with 20 countries and 88,109 keywords across desktop and mobile. The table below shows the resulting countries and the number of keywords by device type:

| Country (Code) | # of Keywords (Desktop) | # Keywords (Mobile) |

| United States (US) | 18,562 | 18,640 |

| United Kingdom (UK) | 17,734 | – |

| Canada (CA) | 4,702 | 638 |

| Australia (AU) | – | 4,458 |

| Rwanda (RW) | – | 4,201 |

| Greece (GR) | – | 3,338 |

| Ireland (IE) | 2,671 | – |

| Philippines (PH) | – | 2,468 |

| Brunei (BN) | 2,368 | – |

| Singapore (SG) | 849 | 1,201 |

| South Africa (ZA) | 1,738 | – |

| Ethiopia (ET) | 1,481 | – |

| Papua New Guinea (PG) | – | 1,437 |

| New Zealand (NZ) | – | 1,402 |

| Kenya (KE) | 1,048 | – |

| India (IN) | – | 529 |

| Sri Lanka (LK) | 514 | – |

| Oman (OM) | – | 429 |

| Turkey (TR) | – | 328 |

| Saudi Arabia (SA) | 323 | – |

Table 1. Countries and number of keywords by device included in our analysis of Google Flight’s ranking performance from December 2023 to August 2024.

Only three countries (the US, Canada, and Singapore) meet the threshold for both desktop and mobile.

Significant Improvements Across All Markets

The data below reinforces what we suspected: Google keyword rankings significantly improved across all markets and devices.

Google Desktop

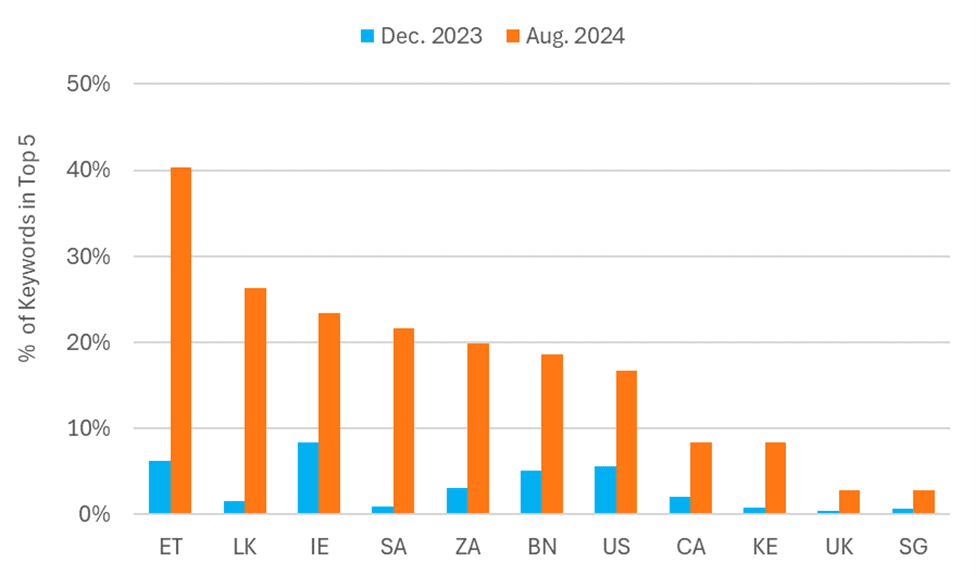

In Google Desktop, the median increase in Google Flights’ percentage of keywords in the top 5 and on the first page was roughly 13.5 percentage points (pp) and 18.2 pp, respectively.

Ethiopia emerged as the top performer, with an extraordinary leap from 6.2% to 40.3% of keywords ranking in the top 5 positions, representing a 34.1 percentage points (pp) increase. Google Flights also showed impressive growth in Sri Lanka and Saudi Arabia, with increases of 24.7 pp and 20.7 pp, respectively.

Its ranking improvement was not so stark in Canada (6.3 pp), the United Kingdom (2.4 pp), and Singapore (2.1 pp). In the United States (11.1 pp), Google Flights performed under its median increase in top 5 rankings.

Figure 6. Google Flights’ percentage of keywords in the top 5 positions in December 2023 and August 2024 across selected countries (Google Desktop).

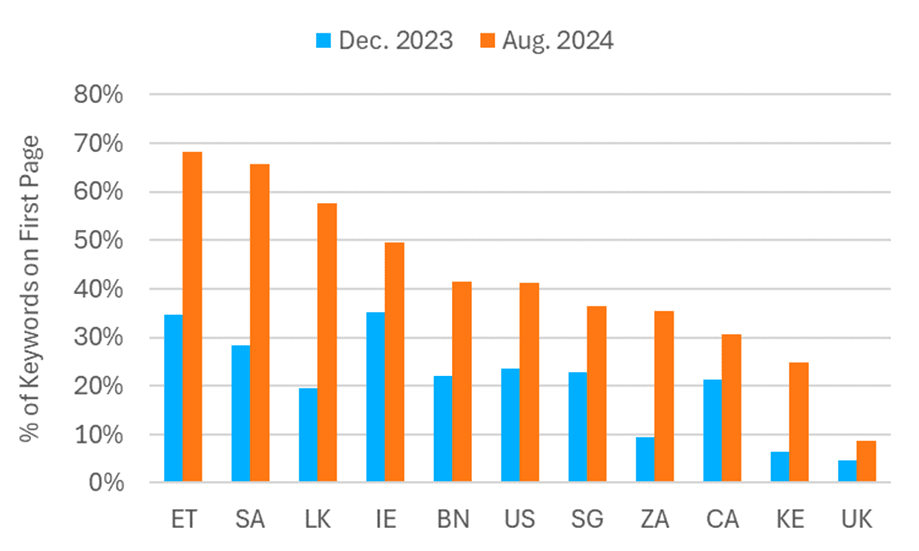

The growth of Google Flights’ first-page visibility on desktop showed even more dramatic improvements. Sri Lanka led the pack with a 38.1 pp increase, climbing from 19.5% to 57.6% of keywords appearing on the first page. Google Flights’ first-page rankings also noticeably increased in Saudi Arabia and Ethiopia, reaching final percentages of 65.6% and 68.3%, respectively.

In contrast, Google Flight’s rankings growth was the lowest in Singapore (13.5 pp), Canada (9.3 pp), and the United Kingdom (4 pp). The United States maintained a middle-ground position with a 17.7 pp increase.

Figure 7. Google Flights’ percentage of keywords on first page in December 2023 and August 2024 across selected countries (Google Desktop).

Google Mobile

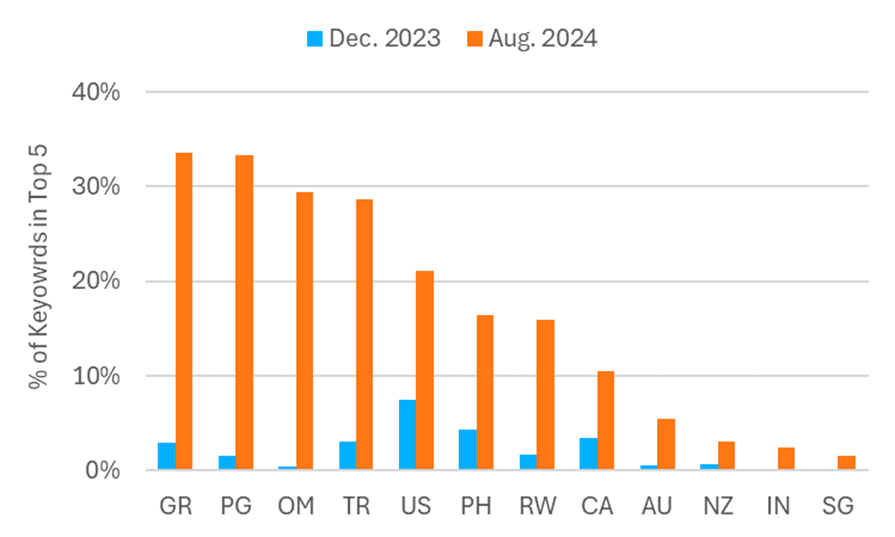

It shouldn’t be a surprise by now, but Google Flights also substantially improved its mobile rankings in the top 5 positions and on first page in general, with a median increase of 12.9 pp and 21.8 pp respectively.

Papua New Guinea and Greece emerged as the leading success stories, with PNG climbing from 1.5% to 33.3% (31.8 pp increase) and Greece surging from 3.0% to 33.6% (30.6 pp). Google Flight’s mobile performance in the US was slightly above the median of 13.7 pp.

On the other hand, Google Flights showed minimal gains in New Zealand (2.4 pp), India (2.3 pp), and Singapore (1.6 pp).

Figure 8. Google Flights’ percentage of keywords in the top 5 positions in December 2023 and August 2024 across selected countries (Google Mobile).

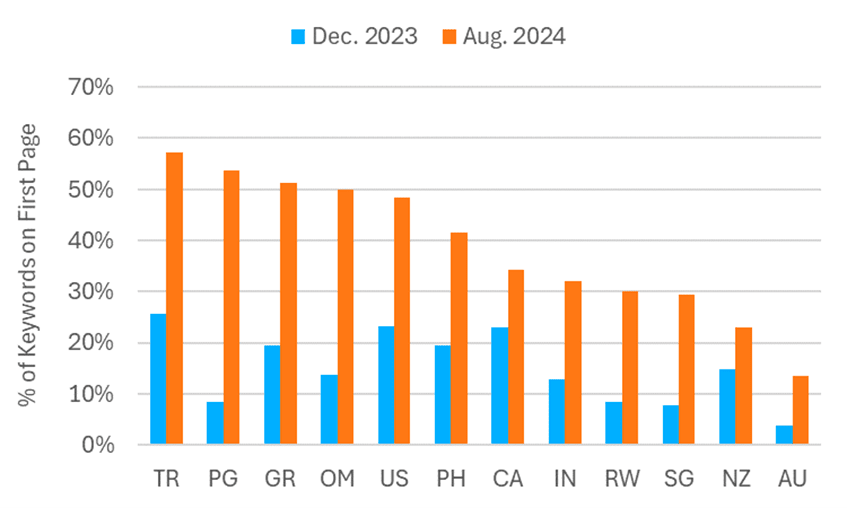

Regarding first-page mobile rankings, Google Flights was best in Papua New Guinea, with a 45.2 pp improvement, followed by Oman (36.1 pp) and Greece (31.7 pp). Even in traditionally strong markets like the US, Google Flights saw substantial gains, improving by 25.1 pp, which is above the median.

However, some markets like New Zealand (8.2 pp) and Australia (9.6 pp) showed more modest first-page rankings improvements for Google Flights.

Figure 9. Google Flights’ percentage of keywords on first page in December 2023 and August 2024 across selected countries (Google Mobile).

Larger First-Page Rankings Improvement

Google Flights achieved significantly better improvements in first-page rankings compared to its top 5 positions across both desktop and mobile devices.

Figure 10. Google Flights’ median increase in the percentage of keywords in top 5 positions vs. on first page, given in percentage points (absolute change) by device.

This means Google Flights was more effective at gaining broader visibility (first-page presence) than achieving top 5 rankings. Of course, this should be expected since ranking on first page is notoriously harder than ranking within the top 5.

This concludes Part I of our research into Google Flights’ surge in organic search visibility. Continue to Part II to discover how this shift has impacted airlines, flight aggregators, and OTAs, including detailed market-by-market analysis of the biggest winners and losers in this evolving landscape.

Frequently Asked Questions

Google Flights indexing refers to the inclusion of specific flight pages in organic search results. This shift, starting in August 2023, significantly increased Google Flights’ visibility for flight-related searches.

Google Flights saw a median increase of 13.5 percentage points in top 5 rankings and 18.2 percentage points in first-page rankings on desktop, with similar gains on mobile.

Regulatory pressures, such as antitrust lawsuits and the EU’s Digital Markets Act, may have prompted Google to build organic rankings as a fallback to potential restrictions on SERP features.

Airlines generally outperform Google Flights in their home markets, with 75% achieving more first-page rankings. However, competition intensifies in foreign markets.

Flight aggregators and OTAs like Momondo, Kiwi.com, and Trip.com have lost significant ranking positions to Google Flights in English-speaking markets.

Airlines can leverage tools like airTRFX to create dynamic landing pages, optimize non-branded keywords, and improve organic visibility for routes and destinations.

The indexing highlights the growing competition in flight search SEO and the need for airlines and OTAs to adapt their strategies to maintain visibility and traffic.