EDITOR’S NOTE: This research has been published in two parts. Part I explains our research methodology and explores Google Flights’ increasing dominance in organic search and its potential connection to regulatory pressure. Part II (below) examines how this shift has impacted airlines, flight aggregators, and OTAs, with detailed analysis of ranking data across different markets.

How Have Google Flights Impacted Our Customers?

To assess the impact of the indexing of Google Flights on our customers, we looked at 58 AWR profiles for 55 airlines, 23 countries, and 141,787 keywords across mobile and desktop.

We set the following criteria to select the airlines sample: The qualifying airlines are shown in the table below.

The qualifying AWR profiles are shown in the table below.

- airTRFX implementations indexed more than three months before August 2024.

- airTRFX implementations in EN language.

- AWR profiles with more than 100 keywords.

- Current customers.

| Customer | Device | Tracked Country | # of Keywords |

| African Carrier | Desktop | ZA | 2,374 |

| North American Carrier | Desktop | US | 561 |

| European Carrier | Mobile | US | 3,570 |

| North American Carrier | Desktop | US | 7,525 |

| North American Carrier | Desktop | CA | 8,238 |

| North American Carrier | Desktop | CA | 6,080 |

| European Carrier | Mobile | GB | 2,924 |

| European Carrier | Mobile | US | 5,493 |

| North American Carrier | Desktop | US | 4,756 |

| North American Carrier | Desktop | US | 1,327 |

| Asian Carrier | Desktop | BN | 2,369 |

| Asian Carrier | Desktop | US | 326 |

| European Carrier | Mobile | LV | 286 |

| North American Carrier (Caribbean Carrier) | Mobile | US | 1,322 |

| European Carrier | Desktop | IE | 3,761 |

| African Carrier | Desktop | ET | 1,501 |

| Asian Carrier | Desktop | US | 5,925 |

| Asian Carrier | Desktop | SA | 134 |

| North American Carrier | Desktop | CA | 258 |

| North American Carrier | Mobile | US | 1,392 |

| European Carrier | Mobile | US | 919 |

| Oceanian Carrier | Desktop | AU | 143 |

| Asian Carrier | Mobile | MY | 114 |

| Asian Carrier | Desktop | IN | 323 |

| Asian Carrier | Mobile | KW | 230 |

| Asian Carrier | Desktop | US | 601 |

| African Carrier | Desktop | KE | 1,048 |

| European Carrier | Mobile | GB | 1,134 |

| North American Carrier | Mobile | US | 750 |

| North American Carrier | Desktop | US | 2,054 |

| Oceanian Carrier | Mobile | NZ | 1,402 |

| European Carrier | Mobile | US | 320 |

| North American Carrier | Mobile | CA | 638 |

| Asian Carrier | Mobile | PH | 2,481 |

| European Carrier | Mobile | GB | 191 |

| Asian Carrier | Desktop | SG | 1,008 |

| North American Carrier | Mobile | US | 824 |

| Asian Carrier | Mobile | SG | 361 |

| North American Carrier (Caribbean Carrier) | Mobile | US | 369 |

| Asian Carrier | Mobile | IN | 441 |

| Asian Carrier | Desktop | LK | 601 |

| Oceaninan Carrier | Mobile | AU | 3,935 |

| North American Carrier | Desktop | US | 111 |

| European Carrier | Desktop | GB | 679 |

| European Carrier | Mobile | GB | 7,306 |

| African Carrier | Mobile | RW | 4,201 |

| Asian Carrier | Mobile | OM | 429 |

| Asian Carrier | Desktop | SA | 299 |

| Oceaninan Carrier | Mobile | AU | 684 |

| North American Carrier | Desktop | US | 1,294 |

Table 2. Airlines selected for analyzing the impact of the indexing of Google Flights on airTRFX subscribers.

Google Flights Is Making Gains, But Most Customers Hold Strong

Although Google Flights’ market share in organic search has expanded significantly, most of our customers maintain better rankings.

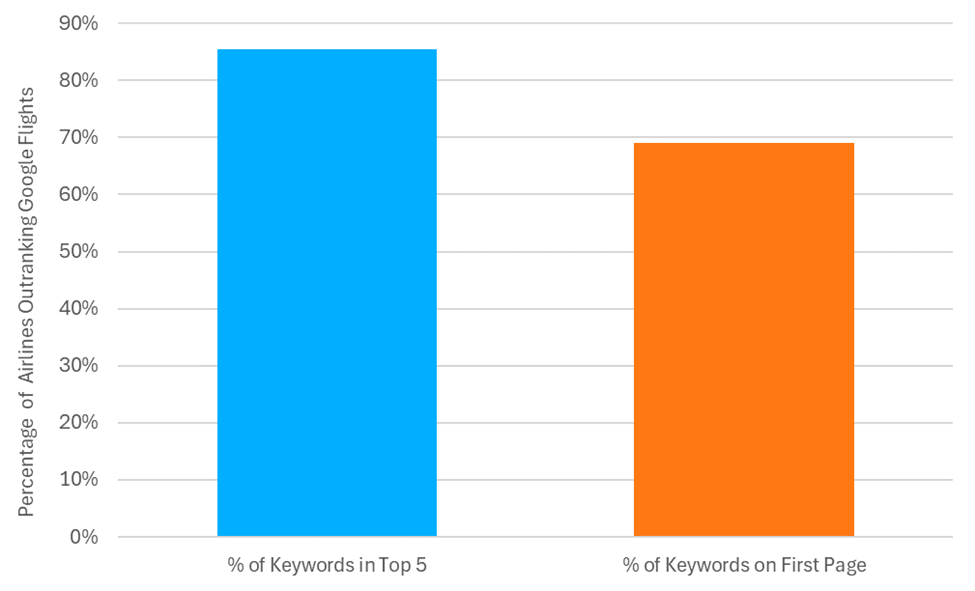

Figure 10. Percentage of customers outranking Google Flights in August 2024.

As of August 2024, Google Flights surpasses only 8 customers (14.5%) in the number of keywords in the top 5 positions. The site performs better on first-page visibility, outranking 17 (30.9%) airlines.

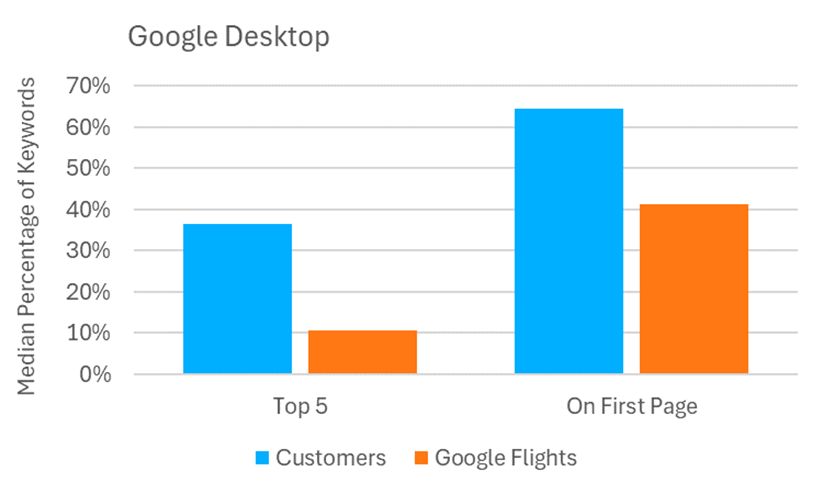

In general, customers significantly outperform Google Flights in both top 5 and first-page positions on desktop and mobile search results.

On desktop, airlines maintain the top 5 positions for 36.4% of keywords—over three times Google Flights’ 10.6%. Our customers also dominate first-page visibility, with 64.4% of keywords appearing on page one, compared to Google Flights’ 41.4%.

Figure 11. Number of customers outranked by Google Flights from December 2023 to August 2024.

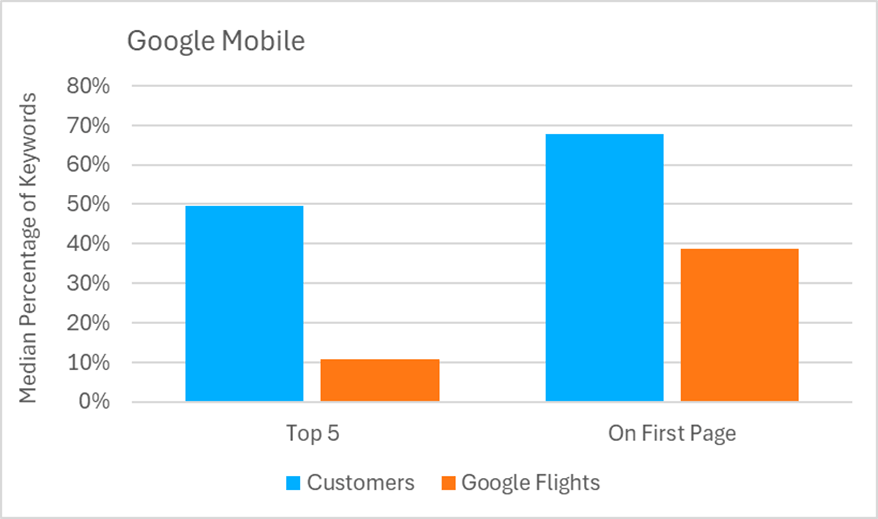

The same trend holds on mobile.

On average, airTRFX subscribers achieve top 5 rankings for 49.7% of keywords, more than quadrupling Google Flights’ 10.9%. First-page presence also strongly favors airlines, with 67.9% of keywords appearing on page one, while Google Flights reaches only 38.8%.

Figure 12. Customers vs. Google Flights keyword rankings as of August 2024 (Google Mobile).

Across both desktop and mobile, our customers consistently maintain superior search visibility.

The airlines’ percentage of keywords in the top 5 is three to four times higher than Google Flights’. While our customers consistently rank roughly two-thirds of keywords on first page, Google Flights falls short of 50%.

Home Market Advantage

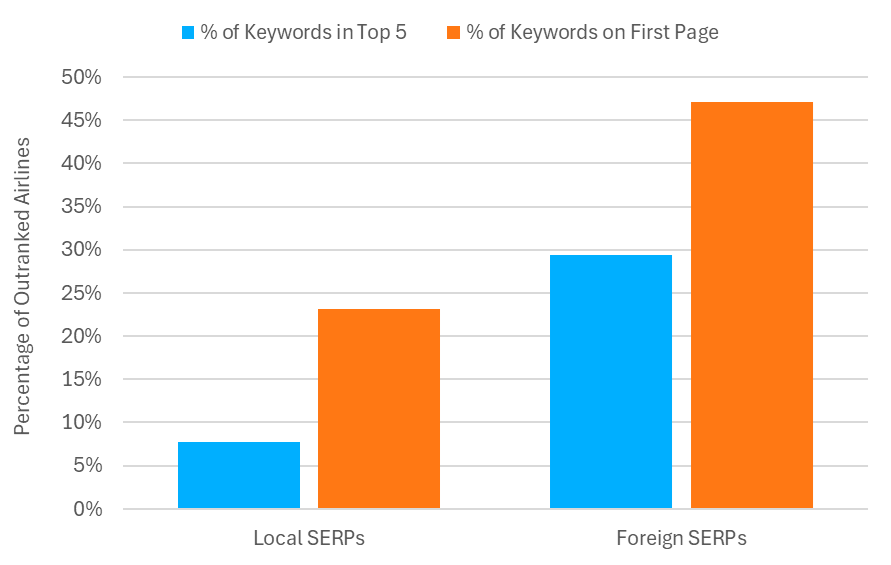

We found an interesting pattern when comparing how airlines perform against Google Flights in their home country’s search results versus other countries’ search results.

We analyzed the ranking performance of airlines against that of Google Flights in two scenarios:

- Rankings in airline’s home country’s search results (39 airlines)

- Rankings in other countries’ search results (17 airlines)

Figure 13. Customer and Google Flights keyword ranking performance based on the airlines’ SERP location (August 2024).

In home country search results, only 3 out of 39 airlines (7.7%) perform worse than Google Flights in the top 5 positions. In contrast, when looking at search results from countries outside an airline’s home market, 29.4% of airlines (5 out of 17) have fewer keywords in the top 5 than Google Flights.

This trend extends to first-page rankings as well. In their home country’s search results, roughly 23% of airlines (9 out of 39) underperform Google Flights. However, in foreign market search results, Google Flights has better first-page rankings than almost half of the airlines (8 out of 17).

These data points indicate that airlines are more resilient against Google Flights in their home country’s search results.

Flight Aggregators and OTAs Losing Ground to Google Flights

With all this progress that Google Flights made, there sure must be some losers, right? We already saw a few airlines that Google Flights outranked, but what about flight aggregator sites or OTAs?

We looked at flight aggregators and OTAs that lost ground to Google Flights in advanced economies where English is the predominant language (remember that the localized Google Flights pages are not yet indexable): the United States (US), the United Kingdom (UK), Canada (CA), Australia (AU), Ireland (IE), and New Zealand (NZ).

In total, we analyzed 46,404 keywords across these countries.

| Country (Code) | # of Keywords (Desktop) | # of Keywords (Mobile) |

| United States (US) | – | 18,865 |

| United Kingdom (UK) | – | 14,306 |

| Canada (CA) | 4,702 | – |

| Australia (AU) | – | 4,458 |

| Ireland (IE) | 2,671 | – |

| New Zealand (NZ) | – | 1,402 |

Table 3. Number of keywords by selected countries to determine flight aggregator sites and OTAs that Google Flights outranked.

How did we measure “losing ground to Google Flights”? We defined the “losers” based on these criteria:

- Had at least 15% of keywords on first page in December 2023.

- Had a higher percentage of keywords on first page than Google Flights in December 2023.

- Had a lower percentage of keywords on first page than by Google Flights in August 2024.

Looking at the change in the percentage of keywords on first page, here are the online travel companies that Google Flights outranked in the selected countries:

| Company | Countries |

| Momondo | US, UK, CA, AU |

| Kiwi.com | UA, AU, NZ, IE |

| Trip.com | UK, CA, NZ, IE |

| Farecompare | UK, AU |

| Cheapflights | UK |

| Rome2Rio | AU |

| Wego | AU |

| Cleartrip | UK |

| Travelocity | CA |

| Flights.com | US |

| Orbitz | US |

| Lastminute.com | UK |

| CheapOair | CA |

| Iwantthatflight | AU |

| Flightsfrom.com | UK |

Table 4. Companies outranked by Google Flights in the selected countries. The company names are written as they appear on their websites. A company may have multiple domains.

Let’s quickly dive into each country. The charts below show the percentage of keywords on first page for the top 5 impacted domains in each country.

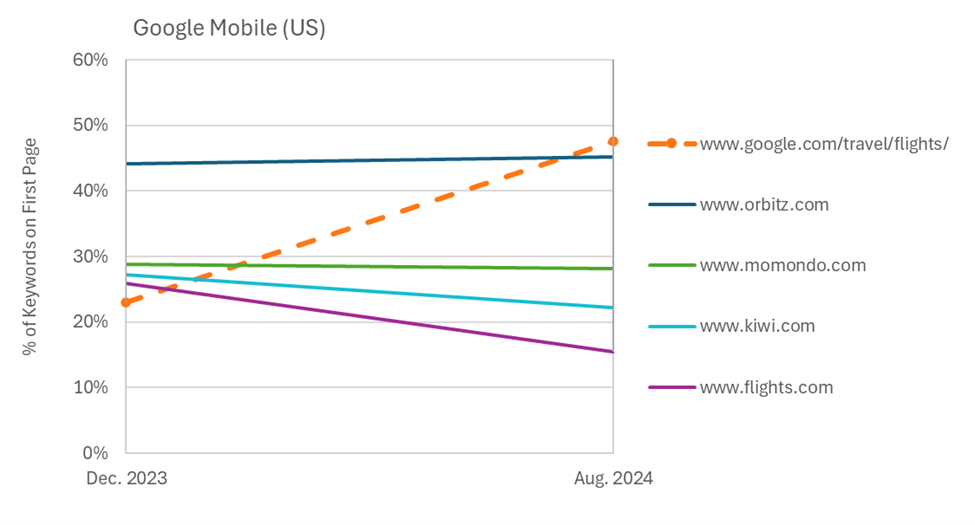

United States

The mobile ranking data in the US shows Google Flights’ dramatic visibility increase, climbing from 22.9% to 47.6% (+24.7 pp) – the highest growth across all markets.

Orbitz.com was the only site showing positive movement, with a modest 1.0 pp increase. Other domains experienced varying degrees of decline, with flights.com seeing the steepest drop (-10.4 pp), followed by kiwi.com (-5.0 pp).

Figure 14. Google Flights outranking leading online travel sites in mobile search results for flight-related queries (US).

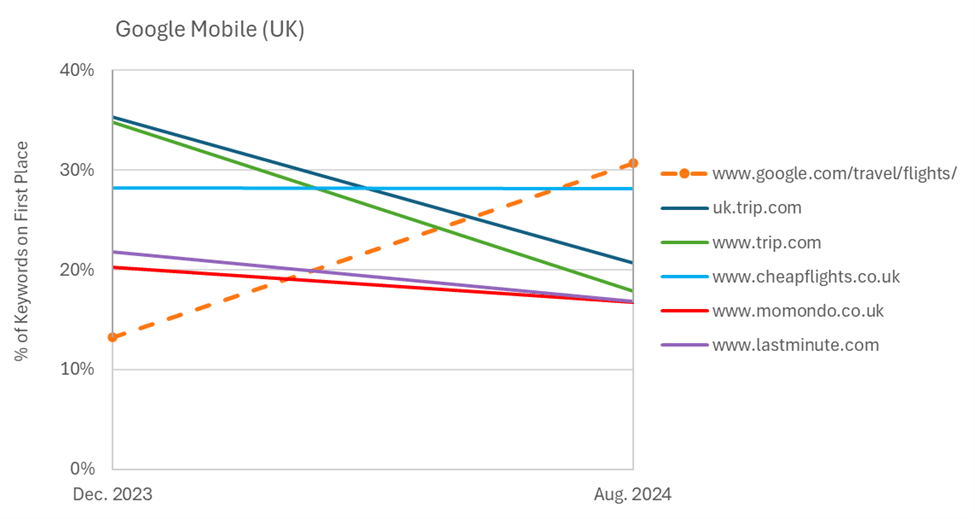

United Kingdom

In the UK, Google Flights also showed impressive growth, more than doubling its presence from 13.2% to 30.6% (+17.4 pp).

Trip.com suffered a large ranking loss, with www.trip.com dropping by 16.9 pp and uk.trip.com declining by 14.6 pp. Notably, cheapflights.co.uk maintained relative stability with only a minimal decrease of 0.1 pp, while both www.momondo.co.uk and www.lastminute.com saw declines, too (-3.5 pp and –4.9 pp, respectively).

Figure 15. Google Flights outranking leading online travel sites in mobile search results for flight-related queries (UK).

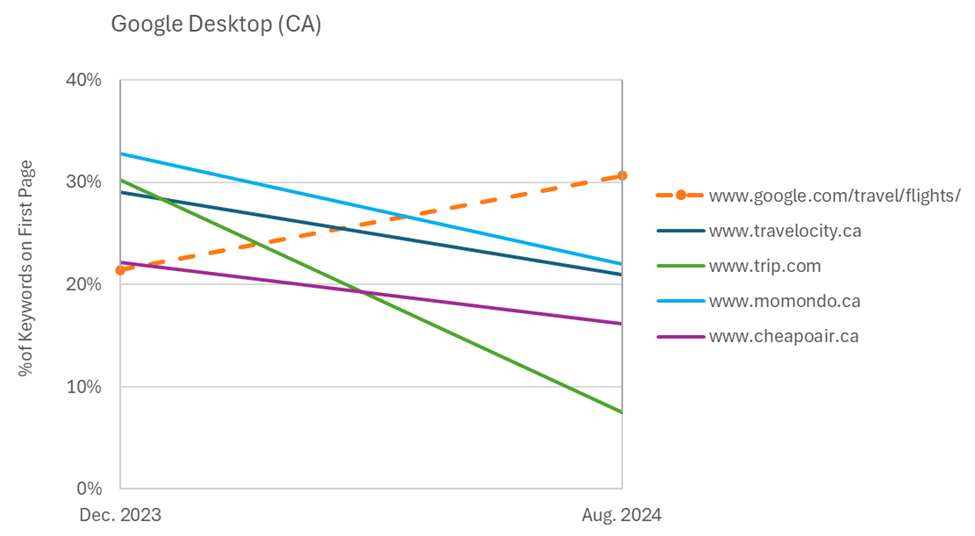

Canada

While Google Flights rankings in Canada didn’t expand as much as in the US and the UK, they also improved, growing from 21.4% to 30.7% (+9.3 pp).

Meanwhile, trip.com experienced the most severe decline, dropping from 30.2% to 7.5% (-22.7 pp). Other important players like momondo.ca and travelocity.ca also saw considerable decreases, falling by 10.8 pp and 8.1 pp, respectively.

Figure 16. Google Flights outranking leading online travel sites in desktop search results for flight-related queries (CA).

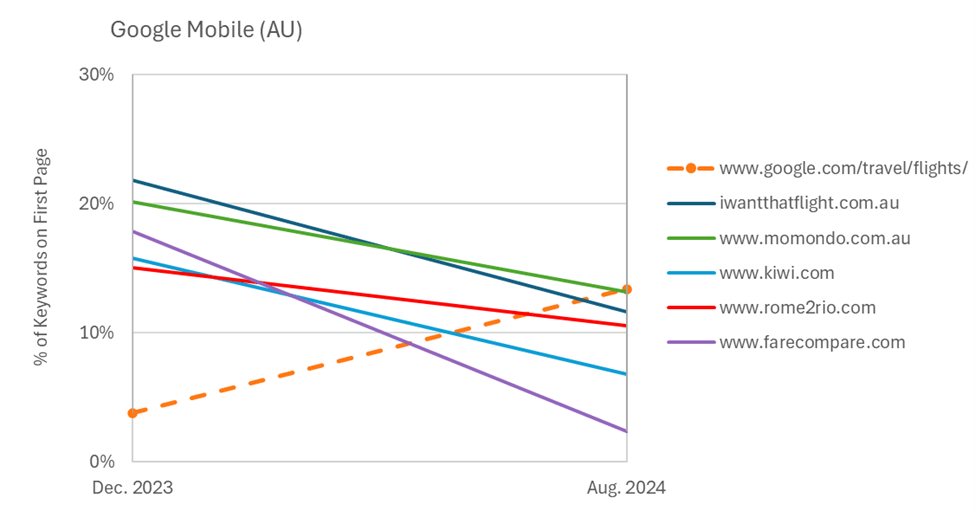

Australia

First-page rankings for Google Flights in Australia increased from a modest 3.8% to 13.4% (+9.6 pp). This growth contrasts with declines in other domains in the market.

The most dramatic drops were seen in farecompare.com (-15.5 pp), cleartrip.com (-10.6 pp), and iwantthatflight.com.au (-10.2 pp).

Figure 17. Google Flights outranking leading online travel sites in mobile search results for flight-related queries (AU).

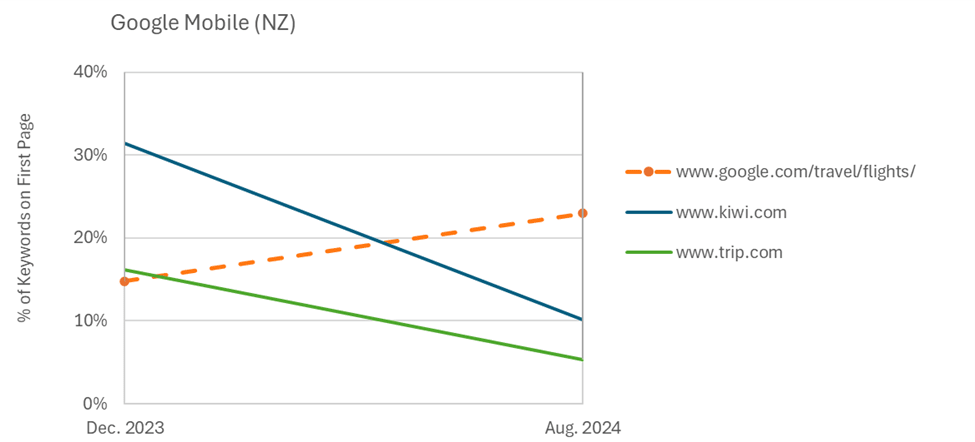

New Zealand

Let’s just say that New Zealand wasn’t the best success story for Google Flights, but the site’s rankings still grew from 14.8% to 23.0% (+8.2 pp).

Once again, www.kiwi.com and www.trip.com experienced notable declines, dropping their first-page rankings by 21.3 pp and 10.9 pp, respectively.

Figure 18. Google Flights outranking leading online travel sites in mobile search results for flight-related queries (NZ).

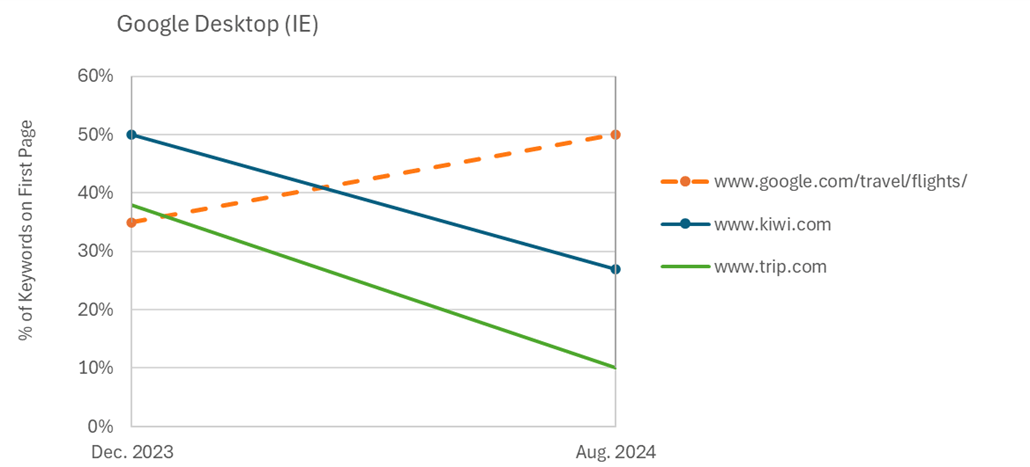

Ireland

Who lost rankings to Google Flights in Ireland? The usual suspects: both www.kiwi.com and www.trip.com lost first-page rankings by 23 pp and 28 pp, respectively.

Google Flights, as expected, increased from roughly 35% of keywords on first page to around 50%, a 15 pp jump.

Figure 19. Google Flights outranking leading online travel sites in desktop search results for flight-related queries (IE).

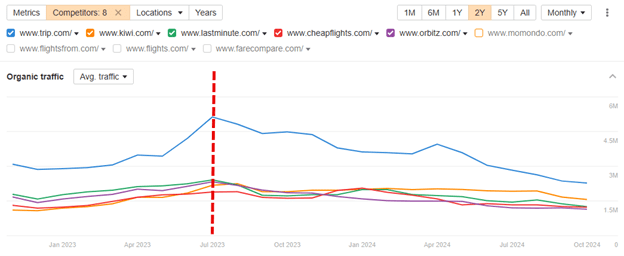

Hardest-Hit Flight Aggregator Sites

If you ran to a third-party tool to see that beautiful chart showing a decline in traffic for these sites but didn’t quite get what you expected, remember that the data is based on keyword rankings, not traffic.

This means that:

- As explained earlier, we track specific flight-related queries (“keyword permutations”).

- Some keywords can generate vast amounts of traffic, but others, especially those connected to less popular destinations, may not bring noticeable traffic, according to third-party tools.

- The analysis was done for a specific domain, country, and device.

- Some sites barely decreased the percentage of keywords on first page (e.g., www.cheapflights.co.uk in the UK).

Therefore, it is possible for a third-party tool to not show a substantial traffic decline for some of the impacted domains.

That said, we did find some of the impacted travel booking sites showing a decreasing trend, starting in August 2023, around the time Google Flights started to index its site, specifically:

- www.trip.com

- www.kiwi.com

- www.lastminute.com

- www.cheapflights.com

- www.orbitz.com

- www.momondo.com

- www.flightsfrom.com

- www.flights.com

- www.farecompare.com

The Ahrefs chart below shows the decreasing traffic for the top five domains in the list.

Figure 20. Global traffic decreased for the top five domains that Google Flights outranked, according to Ahrefs.

Figure 20. Global traffic decreased for the top five domains that Google Flights outranked, according to Ahrefs.

However, probably the best way to look at traffic data is on SEMrush after applying keyword, device, and country filters.

Is Google Flights to Blame?

We are not saying that the decline of these sites is exclusively due to the emergence of Google Flights’ domain.

However, the data suggests a significant shift in SERPs for flight-related queries, with Google Flights steadily gaining market share while traditional flight search sites are losing visibility. This trend is consistent across mobile and desktop searches and different geographical markets, indicating a systematic change in SERPs favoring Google Flights.

Conclusion

Our research reveals a dramatic improvement in Google Flights’ organic rankings for flight-related searches across multiple markets. We suspect this is a deliberate move to establish a solid organic presence, potentially as a hedge against regulatory restrictions on SERP features and self-preferencing in search results.

As if pinning a Google Flights box at the top of search results wasn’t enough, its website has become a major organic competitor to airlines and travel booking companies.

Some established flight aggregators and OTAs have been the hardest hit, with players like Momondo, Kiwi.com, and Trip.com experiencing significant ranking declines across multiple markets.

While our customers have shown resilience, particularly in their home markets, the growing strength of Google Flights poses a potential threat, with 30% of analyzed airlines now having fewer first-page rankings than Google Flights.

However, airlines can effectively compete against and outperform Google Flights in organic search. Our customers set a strong example. They show 3-4 times more top-5 rankings than Google Flights while maintaining roughly two-thirds of keywords on the first page.

We want to update our findings with more recent data, but looking ahead these results raise important questions about:

- The future of SERPs for flight-related searches in an increasingly Google-dominated landscape.

- The potential need for even further regulatory oversight of Google’s self-preferencing in SERPs.

- The value of specialized SEO solutions for airlines, such as airTRFX.

- The importance of market-specific SEO strategies for airlines that can secure better ranking positions, at least in their primary markets.

Frequently Asked Questions

Google Flights has gained significant visibility in organic search, but most airlines maintain strong rankings, especially in their home markets. Airlines using tailored SEO strategies, like airTRFX, outperform Google Flights in top rankings and first-page visibility.

Flight aggregators and OTAs, such as Momondo, Kiwi.com, and Trip.com, have experienced ranking declines in multiple markets as Google Flights gains ground in organic search results.

Airlines have a home market advantage, with stronger rankings in their local search results compared to foreign markets. This is due to localized SEO strategies and brand familiarity within their primary regions.

Airlines can leverage specialized SEO solutions like airTRFX, focus on market-specific strategies, and optimize for localized search to maintain strong rankings and visibility against Google Flights.

Google Flights has become a major competitor in organic search, challenging traditional flight aggregators and OTAs. Its growing presence highlights the need for airlines and OTAs to adopt advanced SEO strategies to stay competitive.

Markets like the United States, United Kingdom, and Canada have experienced the largest shifts, with Google Flights gaining substantial first-page visibility and outranking several OTAs and aggregators.

The rise of Google Flights in organic search raises questions about the future of SERPs for flight-related queries, the need for regulatory oversight, and the importance of advanced SEO solutions for airlines and OTAs to maintain competitiveness.