In my last blog, I unpacked the concept of modern airline retailing and dug into some of the struggles—legacy technology—continuing to hold the industry back. One question came up repeatedly from readers:

“How does an optimal price actually become a ticket?”

The short answer: it’s more straightforward than you’d think. But first, let’s take a quick step back.

Moving Beyond the Myth of Perfect Segmentation

Picture the old revenue management playbook. It treats every booking class as a perfectly carved-out niche, with the assumption that each customer seamlessly fits into one of these boxes. This model is built on “independent demand”—the idea that a customer’s decision only relates to their assigned booking class, unaffected by what’s happening elsewhere in the system.

But here’s reality: No matter how many rules you add or how cleverly you slice your fare structure, actual traveler behavior remains far more variable and nuanced. Asking every customer to “stamp the booking class on their forehead” falls short in a world driven by optimization and digital shopping experiences. Even with the sharpest segmentation, the range of price elasticity in each group is wide, dynamic, and unpredictable.

Why Today’s Airlines Need Dynamic Pricing, Not Static Buckets

The market no longer rewards static thinking. To remain competitive and provide the best offer at the time of shopping, airlines must master the art of calculating the optimal price—in the blink of an eye—in order to convert customers.

Modern revenue management doesn’t just open and close booking classes. It considers two intertwined forces:

- Price elasticity, or the percentage change in demand relative to a percentage change in price.

- Capacity constraint/Opportunity cost (Bid Price), meaning the predicted value the seat could fetch from another customer who books later.

Karl Isler, in “The Art of the Possible,” provides mathematical formulas for setting optimal prices by balancing what the current customer might pay with what the seat could be worth if held for someone else. The Optimal Price, P, satisfies the following equation

P − P |Elasticity| = Bid Price

If we were to assume that the demand function has a mean D(p)=λe−( p−p0 α ), the equation above can be written as

P = α + Bid Price

This form not only provides computational efficiency but also provides consistency whenever the seller can only receive class availability. In which case the optimal control policy satisfies,

Open Class j if and only if ƒj − ƒj |Arc Elasticity| ≥ Bid Price

This rigorous approach remains consistent, even when the underlying systems still operate in terms of booking class availability. It makes traditional segmentation instantly smarter, applying data-driven logic in real-time rather than in periodic batch updates. The math is quite simple, but too often airlines are still using availability in static price points, leaving money on the table for price points that could have garnered more revenue later, or turning potential customers toward competitors if price points are too high.

From Price to Ticket

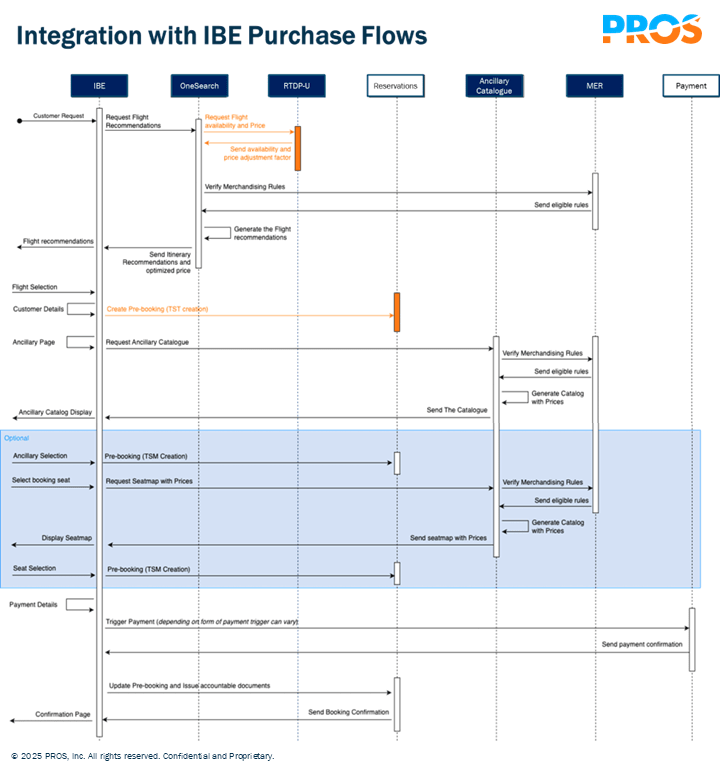

So, how does this optimal price result in a ticket? Let’s look at the following diagram created by my colleague Martin Kozhuharov. It’s an example of an IBE booking flow using PROS products (in blue). The NDC flow is very similar.

Step 1. Search and Input

- A customer searches for flights on your Internet Booking Engine (IBE).

- The IBE hands off key details such as dates, times, passengers in the booking request, and origin and destination to the PROS Shopping solution, OneSearch.

Step 2. Dynamic Pricing Decision

- PROS OneSearch engages with PROS Real-Time Dynamic Pricing (RTDP)

- RTDP assesses in real-time whether the seller and market is eligible to receive a continuous dynamic price

- If eligible, it computes an adjustment factor using the latest demand and availability signals, then recommends the best-fit fare class for ticketing and provides this plus the adjustment factor back to OneSearch.

Step 3. Final Pricing and Offer Assembly

- OneSearch completes the pricing calculation for all fare brands/classes, including all applicable taxes and fees.

- It returns a range of branded offers to the IBE, reflecting hundreds of potential combinations alongside their real-time prices. This could easily exceed 400 depending on the number of brands, number of possible connections, number of inbound/outbound dates provided, etc.

Step 4. Ticket Issuance

- The IBE generates a Passenger Name Record (PNR).

- The ticket is issued, matching the dynamic price and assigned fare class.

Proven at Scale:

This is more than theory. PROS customers have been using this system in production for over four years. One major airline leverages the platform to compute upwards of 168 million dynamic prices per minute. That’s real-world scale without trade-off.

Gaps in Legacy Systems

As mentioned in my previous blog, The Cost of Inertia, despite the clear advantages of continuous dynamic pricing, many airlines remain constrained by outdated legacy systems that hinder their ability to adapt to modern retailing demands.

Monolithic providers often lack flexibility or the incentive—to integrate real-time pricing engines or support dynamic offer creation, resulting in a reliance on static fare structures. This technological inertia not only restricts revenue optimization but also prevents airlines from delivering the seamless, customer-centric experiences that today’s travelers expect.

As the industry evolves, the cost of inaction becomes increasingly significant, potentially leading to lost market share and diminished customer loyalty.

Why Continuous Pricing Matters More Than Ever

One of the biggest advantages of continuous dynamic pricing is its ability to offer a much wider variety of price points to customers—in real-time, delivering the experience customers are looking for. Traditional pricing models are limited by pre-filed fare structures, which means customers often see prices that are either too high (leading them to abandon the purchase) or too low (leaving money on the table for the airline).

With continuous dynamic pricing:

- Airlines can respond instantly to subtle changes in demand, competition and price elasticity.

- Customers are more likely to find a price that matches their budget, leading to better conversion rates.

- The airline avoids the rigid constraints of fare buckets, instead using smart algorithms to generate precise prices for every unique shopping context.

This flexibility is crucial in today’s environment, where travelers expect more personalization and transparency. It empowers airlines to serve a broader market—from highly price-sensitive shoppers to premium customers—without needing to maintain an overly complex fare filing strategy.

In short: More price points mean more opportunities to win the customer—at the right price, at the right time.

And the bottom line is, the shift from fixed pricing to real-time, continuous dynamic pricing is already here—and it’s scalable, proven, and surprisingly elegant in practice.

Frequently Asked Questions

Dynamic pricing uses real-time data to adjust ticket prices based on demand, competition, and market conditions, optimizing revenue.

It balances price elasticity (customer demand sensitivity) with opportunity cost (potential future revenue from the same seat).

Legacy systems rely on static fare buckets, which lack flexibility and fail to adapt to real-time market changes, leaving revenue on the table.

It offers a wider range of price points, increasing the likelihood of matching customer budgets and improving conversion rates.

AI processes vast amounts of data in real-time, enabling precise, scalable, and customized pricing decisions for airlines.

It maximizes revenue, enhances competitiveness, and meets modern customer expectations for customized and transparent pricing.

Dynamic pricing systems, like PROS, can compute millions of price points per minute, ensuring real-time adaptability at scale.