In today’s fiercely competitive B2B landscape, mastering price optimization is not just an advantage—it’s a necessity for maximizing revenue and staying ahead of the competition. For decades, segmentation-based approaches have dominated the field. But at PROS, we revolutionized the game in 2023 by introducing neural network-based price optimization. This blog post will delve into the benefits and drawbacks of each approach and provide a framework to help you choose the best method for your business.

Defining Neural Networks and Segmentation in Price Optimization

First, let’s define both neural networks and segmentation in the context of price optimization:

- Neural Networks: These are advanced AI models that process vast amounts of structured and unstructured data to generate pricing recommendations dynamically. They learn complex patterns, adapt to changing conditions, and provide optimized pricing at scale.

- Segmentation Models: These models categorize data into predefined groups based on key attributes like customer size, geography, or product type. Pricing recommendations are based on historical transactions within each segment.

Now, let’s dig into benefits, challenges, and when to use each approach.

Benefits of Neural Networks

My colleague Mohit Mahajan has penned an insightful piece on the benefits of neural networks in price optimization. Key differentiators that support the use of neural networks include:

- Diverse Data Utilization: Neural networks can harness a wide array of data, from historical transaction records to sentiment data and seasonal patterns.

- Sparse Data Handling: They excel at learning from and generalizing across limited data points.

- Complexity Management: Neural networks adeptly manage complexity, avoiding the oversimplification that can overlook crucial patterns.

- Flexibility and Scalability: These models are dynamic, adjusting recommendations in real-time as new data flows in.

I highly recommend reading Mohit’s article for an in-depth understanding of these points. From my perspective, neural networks replicate human reasoning and incorporate vast amounts of information. Imagine you’re a seller working with a long-time customer. You know their specific needs, how political changes affect them, and their recent experiences with your products. Your brain subconsciously processes all this information to craft the perfect offer; you don’t need to perfectly arrange the information to understand it. A segmentation approach could never account for this volume and variety of information. Neural networks simply surpass segmentation models at replicating human thought processes.

Conversely, neural networks can also outperform humans with new customers by identifying and leveraging similarities with existing customers to propose optimized prices. They can also dynamically respond to market dynamics, such as tariffs, protecting margins and seizing opportunities, as Craig Zawada discusses in his article on navigating tariffs. In essence, neural networks combine the best of both worlds—replicating and enhancing human brain capabilities by supercharging data gathering and real-time response. This allows for full optimization of your transaction set, not just ‘most’ transactions.

Explainability

Explainability, often dubbed the ‘black box’ issue, is frequently cited as a downside of deep learning models. While it’s true that these models can be more complex to unravel than segmentation or regression-based models, we’ve implemented excellent tools to demystify the decision process. As Mohit Mahajan explains, these tools allow users to trace back to the source of a recommendation, providing clear insights into why a specific action is suggested.

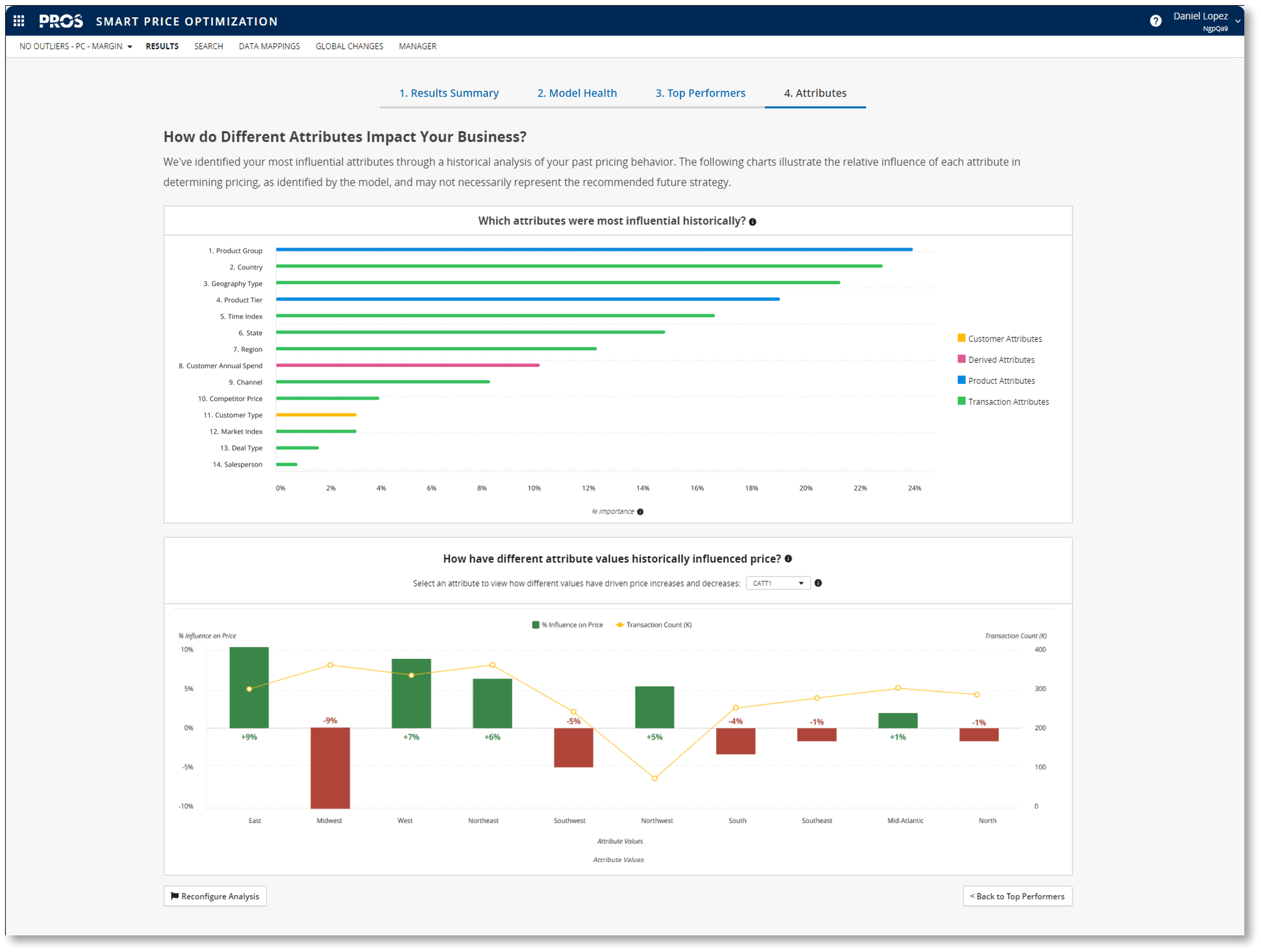

For example, at PROS, we use SHAP (SHapley Additive exPlanations) to identify and explain the contribution of each attribute to the recommended price, as shown in the screenshot below.

In short, the ‘black box’ concern is an oversimplification of deep learning models and it ignores how domain-specific solutions have used analytics, data visualizations, and natural language to unpack what the model is doing for the business user. In fact, neural network-based approaches with proper explainability provide more insight and context to the user than segmentation-based models.

When To Use Neural Networks

Neural networks are the optimal choice for companies that:

- Have a wealth of transaction, market, and behavioral data, even if some of it is unstructured.

- Operate in a dynamic, fast-moving market where pricing decisions need to adapt in real-time.

- Would benefit from transaction-level pricing strategy rather than broad price groupings.

- Have already established pricing discipline and are ready for a more advanced approach.

- Are looking to maximize revenue by accounting for complex patterns that traditional segmentation cannot detect.

Neural networks are most beneficial at the Prescriptive Pricing stage, where they leverage vast data sets and AI-driven insights to personalize and optimize pricing at a highly granular level.

Segmentation-based models

While neural networks offer numerous benefits, segmentation models remain a powerful tool in the price optimization landscape. Segmentation based models, as their name implies, are models that are typically built on a subset of the data that is deemed relevant or “significant”. For example, a statistical analysis might determine that, out of longer list of attributes, only four of them have a significant historical impact on pricing.

Let’s say these attributes are customer size, product type, geographic location of the customer, and length of the relationship with this customer. A segmentation model will then break down these attributes into ranges and create segments that will be used to inform future pricing decisions. For example, a “small customer” purchasing a “lighting product” based in “southern Europe” who has been a customer for “the past 10+ years” will be grouped together with similar customers and a price recommendation for that customer will be exclusively based on similar transactions in that segment.

As of early 2025, most price optimization software vendors still rely on segmentation-based solutions. Are segmentation models bad? No. Segmentation-based models are a valuable steppingstone for improving pricing discipline in organizations.

The pricing optimization journey typically follows a maturity curve with five stages:

- Ad Hoc Pricing: Decisions are made on an ad hoc basis, often cost-based, with little to no data analytics.

- Reactive Pricing: Companies start reacting to market conditions and competitor pricing with basic data analysis.

- Proactive Pricing: Structured pricing strategies emerge, supported by data and analytics.

- Optimized Pricing: Advanced pricing models and techniques, such as segmentation, maximize profitability.

- Prescriptive Pricing: Analytic AI and machine learning forecast market trends and aggregate customer behavior, prescriptively optimizing revenue and profitability at a transaction-specific level. As noted, this is the stage in which neural networks become more impactful.

Segmentation models are particularly effective at stage 4, supporting the transition to more advanced ML- and AI-based solutions. Not every company can leap from step 1 to step 5 in one go. Segmentation can be a crucial steppingstone, helping companies enhance their pricing solutions and upskill their teams.

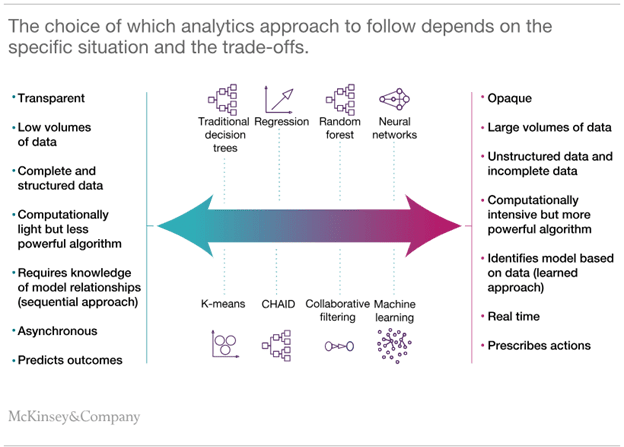

McKinsey & Company (see chart below) highlight the importance of leveraging dynamic pricing and identify the differences between segmentation-based algorithms – on the left-hand side of the chart – and advanced AI and ML based solutions – on the right-hand side of the chart.

Workload Considerations: Neural Networks vs Segmentation

The workload required from pricers differs significantly between segmentation-based models and neural network optimization. With segmentation, pricers need to be deeply involved in manually defining and maintaining segments, ensuring data accuracy, and continuously adjusting price groupings as market conditions change. This approach is more structured than Excel-based pricing but still requires significant human intervention to keep up with market volatility.

Neural networks, on the other hand, remove much of this manual burden by dynamically adjusting pricing based on real-time data, reducing the need for constant human oversight. Businesses today need to be incredibly adaptive, and while segmentation-based models offer some level of improvement over manual methods, they ultimately fall short in meeting the adaptability demands of volatile market conditions. The ONLY way to solve this challenge effectively is by leveraging neural networks, which automate decision-making and provide real-time, data-driven pricing recommendations.

At PROS, we’ve ensured a seamless transition between these two extremes and maturity levels, facilitating your journey to market-driven pricing pricing.

Source: McKinsey & Company, https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/what-really-matters-in-b2b-dynamic-pricing

Choosing the Right Model

Choosing the right price optimization solution can be challenging. Here are key considerations to guide your decision:

- Maturity Curve Position: Assess where your company is along the pricing transformation journey.

- Data Quality: Evaluate the quality and volume of your data and your team’s confidence in it.

- Change Management: Consider your team’s readiness for change and the presence of internal champions.

- Precision Needs: Determine how much you value precise, accurate price recommendations for every transaction: are you looking for price discipline, or are you personalizing every pricing decision?

Answering these questions will help you decide between segmentation and neural network-based models. You will note that our perspective differs slightly from the McKinsey chart above, though they are not in conflict. McKinsey’s perspective (in this particular chart) focuses on the technical aspects of supporting advanced models, which are important considerations. Our perspective focuses on a broader range of enablers that help you decide strategically which model you should turn to. These enablers include the technical aspects that McKinsey highlight.

If you’re considering these models, you’re already ahead of the curve. Our assessment is that most companies are ready for advanced AI solutions based on neural network optimization. However, taking an intermediate step with segmentation may provide the necessary time to complete the transformation.

Conclusion

In conclusion, both segmentation-based and neural network-based price optimization models offer unique advantages and can significantly enhance your pricing strategy. Segmentation models provide a solid foundation for creating pricing discipline and can serve as an essential steppingstone in your journey toward advanced pricing maturity. On the other hand, neural network-based models bring unparalleled flexibility, scalability, and the ability to handle complex data, making them a powerful tool for achieving precise, market-driven and dynamic pricing.

Ultimately, the choice between these models depends on your company’s current position on the pricing maturity curve, the quality and volume of your data, your team’s readiness for change, and your need for precise pricing recommendations. By carefully considering these factors, you can select the best approach to optimize your pricing strategy and drive your business forward.

At PROS, we believe that most companies are ready for the transformative power of neural network-based price optimization. However, we also recognize the value of segmentation models as an intermediate step in the journey to pricing excellence. Whichever path you choose, you are making a strategic decision that will position your business for success in today’s competitive market.

Frequently Asked Questions

Neural networks are AI models that process vast, complex data to provide dynamic, real-time pricing recommendations.

Neural networks adapt dynamically to data and market changes, while segmentation relies on predefined groupings and historical data.

They handle sparse data, manage complexity, and provide scalable, flexible pricing recommendations tailored to real-time conditions.

Segmentation is ideal for companies in the early stages of pricing maturity, offering a structured approach to improve pricing discipline.

Tools like SHAP provide transparency by showing how data attributes influence pricing recommendations, addressing the “black box” concern.

They enable real-time price adjustments based on market trends, price elasticity, and transaction-level data.

Consider your data quality, pricing maturity, team readiness, and need for precise, transaction-specific pricing recommendations.