Part I of this blog post series explored key strategies for implementing airline dynamic pricing, emphasizing the importance of understanding demand shifts and patterns to apply real-time adjustments and maximize revenue contributions. It covered key topics such as improving forecast accuracy with dynamic pricing, preventing revenue dilution, leveraging competitive pricing strategies, and transitioning from dynamic availability to dynamic pricing strategies, with examples from industry leaders like Lufthansa Group.

In Part II you will delve into the transition path from class-based to class-free dynamic pricing, what the adoption of dynamic pricing techniques means for downstream systems, and how dynamic ancillary pricing helps steer an ancillary revenue optimization strategy.

If you missed it, check out Part I of the blog post series here: Key strategies for implementing airline dynamic pricing – Part I.

The transition path from class-based to class-free dynamic pricing

There are many ways to implement dynamic pricing, with some approaches focusing on price manipulations after the revenue management (RM) decision has taken place. As an AI-driven company, PROS is focused on discussing the science-based, RM-led approach that can provide a solution for nearly all markets or Origin-Destination pairs and requires analyst-defined rules only as an exception to manage unique cases

To do that, airlines will need to produce an output control that considers the price elasticity adjustment for the product. In this case the product will be the right-to-fly on a specific itinerary-date for a specific POS (Point of Sale). PROS achieves this by producing Transformed Fares that incorporate price elasticity adjustments, as a science-based alternative to using analyst-defined fare strategies.

In addition to price elasticity, airlines also need to consider what the opportunity cost for each product in the offer is. For this PROS uses the sum of the bid prices for each leg traversing a given itinerary. These bid prices are produced by the optimization process in the Revenue Management system, and they are represented in a vector for each cabin, where each sellable seat has a unique value or opportunity cost.

To use the correct bid price for each flight leg, an airline needs access to inventory information as a live feed. This information includes booking counts per cabin and per class, which act as the index for the bid price vector.

With this information, the dynamic pricing engine, PROS Real-Time Dynamic Pricing, can calculate a “continuous” dynamic price, and also real-time availability in case mapping to legacy class-based controls is necessary. By continuous, we mean that the optimal price calculated by the system doesn’t need to match a pre-filed fare<. In an Offer and Order world, this already translates into a RBD-less dynamic pricing approach that does not rely on legacy class codes.

Airline dynamic pricing and downstream systems adoption

|

Mario Maier

Head of Distribution Solutions  |

– Mario Maier, Lufthansa Group, Director, Head of Distribution Solutions

Airlines need to understand the implications of consuming the dynamic price in other downstream systems. PROS has been doing this automatically for Group Dynamic Pricing for more than a decade. By stamping the price and other key information in specific fields in the Passenger Name Record (PNR), it is possible to later service the booking and properly reflect the order in revenue accounting systems. This enables airlines to implement dynamic pricing strategies in a legacy setup where all internal business processes and systems are reliant on existing class-codes and pre-filed ATPCO fares.

The Lufthansa Group have been live with continuous pricing for fares or seats (the right-to-fly) for more than five years. Looking at the entire dynamic price lifecycle has been part of the airline’s strategy for adopting dynamic pricing. To enable downstream systems adoption the airline group explained at Outperform with PROS 2024 that additional indicators were added to their fare basis codes for auditing purposes and for their reporting systems, ensuring interoperability between internal systems and departments.

As carriers move along the IATA roadmap for Offer and Order Management, having direct control of a truly interconnectable inventory module and adopting NDC compatible orders facilitates the consumption of dynamic prices.

The value of dynamic ancillary revenue optimization

Airlines today have more control on how they deploy dynamic pricing to their offerings. As ancillary revenue continues to gain importance in the balance sheet, carriers are looking at ways to scientifically price their ancillaries to maximize total contribution, beyond the simple experiments of A/B testing certain static price points.

PROS now offers PROS Dynamic Ancillary Pricing (DAP) – a stand-alone AI-powered solution to produce a dynamically adjusted price for ancillaries in real-time. This can be done for one or many ancillary categories and is not dependent on whether an airline files their ancillaries with ATPCO or not. PROS DAP can price both ATPCO and non-ATPCO ancillaries in real-time based on price elasticity and data-driven insights. It works along PROS Merchandising while being compatible with any merchandising solution that is able to provide the ancillary catalog and base price. It only requires a small effort to integrate a feed with successfully converted orders to power the reinforced learning algorithms that adjust prices. This feed can be provided in real-time or in batches, and could come from the Internet Booking Engine (IBE).

Science approach used in PROS Dynamic Ancillary Pricing solution

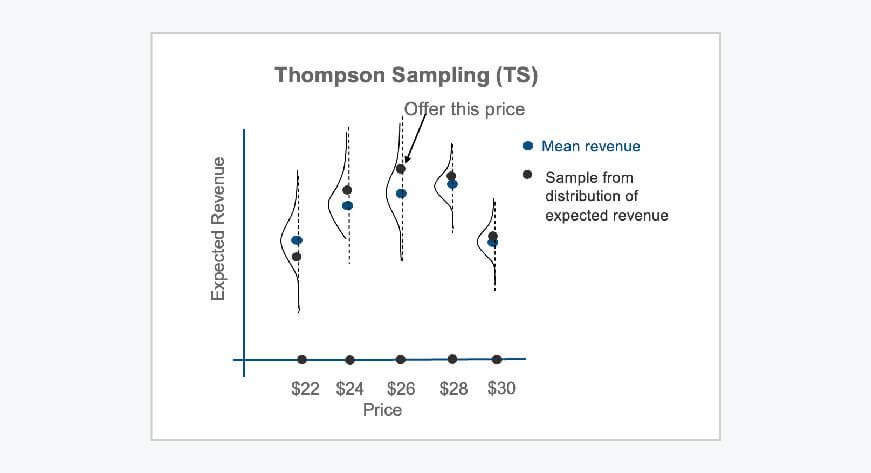

The science used in PROS DAP includes multi-armed bandit heuristics with Bayesian logistic model. It helps optimize price exploration using Thompson Sampling and other techniques that minimize losses from exploration, making the ancillary price optimization process faster and more efficient. For added value, airlines can pair this solution with PROS Merchandising and empower eCommerce and RM analysts to toggle between rule-based and science-based dynamic prices on certain markets, date ranges and ancillaries. In addition, they can also gain bundling flexibility, by including dynamically priced ancillary bundles to better meet customer needs.

|

Jolanta Rema

VP eCommerce and Commercial Distribution  |

airBaltic is one of the carriers that has been using PROS Dynamic Ancillary Pricing solution to optimize seat assignment pricing across their entire network. The leading carrier in the Baltics is an avid AI adopter and took only six months to fully implement and see positive results on ancillary revenue per passenger. The AI-fueled dynamic pricing approach complements the airline’s robust merchandising strategy to drive product and price differentiation for their ancillary catalog, which has also proven a successful endeavor for the carrier’s bottom line.

Building the business case for dynamic pricing adoption

Going back to how this blog post started – there are multiple ways to implement airline dynamic pricing. In order to determine which approach is best suited to deliver on your airline’s business goals, a strategy for implementing dynamic pricing should be the starting point for any carrier. At PROS, we have been supporting airlines of different sizes and business models identify their path to dynamic pricing and achieving the milestones. Reach out and we are happy to talk about yours, too.

Frequently Asked Questions

Class-free dynamic pricing eliminates reliance on traditional class-based fare systems. Instead, it uses AI-driven tools to calculate continuous, optimal prices based on real-time data like demand, price elasticity, and inventory.

Real-time dynamic pricing allows airlines to adjust fares instantly based on live data, such as booking trends and market demand. This ensures optimal revenue generation and better alignment with price elasticity.

AI powers dynamic pricing by analyzing factors like price elasticity, demand patterns, and opportunity costs. It enables airlines to make data-driven decisions, optimize fares, and dynamically price ancillaries in real-time.

Airlines can integrate dynamic pricing by stamping prices and key data into Passenger Name Records (PNRs). This ensures compatibility with legacy systems for rebooking, auditing, and revenue accounting.

Dynamic ancillary pricing uses AI to adjust prices for add-ons like seat selection and baggage in real-time. This approach maximizes ancillary revenue and enhances customer satisfaction by offering tailored pricing.

Challenges include ensuring data quality, integrating with legacy systems, and aligning internal processes. Airlines must also address regulatory compliance and train teams to manage AI-driven systems effectively.

Airlines should begin by defining a clear strategy, investing in AI-powered tools like PROS Real-Time Dynamic Pricing, and ensuring seamless integration with existing systems to achieve their revenue goals.