As airlines transition to offer management, ancillary revenue optimization will play a central role in monetizing revenue opportunities across customer touchpoints with attractive offers and optimal pricing.

The evolution of ancillary sales – where to next?

For most airlines today ancillary revenue is an important revenue contributor and no longer a business strategy solely in the low-cost carrier (LCC) space. Over the past few decades, airlines of all sizes and business models have rapidly evolved in offering a-la-carte products and services.

It all began in the early 2000s, with the unbundling of services from the base fare. In less than a decade, full-service carriers were already following in the steps of their low-cost rivals, introducing fees for ancillary services such as checked bags, in-flight entertainment, and more. The industry saw mainstream adoption and merchandising advancements such as ancillary price experimentation, bundled packages, as well as third party partnerships for the introduction of travel insurance, hotel bookings, and car rentals.

Today, ancillary sales are integral to airlines’ commercial strategies, recognized for their impact on revenues, profitability, and customer satisfaction. In the broader context of the retail transformation toward Offers and Orders carriers are about to witness another step in their evolution, promising to unlock up to $7 additional revenue per passenger, according to IATA and McKinsey.

Ancillary revenue optimization vs. revenue management

With such significant revenue potential at stake, what would ancillary revenue optimization mean for airlines in the future, and how can carriers effectively manage ancillary revenue streams?

The answer varies based on the airline’s commercial model and business objectives. However, it is important to note the starting point today: there is a clear distinction between an ancillary offer and a flight (right-to-fly) offer for travelers.

Ancillary sales aim to grow airline revenue by tapping into travelers’ second wallet. Products like additional bags, seat selection or Wi-Fi are not primarily driven by capacity and demand, as is the case with flight prices. Passengers might not be willing to pay more for such products closer to departure but might instead decide they need them later, ahead of their journey.

This leads to a logical division between passengers’ willingness-to-pay for the flight (the right-to-fly) and their willingness-to-pay for the travel extras based on their needs and preferences. Airlines need to be mindful and strategic in how they maximize revenue opportunities on both ends.

The revenue management (RM) approach for flights is to balance between filling up the plane early on with price-sensitive demand versus saving enough capacity for high-yield demand closer to departure. Sophisticated forecasting and optimization techniques today help airlines manage demand across complex networks, with willingness-to-pay models enabling successful management of the buy-down effect.

In contrast, ancillary management shifts to optimization. How can airlines present more relevant ancillary offers and avoid overwhelming shoppers with endless choices? How does a carrier increase travelers’ shopping basket with products and services that improve their travel experience and keep them coming back for more? It all boils down to optimizing the ancillary offer in terms of content, pricing, and packaging, revealing almost unlimited revenue potential for airline commercial teams.

From merchandising to offer optimization

Merchandising – the foundation for ancillary optimization

Ancillary merchandising has become an advanced discipline within eCommerce and RM teams where airlines manage extensive ancillary catalogs by defining business strategies per market, point-of-sale, passenger type, and more. Merchandising systems are often standalone tools connected to booking engines, allowing airlines to granularly control how ancillaries are priced and distributed. This hands them commercial freedom to experiment with different strategies and campaigns to optimize ancillary sales. From price alteration rules to product and service bundling, ancillary revenue optimization techniques are driven by analysts who deeply understand their travelers and markets.

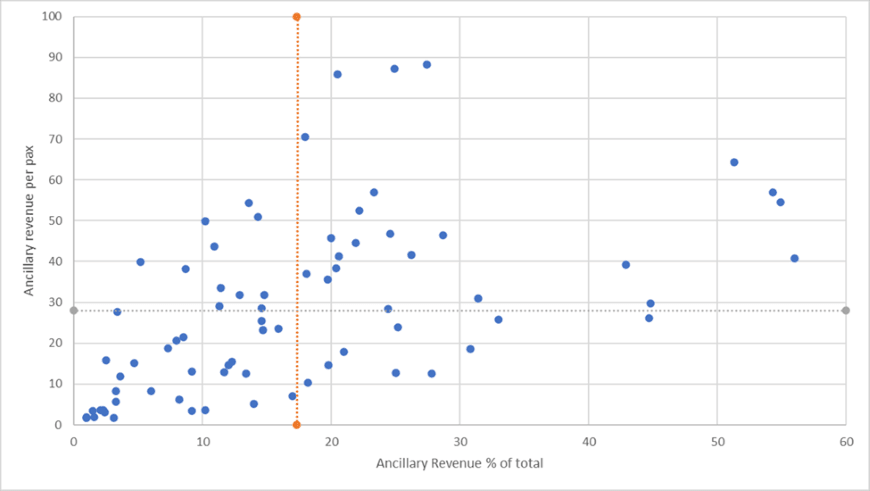

Airlines with this distinct approach to managing a-la-carte services see significant revenue contributions from ancillary sales to their revenue and higher revenue per passenger. The chart below illustrates that the industry sees a good portion of ancillary high performers in the top right corner. For followers in this space, this means untapped revenue potential as they move up and right on this chart, promising also higher customer satisfaction and increased market competitiveness.

Average values for ancillary revenue per passenger and ancillary revenue % of total revenue

Data source: CarTrawler/IdeaWorks Company

Next steps: AI-driven offer optimization

The introduction of artificial intelligence (AI) on top and in a synergy with existing merchandising technology is where ancillary revenue optimization gets exciting. With AI, airlines reduce the heavy lifting around ancillary management and automate much of the business rule creation and maintenance.

The real value though lies in using AI to discover trends and insights and optimize ancillary revenue based on real-time data. A few examples that are beginning to reveal revenue potential for carriers include dynamic ancillary pricing, ranking, and bundling, and PROS team has been actively developing the science behind these new AI algorithms.

- Dynamic ancillary pricing: Using dynamic ancillary pricing airlines can present more relevant prices to travelers helping convert more ancillary sales by considering passenger, trip and context information. Even slight price variations between customer segments based on booking behavior can result in significant revenue uplift. What if you airline was to make an additional 6% ancillary revenue per passenger?

- Ancillary ranking: Ranking is another area where carriers can unlock more revenue by using AI to display more relevant ancillary offers in an order most likely to convert. The beauty lies in its application across ancillaries and ancillary groups, as well as across airline brands. Instead of bombarding travelers with all available offers, airlines can recommend the brands most likely to covert a looker into a booker, even when offers are fixed and predetermined in ATPCO.

- Ancillary bundling: As to bundling, AI has the potential to redesign how a-la-carte services are retailed. In eCommerce across other industries, bundles have multiple dimensions – from dynamically packaging standalone products, to dynamically offering predetermined groups of products, and dynamically adjusting the shopping basket based on its contents. As airlines start experimenting in this domain, AI will augment its hidden revenue potential, making retailing real-time, more personal and dynamic.

airBaltic is one of the innovative airlines in Europe with a strong emphasis on ancillary sales. Watch this video to learn more about airBaltic’s airline-led eCommerce strategy in partnership with PROS, their approach to merchandising, and the recent application of AI for ancillary pricing.

The future of ancillary revenue optimization

Where all these approaches blend and start merging is where the industry is headed as retail transformation. In the context of Offers and Orders, as airlines gain more commercial autonomy and retail freedom, they will start considering much more information about the passenger, their trip and shopping context, as critical input for their pricing decisions.

A direction for revenue optimization in the (not so) distant future is for airlines to begin looking at ancillary spend as a factor. Price sensitivity and travelers’ second wallet are an interesting consideration for making right-to-fly decisions. In that sense, revenue management will not be a separate decision from ancillary price management, and there will be a strong tie between the two to steer the overall airline offer management strategy.

Another area in which ancillary revenue optimization is expected to evolve is around branded fares and bundling. Today, airline brands are static bundled offers that reflect only a few customer segments. With AI-driven offer optimization in an Offer and Order setup, they can evolve to dynamic bundles of products and services that are constructed in real-time to match customer demand, as well as the airline revenue goals. Upsell offers, regardless of if bundled or not, can also be offered real-time based on AI-driven recommendations for what is most relevant to the traveler.

The future of ancillary revenue optimization promises dynamic offer creation, revenue potential, and retail strategies that are more closely aligned with travelers’ needs. To seize these opportunities, airlines must embrace commercial independence and chart their own path forward, driven by innovation and supported by symbiotic partnerships.