Is ChatGPT still a side-show in the flight-search funnel?

Since OpenAI rolled out ChatGPT Search in late 2024, referral clicks from ChatGPT to our airline customers’ flight pages have grown thirteen-fold. The timing is perfect to quantify what that means for an airline’s SEO strategy… or is it GEO strategy?

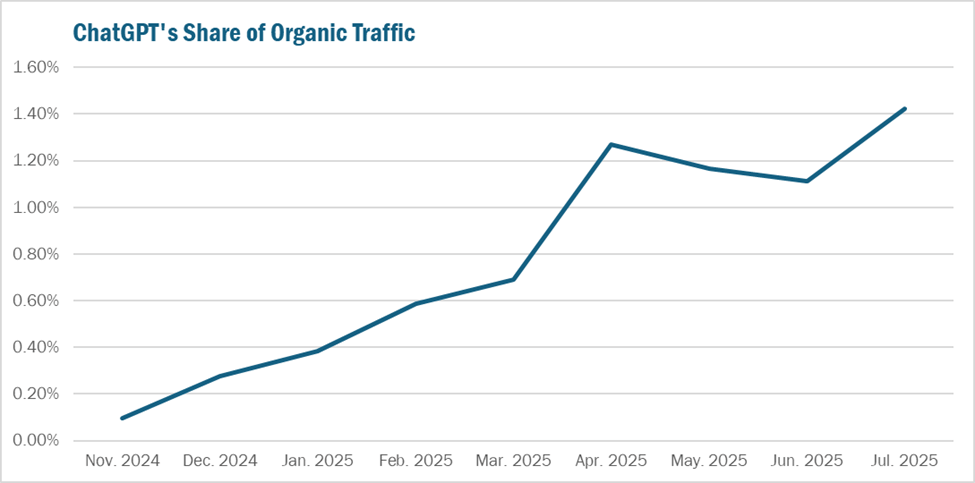

When ChatGPT Search first appeared (November 2024), it drove just about 0.10% of the total organic traffic, according to aggregated data from over 150 airlines. By July 2025, that share hit 1.42%, still small, but a remarkable jump.

Even these tiny percentage shifts could translate into thousands of missed seat sales if airlines’ domains aren’t represented in ChatGPT. This upward trend signals the growing importance of optimizing flight pages for this emerging channel.

To quantify this shift, we conducted an analysis comparing the URLs sourced by ChatGPT against the top 20 organic results on Google for 376 flight-related queries with origins and destinations in the US. The goal was to measure the overlap, identify the dominant domains on each platform, and uncover the key differences in their sourcing strategies.

Our Methodological Approach

We designed a controlled, repeatable analysis of ChatGPT’s responses for flight searches… but there are some considerations.

Keyword Corpus

We sampled city-to-city flight queries with origins and destinations within the US. The final sample included 376 city-to-city prompts following the exact format “flights from ORIGIN to DESTINATION” (e.g., ‘flights from Denver to Orlando’).

Why We Used a Standardized Prompt

The prompt used is not exactly conversational, and it may not fully represent how all users search for flights in ChatGPT.

However, we decided to use it because:

- It establishes a controlled baseline: Using a consistent prompt format allows for a scientifically rigorous comparison by removing the ambiguity of natural language and isolating the AI’s response as the key variable.

- It mirrors high-intent search behavior: The format is identical to high-volume, commercially valuable queries used on Google, making the comparison between the two platforms direct and relevant.

- It reflects the app’s internal process: ChatGPT rewrites conversational prompts into more structured, targeted queries for its search partners. This study simply uses the likely end-state of that process.

- It ensures comparability: A standard format ensures that any variations in the results are due to the specific flight route analyzed, not random differences in how the prompt was phrased.

In a nutshell, the prompt pattern is representative, comparable to Google searches, and a clean way to benchmark link-selection behavior.

The Model

We chose ChatGPT-5 Fast for this study, which is powered by GPT-5, the default model for all logged-in users, including those in the free tier.

Session Isolation

We ran each prompt in a fresh chat with the Memory feature off to eliminate carry-over context.

Why We Isolated Each Search

We understand that ChatGPT’s “context” and “memory” influence its responses in real-world scenarios.

However, we chose this approach to isolate and analyze the app’s foundational response mechanism. Ultimately, the study’s value comes from providing a clear picture of ChatGPT’s core, non-personalized sourcing and linking strategy for flight searches. This foundational understanding is the critical starting point for airlines seeking to optimize flight pages for ChatGPT.

Data Captured

For every ChatGPT’s answer, we logged:

- Sentences, phrases, or words with Inline Citations.

- Any airline, OTA, or travel brand mentioned in the text.

- All domains and URLs cited in Inline Citations and the Sources sidebar.

Two Citation Slots

ChatGPT’s answer shows link sources in two distinct spots: Inline Citations and Sources.

Not all URLs are cross-referenced across the two categories. About 3.5% of in-text citations do not appear in Sources, while 5.3% of source links are never cited in the conversation itself.

Below, we briefly cover how these different link placements work.

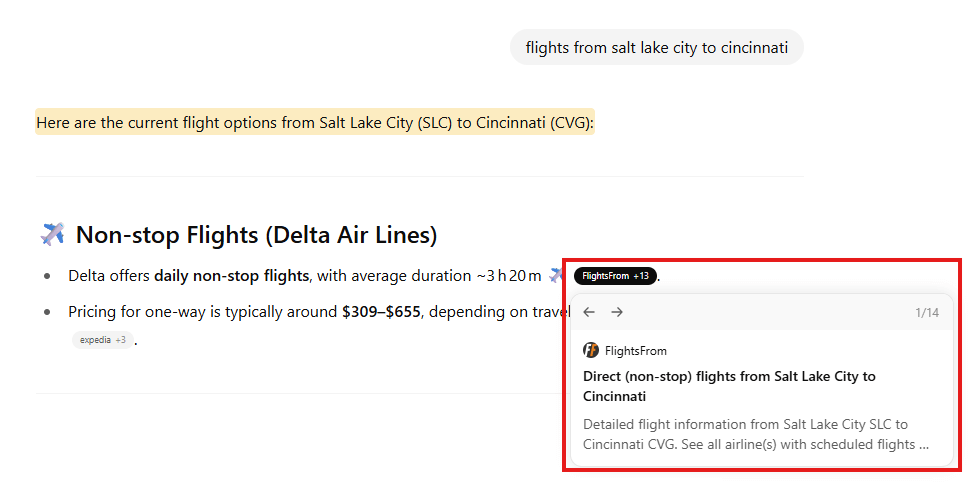

Inline Citations

Inline Citations are superscript gray circles or bubbles rendered immediately after the sentence they support.

Only a few source names in the citation bubble are immediately visible. Hovering (on Desktop) or tapping (on Mobile) that bubble shows a numbered mini-card with all the source names, page title, domain, and a short snippet. Clicking any citation in the mini-card opens the full article.

Inline Citations reflect prominence, since they provide direct visual attribution within the sentence they support. A single URL may even appear multiple times throughout the conversation.

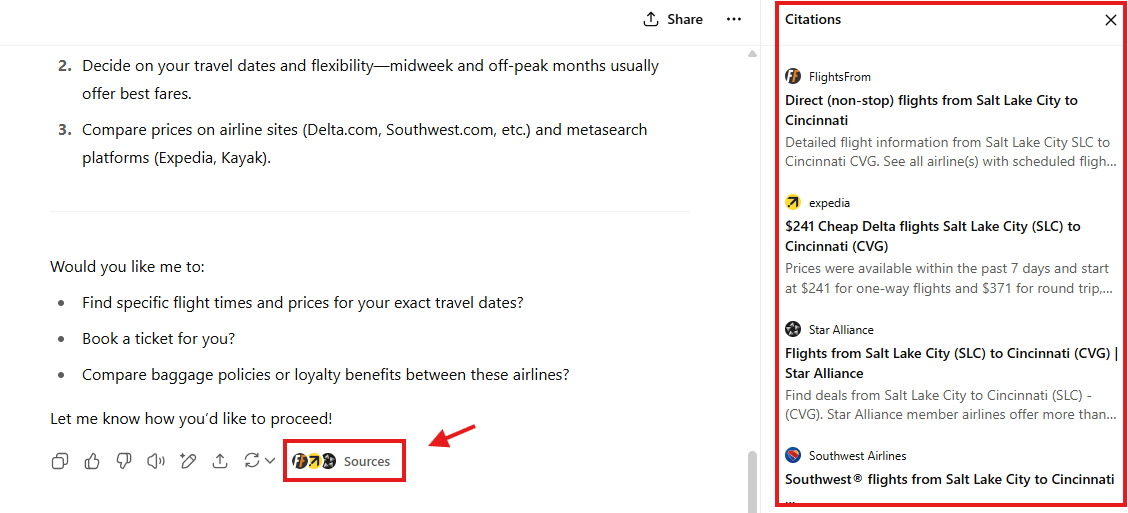

Sources Panel

The Sources side-panel lists most references used in the answer.

They show after clicking on a pill-shaped Sources button below the answer. They also include source names, page title, domain, and a short snippet.

Sources emphasize breadth, capturing most of the unique links referenced in the conversation.

Google Rankings

We used Advanced Web Rankings (AWR) to get the top-20 ranking URLs for the same prompts submitted to ChatGPT, using the same device (Desktop), and country (US).

Why Google – Not Bing?

While officially Bing powers ChatGPT’s search integration, we chose Google’s rankings as our benchmark for three primary reasons.

- Strategic SEO priority: Google remains the dominant search engine for airlines, with a much larger traffic share than Bing.

- High Google and Bing results overlap: for the high-intent commercial queries used in this study, the top organic results on Google and Bing are highly correlated, roughly surfacing the same domains.

- ChatGPT may be using Google Search, too: several studies and tests demonstrate that, at least occasionally, ChatGPT uses Google Search’s index or search results pages.

Key Performance Indicators

To understand how ChatGPT’s sourcing compares to Google’s, we quantitatively compared the URLs from ChatGPT’s Inline Citations and Sources against Google’s top organic results, asking:

- What is the URL overlap? We calculated the percentage of ChatGPT’s URLs that also rank in Google’s Top 3, Top 5, and Top 10.

- Do the same players dominate both platforms? We compared the domain dominance by identifying the top 10 most frequently sourced domains on ChatGPT versus Google.

- What are the top ChatGPT-exclusive domains? We identified the domains that ChatGPT sourced the most that don’t rank in Google’s top 20 results.

The Results: New Game, Familiar Plays

Our analysis revealed that while ChatGPT and Google share some common ground in the URLs they surface for flight searches, the overlap is far from complete. While ChatGPT’s top-sourced domains partially mirror Google’s top-ranking domains, ChatGPT also introduces a distinct set of sources not necessarily prominent in Google’s search results.

Substantial Overlap in High-Ranking URLs

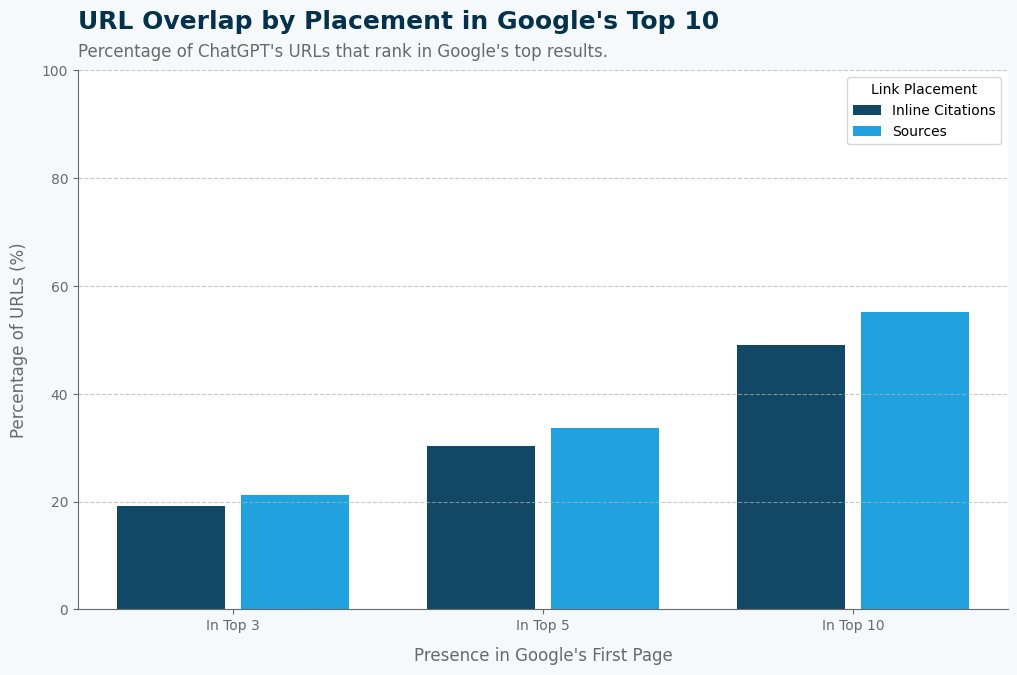

Many of the URLs ChatGPT surfaces are established players already ranking well on Google. Our data shows a substantial overlap between ChatGPT’s sourced URLs and Google’s first-page results.

| Presence in Google’s First Page | Inline Citations (% Overlap) | Sources (% Overlap) |

|---|---|---|

| In Top 3 | 19.17 | 21.15 |

| In Top 5 | 30.27 | 33.66 |

| In Top 10 | 49.09 | 55.17 |

About 19–21% of ChatGPT’s in-text citations and sources show up in Google’s Top 3, and that figure climbs steadily with rank depth. By the time we look at the Top 10, roughly half of ChatGPT’s Inline Citations (49%) and 55% of Sources overlap with Google’s first page.

In practice, ChatGPT doesn’t just replicate Google’s top results. It combines them with a broader set of references it deems helpful in generating its answers. This overlap pattern suggests that ranking high on Google still improves the chances of appearing in ChatGPT.

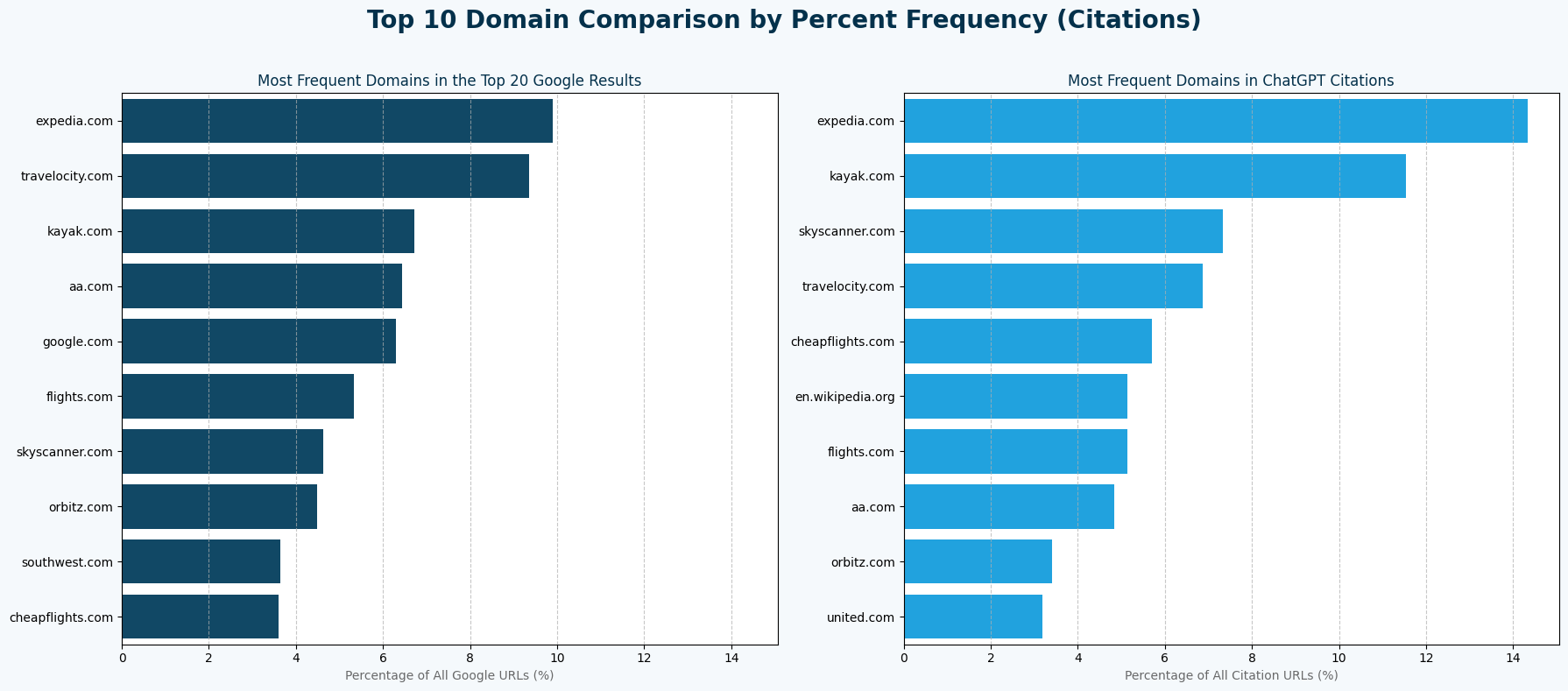

Familiar Players Dominate Both Ecosystems, With a Few Key Differences

The domain-level analysis of Inline Citations confirms that the major players in the online travel industry have successfully extended their dominance from Google’s search results to ChatGPT’s answers.

Most Frequent Domains in the Top 20 Google Results

| Domain | Percentage of Google’s Top 20 Domains (%) |

|---|---|

| expedia.com | 9.90 |

| travelocity.com | 9.36 |

| kayak.com | 6.72 |

| aa.com | 6.43 |

| google.com | 6.30 |

| flights.com | 5.32 |

| skyscanner.com | 4.63 |

| orbitz.com | 4.49 |

| southwest.com | 3.65 |

| cheapflights.com | 3.60 |

Most Frequent Domains in ChatGPT Citations

| Domain | Percentage of All Ciation Domains (%) |

|---|---|

| expedia.com | 14.34 |

| kayak.com | 11.54 |

| skyscanner.com | 7.34 |

| travelocity.com | 6.88 |

| cheapflights.com | 5.71 |

| en.wikipedia.org | 5.14 |

| flights.com | 5.14 |

| aa.com | 4.84 |

| orbitz.com | 3.41 |

| united.com | 3.18 |

However, the data reveals a few key differences in sourcing.

- Wikipedia’s presence in ChatGPT: Wikipedia is among ChatGPT’s top 10 citation domains, despite being absent from Google’s list. This reflects ChatGPT’s reliance on general-purpose reference sources for factual grounding.

- Google Flights missing from ChatGPT: Google includes its own Google Flights in the top 10, but it does not appear in ChatGPT’s most-cited results.

- Expedia and Kayak expand dominance: Expedia and Kayak together account for nearly 25.8% of ChatGPT citations, compared to about 16.6% of Google’s top-ranking domains.

- Airline visibility slightly diluted: On Google, American (~6.5%) and Southwest (~3.7%) both make the top 10. In ChatGPT, Southwest disappears, American drops to ~4.8%, and United enters at ~3.2%.

In short, while the “usual suspects” of online travel continue to dominate, ChatGPT’s Inline Citations amplify a narrower set of leaders and slip in reference-style domains that Google largely sidelines in its top search results.

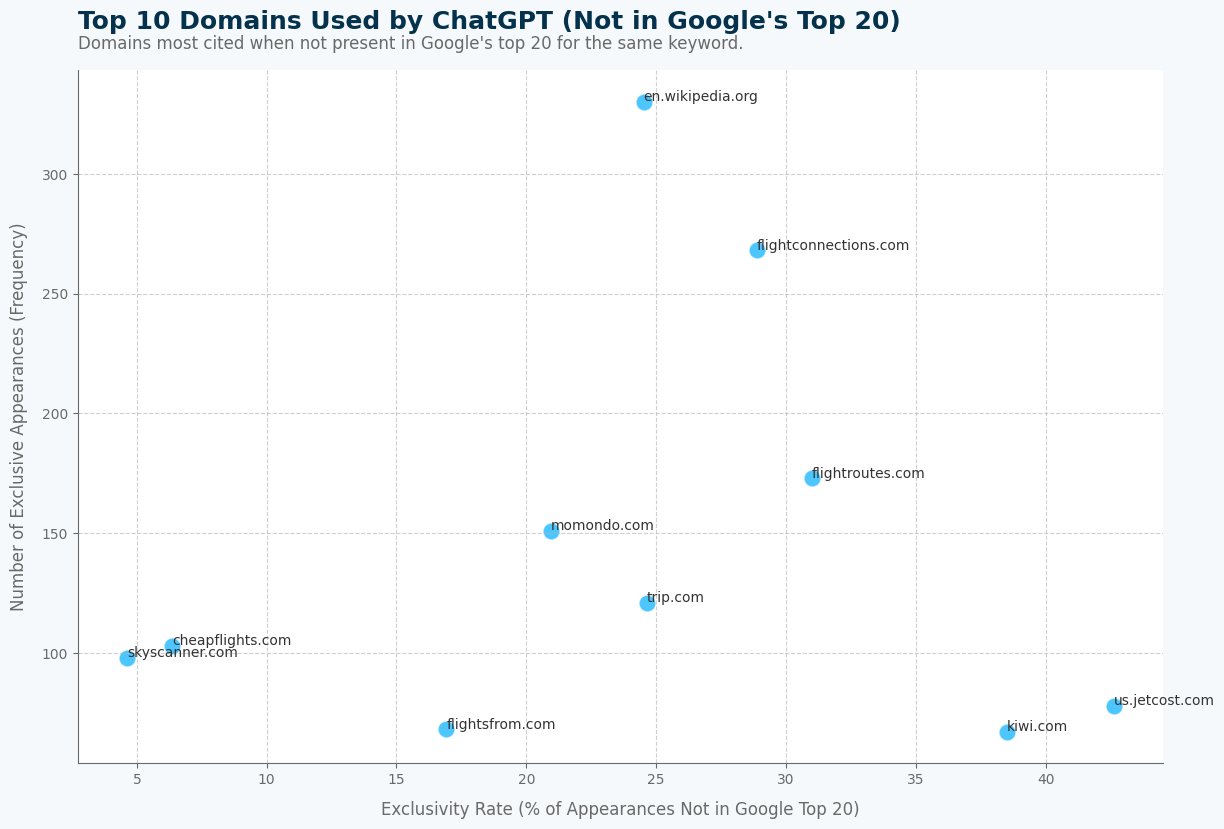

ChatGPT’s Exclusive Domain Pool

To investigate this divergence, we analyzed the domains ChatGPT cites that are not present in Google’s top 20 results for the same query.

| Domain | Exclusivity Rate (%) | Number of Exclusive Appearances |

|---|---|---|

| en.wikipedia.org | 24.52 | 330 |

| flightconnections.com | 28.88 | 268 |

| flightroutes.com | 31.00 | 173 |

| momondo.com | 20.94 | 151 |

| trip.com | 24.64 | 121 |

| cheapflights.com | 6.37 | 103 |

| skyscanner.com | 4.63 | 98 |

| us.jetcost.com | 42.62 | 78 |

| flightsfrom.com | 16.92 | 68 |

| kiwi.com | 38.51 | 67 |

The data shows that Wikipedia, FlightConnections, and FlightRoutes are ChatGPT’s most frequently used alternative sources, with each appearing over 150 times outside of Google’s top 20. This suggests that while ChatGPT relies on Google’s top results for surfacing sources, it also pulls from a secondary, broader set of topic-relevant websites even when Google’s algorithm does not rank them in the top 20.

The Way Forward: A Dual Strategy for Airline Visibility

ChatGPT’s sourcing patterns overlap with Google’s but also draw on a distinct set of references, from Wikipedia to niche flight-information sites. For airlines, this dynamic is both a risk and an opportunity.

The risk is diluted visibility: while carriers still appear, OTAs and aggregators dominate ChatGPT’s citations thanks to pages rich in structured flight information (duration, distance, layovers, and comparison-friendly data, etc.)

The opportunity is to close that gap by enriching flight pages with structured flight-related information. Add not just fares and destination copy, but route distance, schedules, connection details, and booking insights (e.g., cheapest days or months to book).

In short, airlines need to think beyond Google’s search results. Call it SEO or GEO: optimizing not only for Google’s rankings but also for the sourcing logic of AI systems and apps. The good news is that richer pages improve visibility in both.

Next Steps

Next, we will study mention-link patterns: Is ChatGPT biased towards OTAs or aggregators even when mentioning flight data available on airlines’ flight pages? Stay tuned!

Ready to boost your airline’s visibility in both traditional and AI-powered search?

Discover how PROS Offer Marketing, SEO, and SEM solutions can help you optimize flight pages for Google and ChatGPT, improve rankings, and drive more bookings.

Frequently Asked Questions

ChatGPT is increasingly driving referral traffic to airline flight pages, becoming more important as an alternative traffic channel.

ChatGPT uses a mix of top-ranking Google results and alternative sources like Wikipedia and niche flight data sites, creating a unique citation pattern.

OTAs like Expedia and Kayak are most frequently cited, followed by niche sources like FlightConnections and Wikipedia. We can also see that some PROS customers (American Airlines, United Airlines) are cited in the top ChatGPT domains.

No. While there is overlap, ChatGPT also pulls from sources outside Google’s top results, so dual optimization is key.